The Wyckoff Wave Continues It’s Ongoing Rally

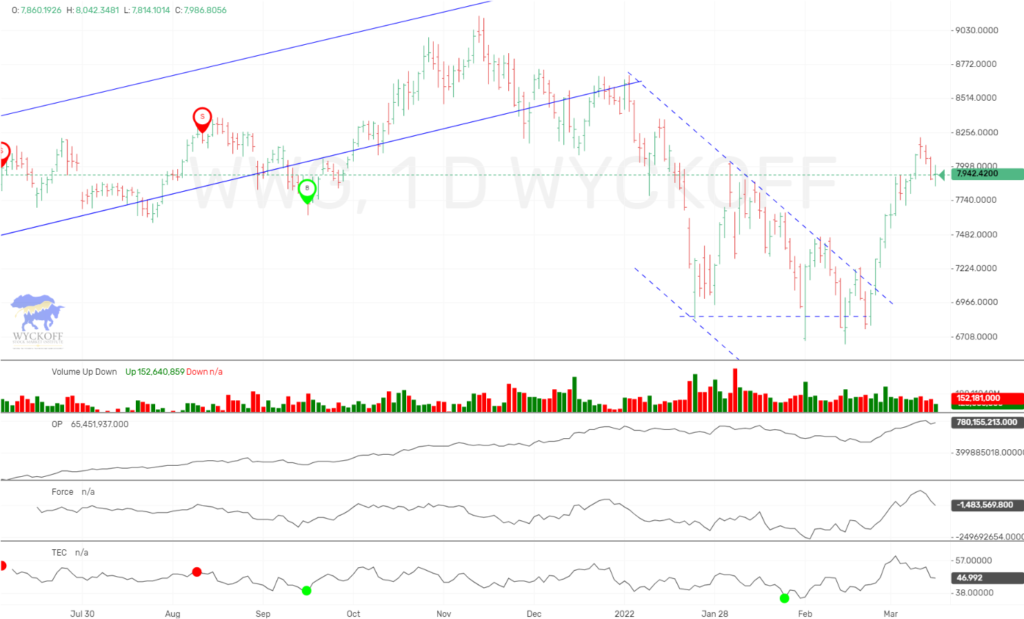

The Wyckoff Wave once again was up slightly for the week. Volume was at average levels.

The O-P was also up for the week.

The Force Index flat for the week.

The Technometer reading is slightly above neutral.

The OP and Wyckoff Wave is showing a small divergence with the OP rallying while the Wyckoff Wave has moved sideways. This is the beginning of a bearish divergence. Effort with no result…

We have continued to expect the Wave to experience a correction the last few weeks but it continues its rally but at a slower pace. The overbought Technometer has slowed the advance, but thus far has not given us any correction of the recent advance. The dashed purple uptrend line could be giving away here so we are still expecting some type of pullback this coming week.

We continue to add to our gains off of the 44,000 level, which keeps this long bull market alive. We expect further sideways action in the weeks and months ahead.

