The Wyckoff Wave Respected the Top of the Range Resistance

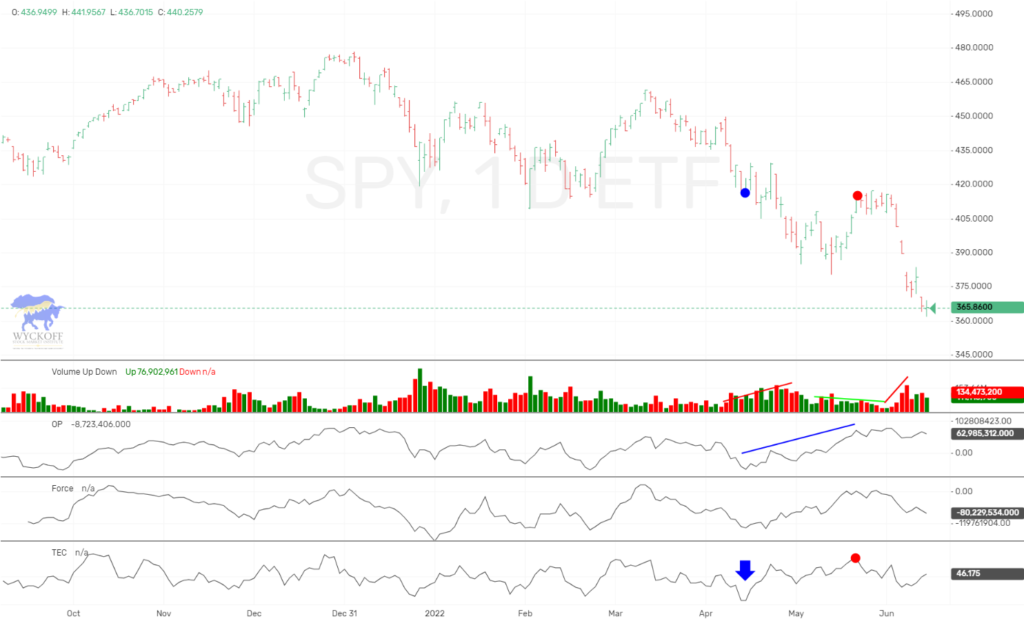

This past week the Wyckoff Wave started the week trading higher, but succumbed to selling for the rest of the week and closed lower. Volume increased to the downside every so slightly.

The Technometer began the week slightly below neutral, and finished the week at oversold levels.

For the week the S&P was down .20%, and the Nasdaq 1.1%.

The Wave continued its correction back into the middle of the recent range as expected.

The O-P had not rallied at all since the short term lows of Feb 5th. This was showing there was not much buying behind the recent surge, and the O-P collapsed to new lows for the downtrend.

The Force Index also continues to show slight relative weakness to the Wave and continues to apply pressure to the downside.

The Technometer finished the week at oversold levels, showing a vulnerability for the Wave to slow its selloff.

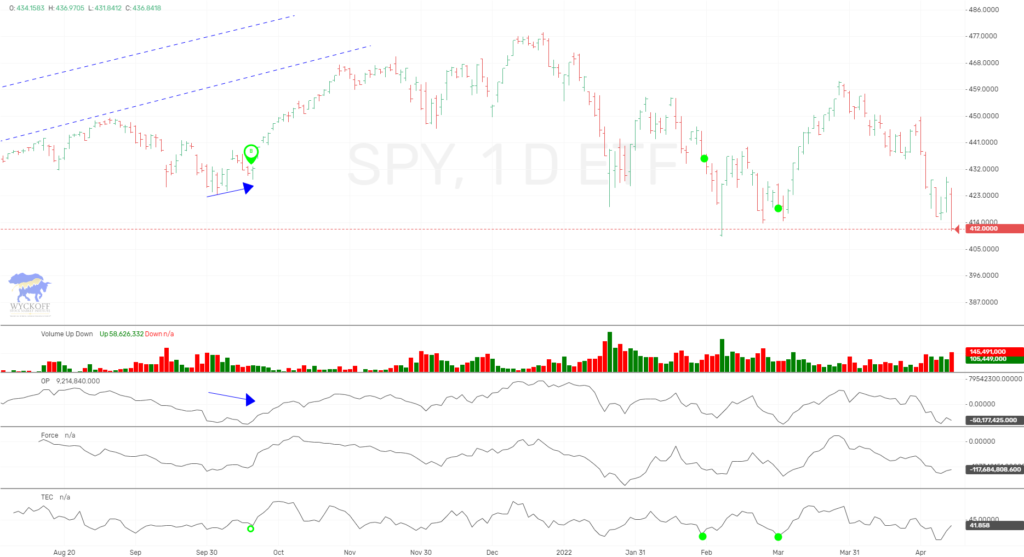

The one year daily chart shows the Wyckoff Wave trading in an uptrend but possibly tiring within the steeper uptrends. We had felt that we would possibly begin sideways trading action, which appears to be happening. With 57,000 being resistance as mentioned, and 51,000 support.

The Technometer did not give us the overbought reading we wanted for short positions, but has now returned quickly to oversold. We might need some corrective or sideways action here to relieve the oversold reading before further downside.

The Wyckoff Wave Growth Index (WWG) also spent the weak in a correction off of the top of the what we believe will be resistance. Volume increased ever so slightly.

The Technometer is trading near oversold levels but we expect some more downside from here in the WWG.

The bond market traded sideways for the week. The oversold Technometer has not given us much of a rally off of the lows, only sideways.

TLT is now trading near its supply line of its recent downtrend channel. We feel this market has lower objectives ahead, so we continue to hold shorts from $125.08.

IMPORTANT ANNOUNCEMENT: This week we will be launching our “Pulse of The Market” for Cryptocurrrencies. This software will have consolidated volume for the Crypto’s which will be most important when applying Technical Analysis.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is still being offered at an affordable $199.99 by using code “feb199” at checkout till midnight tonight. We have had 894 students enroll in the last 33 weeks.

If you are interested in Cryptocurrency news and Wyckoff chart analysis, search “Crypto News” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Friday approximately 11:30 a.m. CST, as well as Monday-Thursday 6:30 p.m. CST and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses