Reaction In The Trading Range Is Still In Play

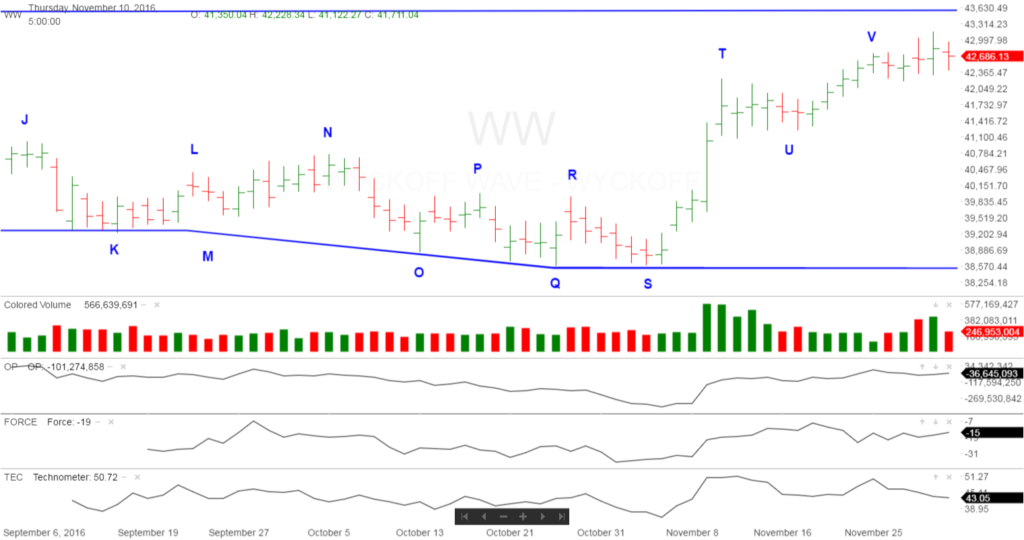

As we discussed last week, the recent rally to “V” was on a lack of demand, and not consistent with a Sign of Strength. It appears the resistance at the top of the trading range is putting a lid on prices here. This past weeks action did nothing to change our opinion.

We expected a correction to begin this past week, and for the Wyckoff Wave it has been very slow to materialize, and make much downside progress.

The correction has been much more meaningful off last weeks highs if you are trading the S&P or Nasdaq Indices and stocks. Volume has increased as well on this selloff so the continued correction scenario has still the highest odds of success.

We are currently holding shorts in ORCL, AAPL, and DIA for our ProTrader Subscribers. We are also long GDX.

The weeks action, still supports the fact that the rally to “V” was simply a rally to test the resistance at the top of the trading range. We therefore expect a correction back to the middle or lower portion of the recent trading range, and wait for ending action once again.

One important purpose of a trading range, especially one that appears to be accumulation, is the drying up supply. This is done by taking in stock sold by weak holders. Supply is found at different levels within the trading range. Currently the supply at the top of the trading range appears sufficient to turn the Wyckoff Wave down into the lower portion of the range.

The Technometer’s overbought reading at “V” did stop the rally as expected. The Technometer has now moved into a neutral condition, and still room to correct further before we would expect an oversold reading. In addition, the moderate negative readings from the Force Index does not have a mitigating impact on the expected reaction.

In addition, the Optimism – Pessimism Index is still in a negative divergence with the Wyckoff Wave.

These negative indications still support the reaction scenario back into the middle of the recent trading range at “U”, and possibly even testing the lows at the bottom of the range scenario at “S”.

While the Wyckoff Wave will most probably not be putting in a Last Point of Support, the market action, beginning with the selling climax in August 2015, continues to suggest we are in a period of accumulation. If so, the Wyckoff Wave would experience ending action and the bull market would then continue.

Good Trading,

Todd Butterfield

Responses