Wyckoff Wave Taking A Breather At New Highs

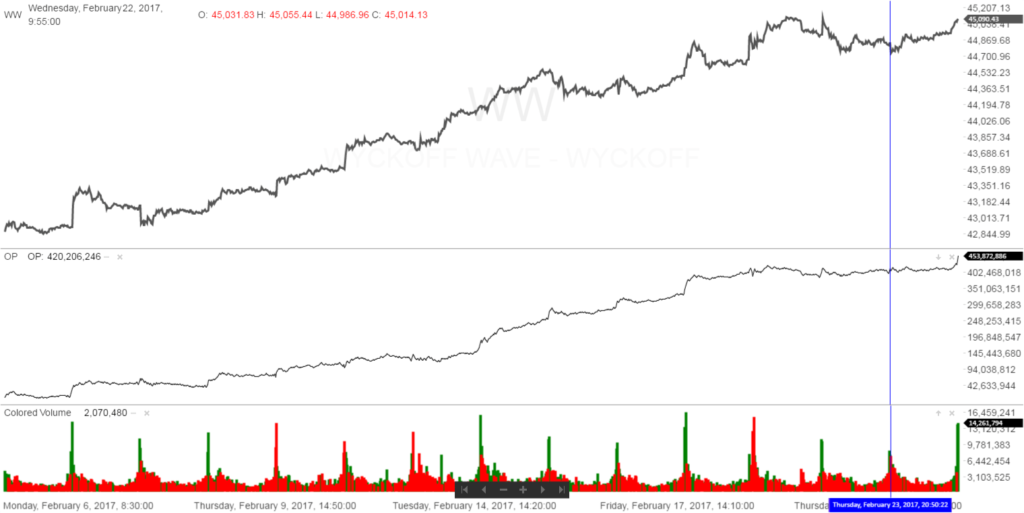

The Wyckoff Wave spent last week digesting the gains of the previous three weeks, and closed slightly higher. Volume has not increased noticeably on this rally, but the Wave continues to try and grind higher.

The Technometer is still registering an overbought level, after trading at a dangerously overbought reading early in the week. This should continue to make it hard to extend the advance much higher from these levels.

Volatility has continued to contract, and we are at historical low levels.

The S&P and Nasdaq Indices were both up slightly for the week as well.

The Wyckoff Wave has rallied back to new highs, but we did not feel the selloff to “E” and “G” was a Last Point of Support (LPS). Volume has not came in strong as we would have expected, so we are of the opinion that we are just making a higher high here, and not beginning a strong move to the upside. We spent last week trading sideways and would expect further consolidation in the week ahead.

The Optimism – Pessimism Index continues to rally to new highs as this move continues. We traded at a new high Friday as you can see from the chart below, and this shows continued volume supporting the rally.

The Force Index spent last week in a narrow range at the 120 level. This helps negate some of the overbought reading from the Technometer.

We still have shorts on various stocks that continue to show relative weakness versus the general market. For our ProTraders we have been short GE, KO, SBUX, CAT, PX.

The bond market traded slightly higher early in the week, then had a strong rally on Friday back to the earlier highs from two weeks ago. We continue to expect higher prices before this rally ends. We show our long entry level with the blue circle below.

Good Trading,

Todd Butterfield

Responses