Individual Chart Studies – 16M, 17M

Loading…

Loading…

IMPORTANT POINTS

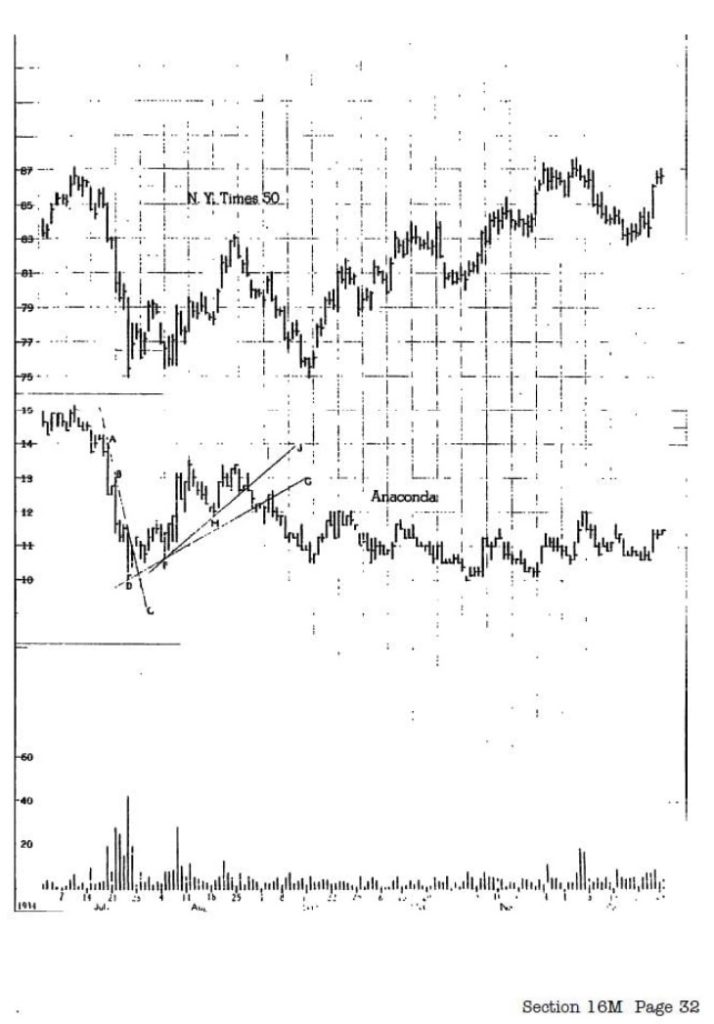

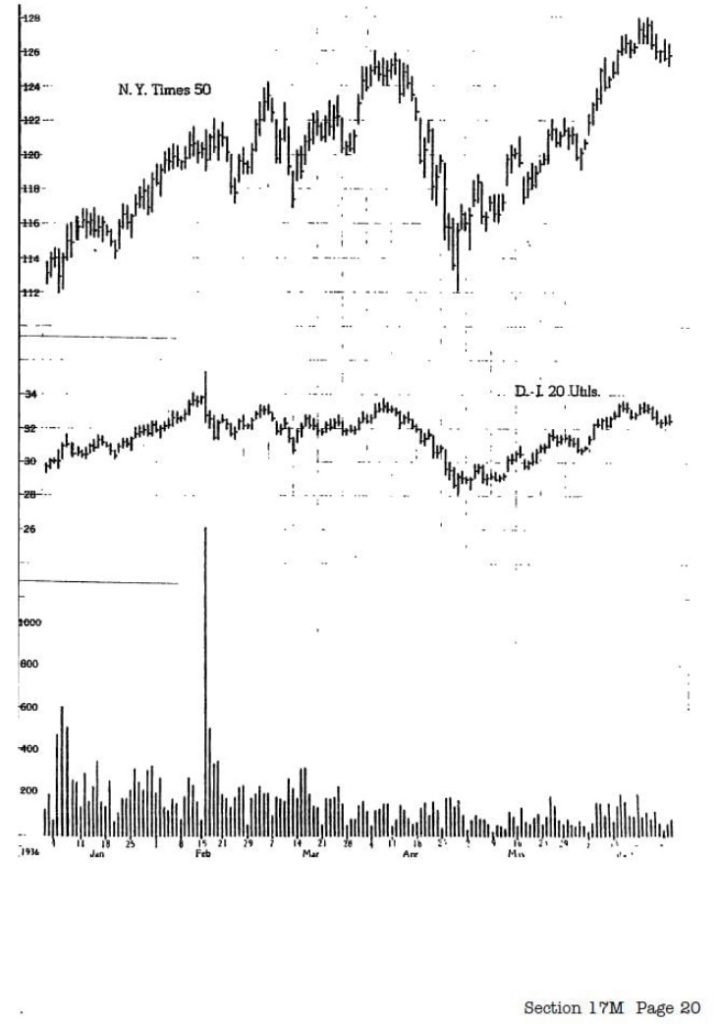

1. The four principal phases of a market campaign are:

a. accumulation b. marking-up c. distribution d. marking-down.