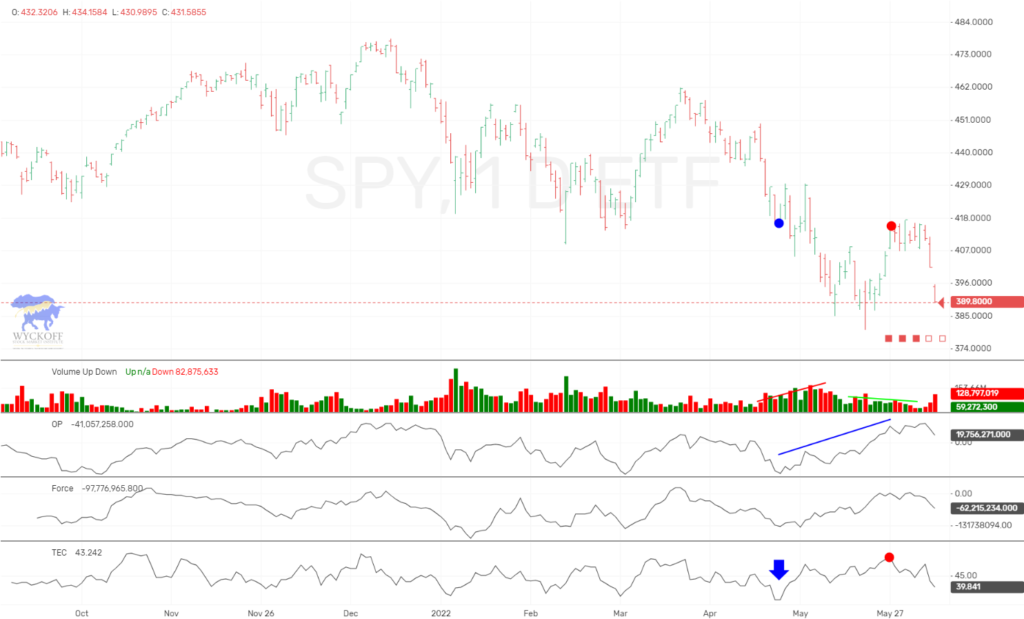

The Wyckoff Wave Growth Index (WWG), had slight gains for the week, which we were looking for, but Friday’s action looks bearish for the week ahead. We have a very overbought Technometer as marked with the red arrow. Friday’s volume was not heavy but price action was weak. Look for lower prices…

The bond market traded slightly higher for the week once again.

The Technometer registered an overbought reading at Friday’s close, and price action was not desirable for the bulls. We are long this market with tight stops. If the Wyckoff Wave turns down here, then hopefully the TLT will work higher still.

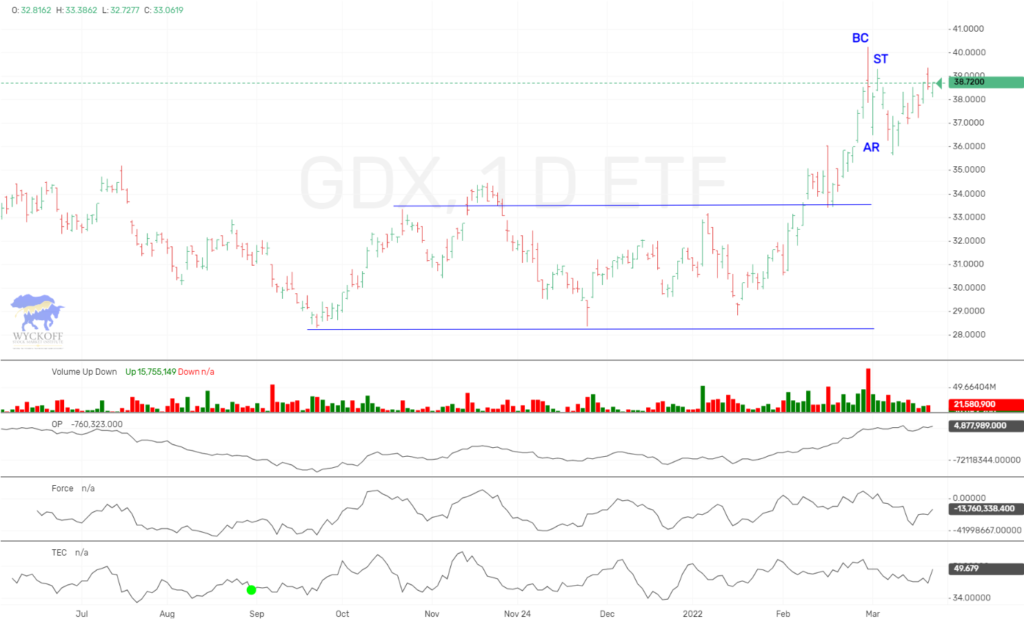

The GDX has had an interesting setup over the last six months. Last week we said we felt that this market had just came off of a Backup To The Creek, and could experience a nice mark up to the upside in the weeks ahead. This weeks action was just what we was looking for and we expect more upside. Hopefully you were able to get on this trade. We are long and looking to buy more on pullbacks.

Square (SQ) experienced some selling this past week, and we think has more to come. The Technometer is nearing oversold so we will watch this stock carefully this week.

With the Wyckoff Wave looking lower in the week ahead, you should be looking for short term plays to the downside. IBM could be one of these. The last week it has been sideways and intermediate chart looks bearish.

Caterpillar is another stock that does not look good short term.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 948 students enroll since its launch on June 22, 2017. On June 28th we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Crptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses