Determining The Trend Of The Market By The Daily Vertical Chart – 7M

Loading…

Loading…

IMPORTANT POINTS

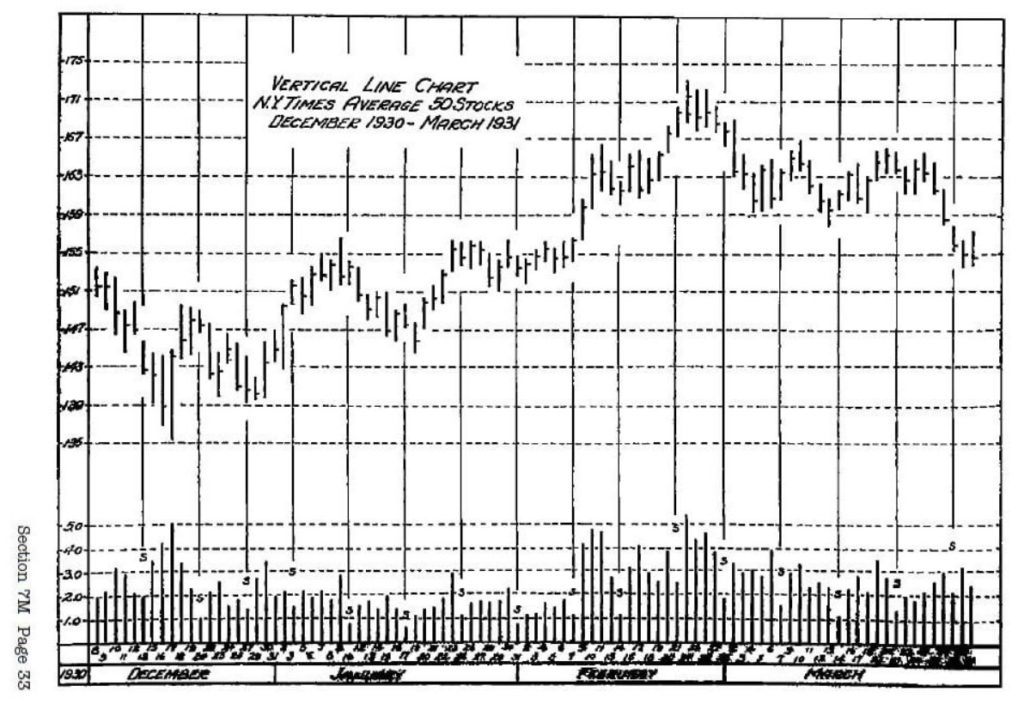

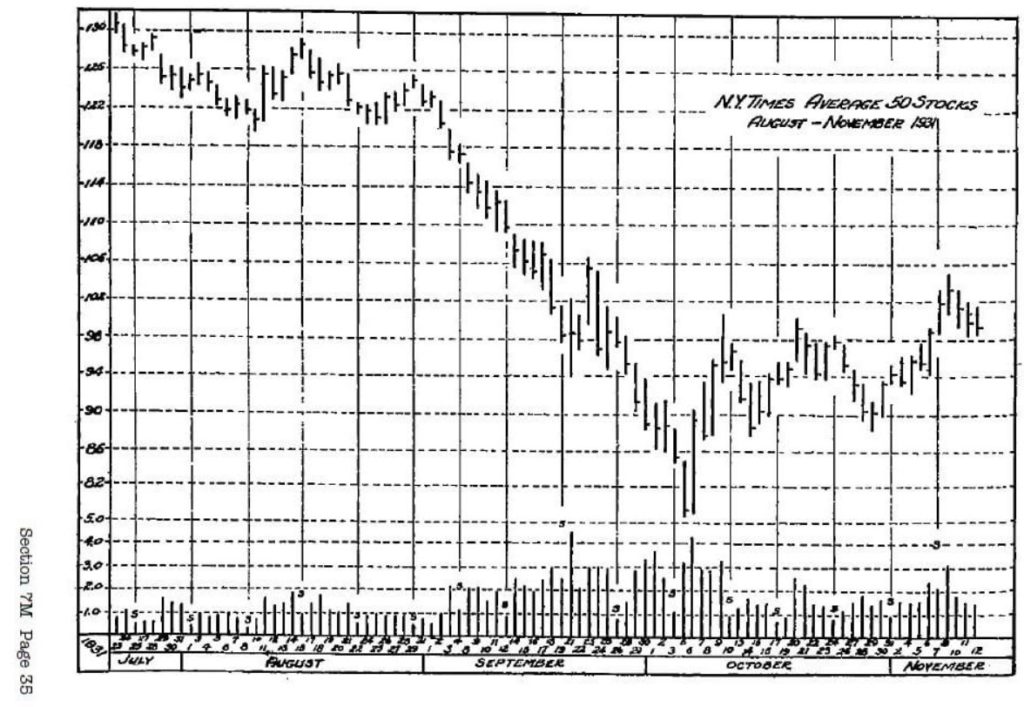

1. The most important aspect to know about the market is the trend.

2. Our aim is to operate in harmony with the trend.

3. The Wyckoff Wave is a market index which reflects the movement of the market leaders.

4. A selling climax is caused by panicky unloading of stocks by the public (supply) which is matched by buying (demand) of:

a. experienced operators

b. large interests

c. short covering by bears who sense a turn.

5. An abnormal increase in volume is characteristic of a selling climax.

6. After a technical rally, if prices hold around or above the climax lows on shrinking volume, then we have an indication of support and the completion of liquidation.

7. Three possible buying opportunities to establish a long position are:

a. after the completion of a selling climax.

b. after completion of a secondary reaction where the selling pressure is being lifted as shown by closes for the various days.

c. when the index breaks into new high ground. (The last is the least satisfactory since the risk would not be at a minimum.)

8. When the trend is doubtful, take a neutral position.

9. To limit risks, place stop orders below the previous support points in long trades.

10. Bullish behavior is often accompanied by higher tops, higher lows, and higher closes in combination with gradually increasing volumes.

11. Absorption rather than distribution may be observed by:

a. volume remaining low on reactions or possible tapering off

b. price movement restricted to a narrow range as compared to a half-way reaction

c. volume consistently building up, or there is a lifting of support points.

12. Large volume with no further material gain is an indication of distribution.

13. Increased public participation creates active demand (of a poor quality) which facilitates selling (supply of a good quality) by large interests.

14. At the top of a rally or up-trend, close out your long positions and seek those stocks in the weakest technical position to establish short commitments.

15. Hypodermics is the sudden run-up of prices on expanding volume created by large interests. It may be an indication of a turning point.

16. Sharp acceleration of a downward movement often creates an over-sold condition.

17. Declining markets are normally accompanied by lower volume than advancing markets, except perhaps at times of active liquidation.

18. A sudden or abnormal increase in volume, appearing after a given price movement has been in progress, usually indicates the end or the approaching end of that particular movement. However, if this occurs when the price breaks through a defined trading range, this probably indicates a continuation of the movement in the direction of the break-through .

19. A common sequence in market fluctuations is:

a. selling climax, b. technical rally, c. secondary reaction -OR- a. buying climax, b. technical reaction, c. secondary rally

20. Risks are greatly increased by:

a. failure to liquidate promptly on early warnings of danger to bull position

b. refusal to place stop orders on long commitments

c. purchasing of issues when prices are up and the public is buying emotionally.

21. The market seldom runs continuously in one direction for an extended period of time without some type of reversal.