2. Three basic factors needed to determine the technical position of a stock are:

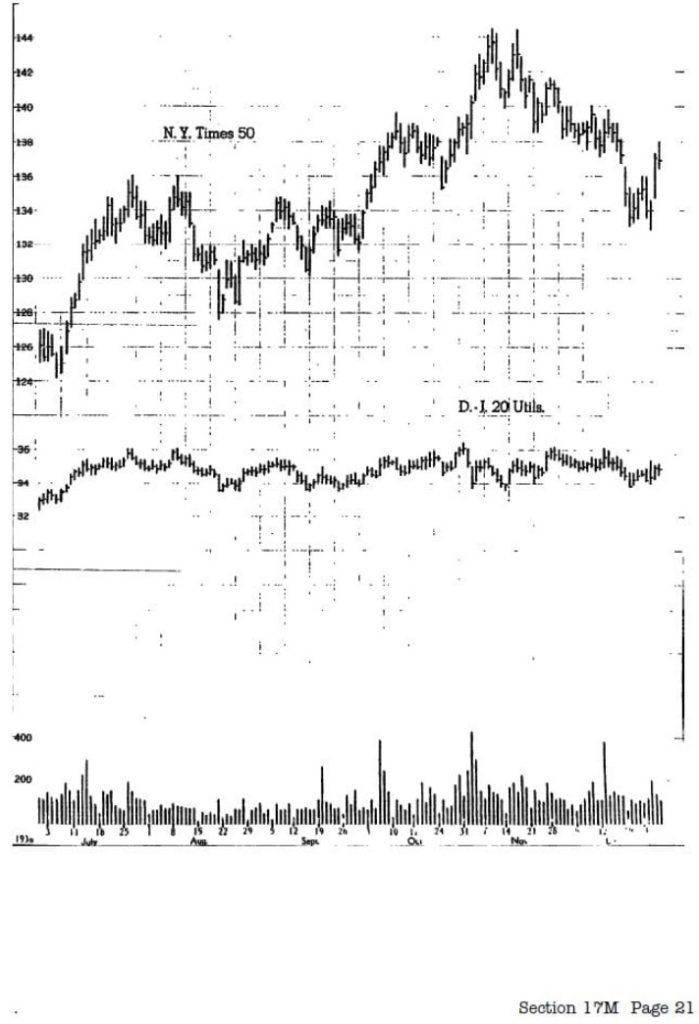

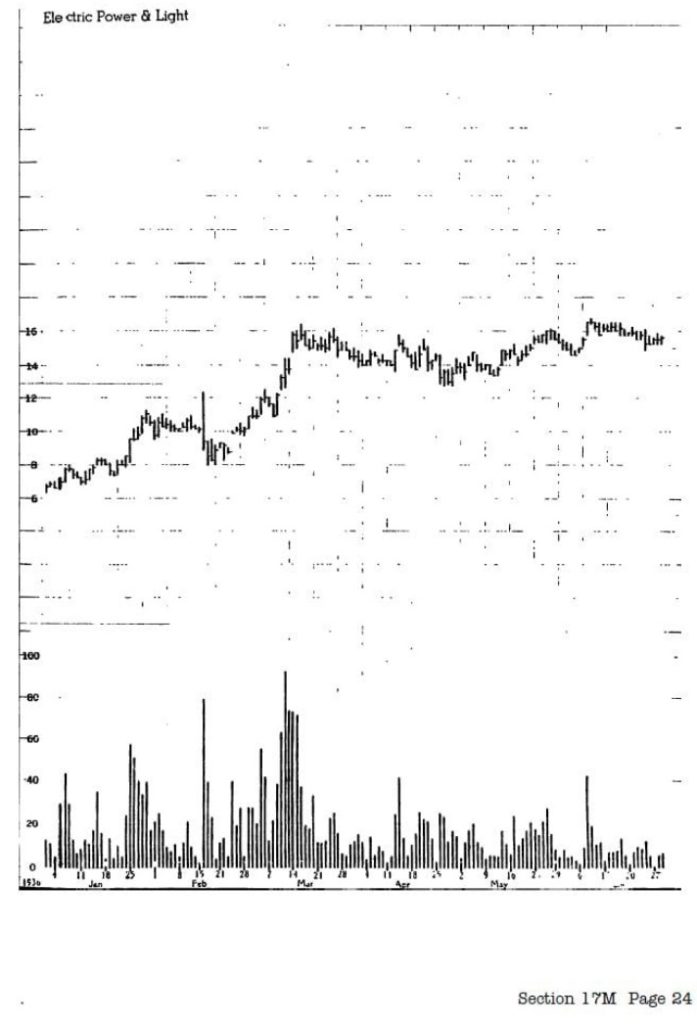

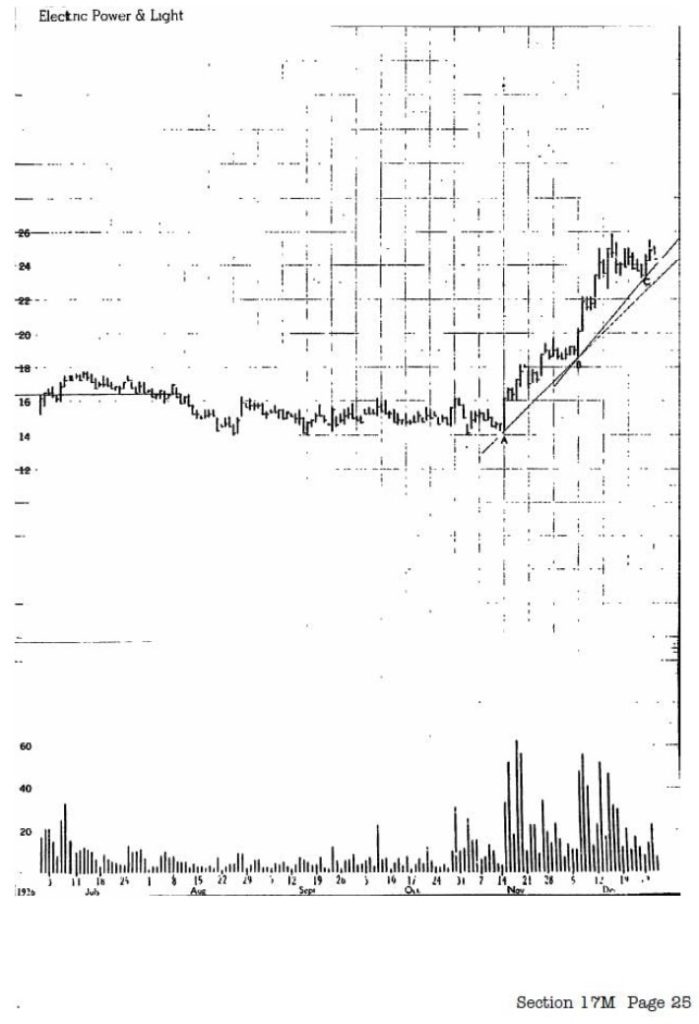

a. price movement

b. volume

c. the inter-relationships between price movement and volume.

3. Price Movement Reflects – Comparative strength and weakness, Points of support and resistance, Trend lines & shake-outs, Overbought-oversold positions.

Volume Reflects – Buying and selling climaxes, Quality of supply and demand at support and resistance points, Quality of supply and demand approaching trend lines, Shake-Outs, Overbought-oversold positions, Accumulation-distribution.

Inter-relationship of Price Movement & Volume Reflects – Beginning of a move, Culmination of a move, When to buy or sell.

