The Wyckoff Wave still trading constructive for further advance

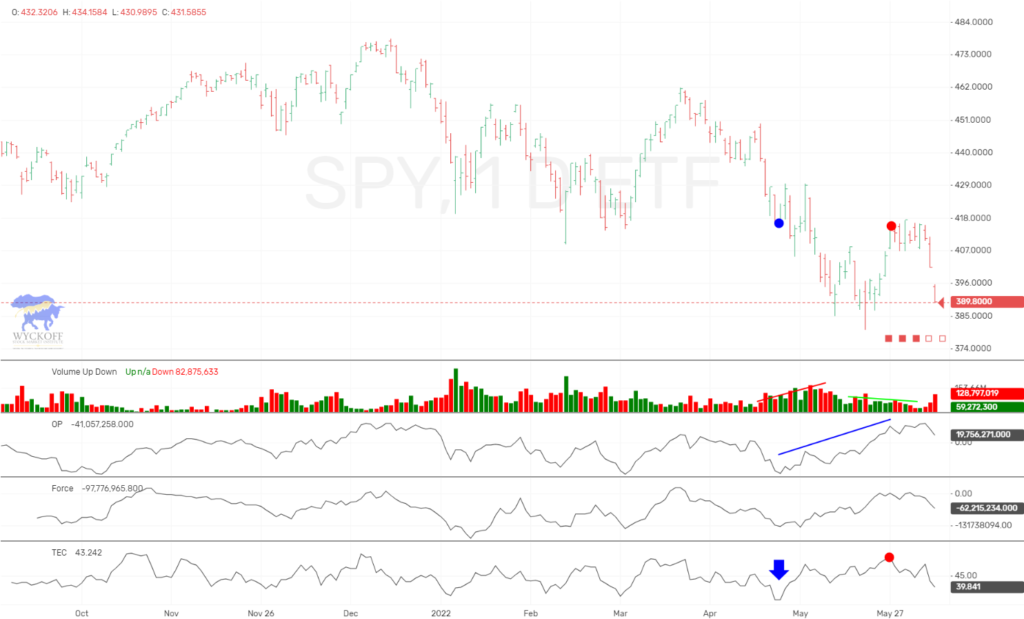

The Wyckoff Wave traded slighlty lower this past week. Volume was slightly lower for the week as well.

The O-P continues to underperform on the upside. The O-P traded for a new low versus the late June lows, while price is still holding higher. This could be a bullish divergence so we want to watch this in coming days. If volume would come in off these lows we could see the WW respond nicely to the upside.

The Force Index increased slightly for the week.

The Technometer closed the week slightly below neutral.

The intraday chart for last week shows the OP and the Wyckoff Wave (WW) moving in unison. The OP will need to expand to the upside with good volume to keep this rally alive…

The one year daily chart shows the Wyckoff Wave trading in an uptrend on an intermediate term basis, and in the middle of the short term trading range shown by the purple trendlines. We had expected a pullback to the blue dotted line this past week, which we almost achieved before the late week reversal higher. We feel we still have the ability to work lower in the coming week.

With the Technometer slightly below neutral, we would expect it to quickly get to oversold on any further reaction. After that we need to see volume to come in and support the next rally.

If the 50,500 level was a test of the previous spring down to 49,000 then this rally should be able to continue with wider spread and volume. If it does not, then any long positions could be in trouble, and we would not want to see the support at 50,500 to then give away.

The Wyckoff Wave Growth Index (WWG) came down early in the week and respected the support line of its recent uptrend as expected. This market still appears to want to trade sideways for the coming week. Lets see if on a selloff we can get the Technometer down to an oversold reading which could then support further rally.

Like the Wyckoff Wave, any pullback here should still find support at the support line of its recent uptrend.

Its Technometer reading is slightly above neutral and should approach oversold on any pullback.

The bond market traded sideways for the week after recovering from a sharp selloff on Wednesday. Volume increased on that selloff, and we had a corrective bounce on lower volume to end the week. We are wanting to get short this market on a corrective bounce and early next week might allow us to do this.

The TLT had met resistance at its supply line of its intermediate down trend, and volume came in on the decline as well. The Technometer is now nearing overbought so short positions should be warranted soon.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are going to test reliability next few weeks, and then preparing to offer it to subscribers.

***At checkout use code “20DogDay” until July 14th for 20% off our Crypto & Wyckoff online Course***

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 937 students enroll since its launch on June 22, 2017. On June 28th we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Crptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses