Legendary Value Investor Bill Miller Says Buy Bitcoin And Eight Other Stock Bargains

Legendary value investor Bill Miller sees fresh opportunities in the stock market amid the brutal selloff this year, urging investors to take advantage of shares that are trading at discounted prices while also remaining bullish about BitcoinBTC0.0% calling cryptocurrencies “misunderstood.”

Speaking at the Forbes/SHOOK Top Advisor Summit at the Encore At Wynn hotel in Las Vegas on Thursday, the former Legg MasonLM 0.0% chairman and chief investment officer talked up his signature bets on Bitcoin and AmazonAMZN -4.3%, while also identifying several companies that he thinks will benefit from an eventual market rebound.

While at the Baltimore investing giant, Miller gained prominence by outperforming the S&P 500 annually from 1991 to 2005. He eventually went out on his own, serving as chairman and chief investment officer of Miller Value Partners, which had $1.9 billion in assets under management at the end of August 2022. In January, Miller announced that he would retire at the end of the year, outlining succession plans for his two main funds, transferring management to his son, Bill Miller IV, and longtime protégé Samantha McLemore.

Speaking with Morgan Stanley Private Wealth Management managing director Marvin McIntyre at the Forbes/SHOOK Top Advisor Summit, the 72-year-old Miller reflected on the stock market, cryptocurrencies and the Federal Reserve.

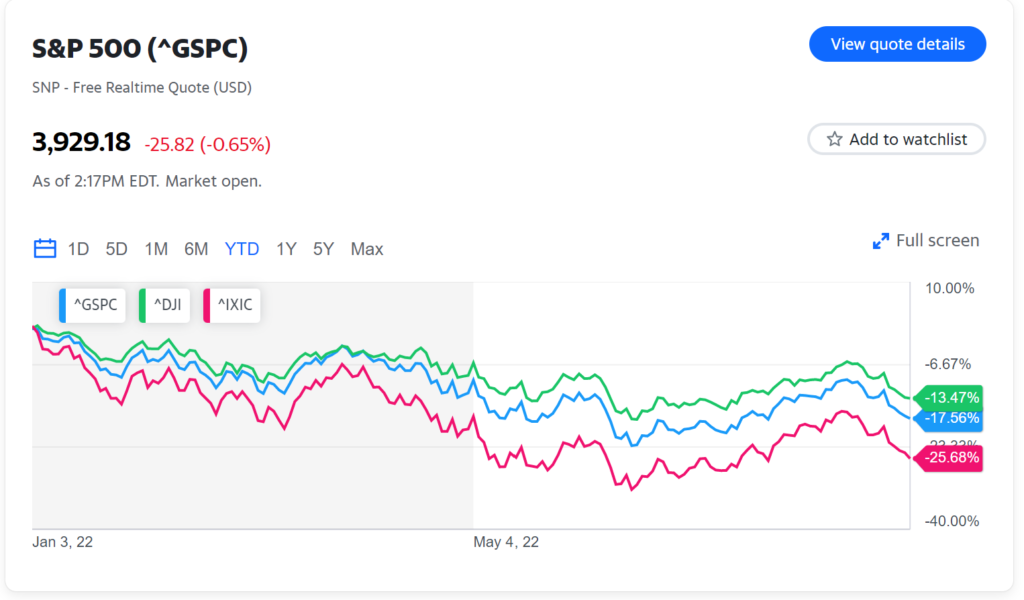

“Stocks that worked in the last bull market for the last ten years or so through last November are now getting crushed,” he explained, adding, “Rising rates have caused growth compression.” His advice to investors? Buy shares of companies trading at cheap, discounted prices.

Miller famously bought Amazon, his favorite stock, at the company’s IPO in 1997. He’s been a longtime believer in the company’s booming e-commerce business and steadily ramped up his holdings over the past couple of decades.

The famed value investor remains undeterred by the recent stock selloff for that reason: “If your time horizon is longer than one year, you should do very well in the market,” Miller said, pointing out that prices have now “come down significantly.”

In terms of stock picks, he identifies companies that have strong, free cash-flow trends but are trading at discounted share values. Those include some of this year’s worst performers: Norwegian Cruise Line HoldingsNCLH +1.8% (down 41% this year), ride-sharing service UberUBER -0.9% (down 43%) and luxury fashion e-commerce platform FarfetchFTCH -7.7% (down 76%).

Miller also likes Delta Air Lines, pointing out that the company stood out amongst airlines because it didn’t dilute shares with new equity during the pandemic, which has paid off with improving free cash-flow trends, he said. One of his more under-the-radar picks is Clear Secure, a profitable tech company with a subscription-based business that specializes in document verification in U.S. airports. Miller predicted the market capitalization could balloon from over $3 billion to $30 billion in ten years as the company signs more big deals with major stadiums.

Other notable picks from the famed investor included Silvergate Capital, a Fed-regulated bank with a crypto exchange, and Chesapeake EnergyCHK -6.1%, based on Miller’s view that shares of oil companies are still “mispriced” and going through a long “reset period.”

He also chided the Federal Reserve for “talking a tough game [on inflation] but being psychologically behind the curve.” The central bank is “reacting to [economic] data” too much rather than focusing more on real-time or forward-looking indicators, Miller said, adding that these signs “suggest they might go too far” with raising interest rates.

An early advocate and buyer of Bitcoin, Miller also reiterated his bullish outlook on the cryptocurrency, calling it “misunderstood.” Though prices can be volatile, Bitcoin can provide investors with “an insurance policy against financial disaster,” he argued. If the Federal Reserve tightens monetary policy too far, Bitcoin prices will probably fare better than most of the market, Miller predicted. What’s more, because it is “not connected to the rest of the financial system,” there is “limited fallout” during tumultuous market periods.

Though many investors can fret over the current uncertainty in markets, Miller quoted the advice of Warren Buffett, John Templeton and Leo Tolstoy for guidance, respectively. “Be greedy when others are fearful”; “The time of maximum pessimism is the best time to buy”; and “The two most powerful warriors are patience and time.”

Responses