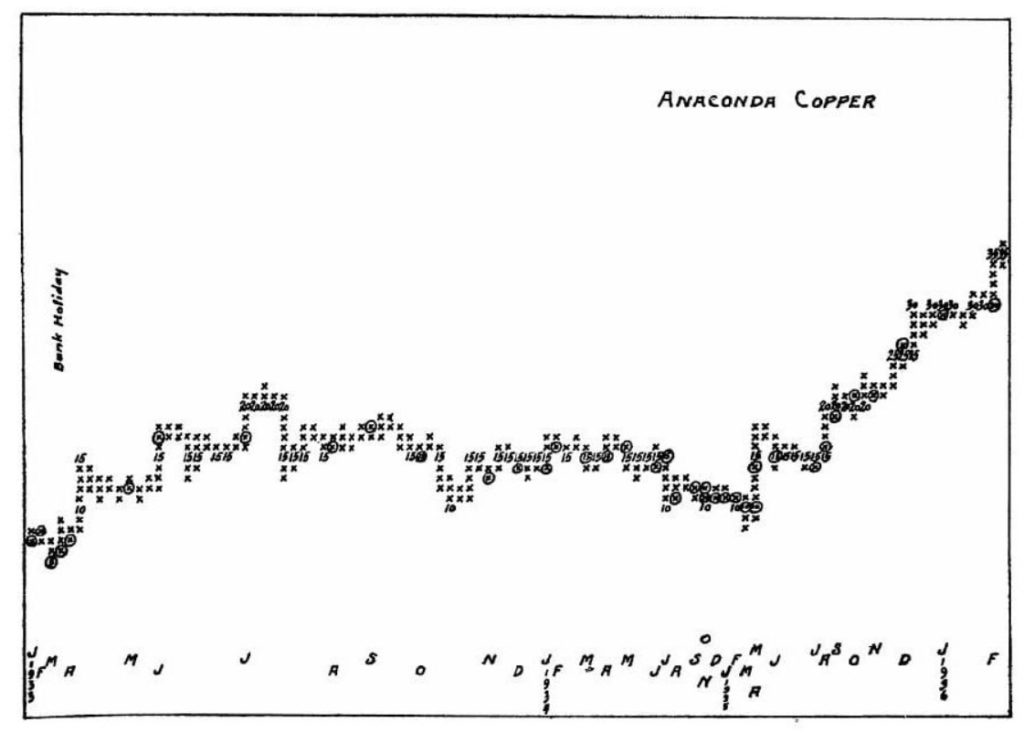

4. Figure charts are best for determining the probable objectives of a campaign.

5. Vertical charts aid in determining the probable direction of a future trend.

6. A stock which remains dull and inactive tends to discourage traders, causing them to close out their positions.

7. A selling climax is generally followed by a secondary reaction.

8. When the stock is not acting right – get out!

9. If the market is advancing one should generally be unwilling to take a short position.

10. Weakness in a stock may be indicated by the inability to develop rallying power after returning to a former support.

11. Following a terminal shake-out there is likely to be a persistent mark-up to ‘lock in’ shorts and ‘lock out’ potential buyers.

12. High volume on a sharp mark-up need not be a buying climax, but may be caused by traders accumulating stock through prior resistance points; sometimes called absorption volume.

13. Traders often distribute their holdings on a reaction from a high level.

14. A technical rally following a decline is characterized by constant volume and a gain of approximately one-half the decline.

15. Dullness in volume following climactic volume is an indication that one phase of a campaign is culminating and another phase is beginning.

16. Using good judgment and accurate timing you should be able to make substantial gains on your capital.

17. Figure charts of low priced stocks are generally too insensitive to be used alone in making decisions in those issues.

18. Figure charts and vertical line charts should be used as a combination in developing market campaigns.

19. If a group of issues is preparing for an advance, seek those issues which show more strength than weakness.

20. Diminishing volume and a narrow price range at the top of a rally indicates a lessening of demand.

21. Some conditions which may mark a preparation for an advance are:

a. decline from a high point

b. narrow price swings and persistent support at the bottom

c. small daily volume

d. sufficient time to tire weak holdings, and

e. ability to hold support.