Dull Sideways Action….

The Wyckoff Wave opened lower Monday, then rallied into Wednesday before succumbing to a sharp reversal. The Wave then spent Thursday/Friday trading sideways. For the week the Wave was up slightly. Volume gave no strong clues during the week, but showed supply still present.

The Technometer spent the week trading near neutral and finished Friday slightly below neutral.

The S&P and Nasdaq Indices were both down slighlty for the week.

The Wyckoff Wave spent the week both sides of unchanged. Wednesdays high looks important for short term short positions, and we used it to place a downtrend line as shown buy the dotted red supply line. If that high is taken out we would probably see a day or two of strength, but not the start of another strong rally. We still feel we are in the midst of a correction that has further to go on the downside.

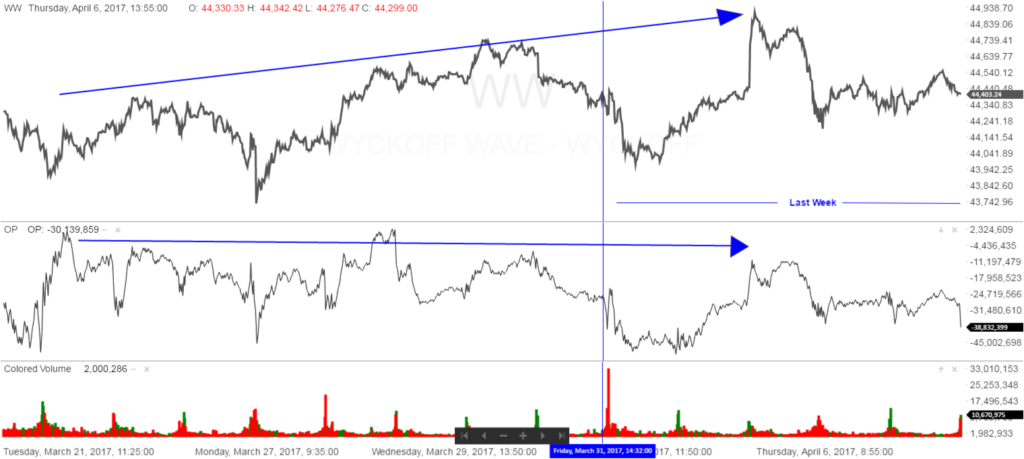

The Optimism – Pessimism Index has continued to display relative weakness, with no desire to rally as of yet. As we show on the intraday chart below, the Wyckoff Wave has rallied to three successive highs recently while the O-P has only managed to trade sideways.

The Force Index lessened its downside pull last week, and nothing new to add.

The O-P and Force continue to show relative weakness, with the Technometer currently neutral. We think we are in the midst of a correction and will see lower prices in the weeks ahead.

We still are looking to be short here, but also looking for stocks that are outperforming to the upside, and could lead us higher after this correction has run its course.

The bond market was unchanged for the week. Our TLT Technometer was strongly overbought this week so we are expecting further pullback here, which we feel will lead to us buying. We are standing aside awaiting clarity.

We have made the Wyckoff Unleashed Course more affordable to possible students. We have added an option of paying for the course in six easy installments of $189.99. We are trying to build the Wyckoff community and hope this easier pay option helps!!

Click here for more info…

Good Trading,

Todd Butterfield

Responses