The Wyckoff Wave back in the middle of the trading range

Click the following link if you would like to also view a video we did Friday on the components of the Wyckoff Wave. https://youtu.be/NWptdcGlzVw

The Wyckoff Wave traded sharply higher at week’s end to finish the week higher. Volume still trading at slightly lower levels.

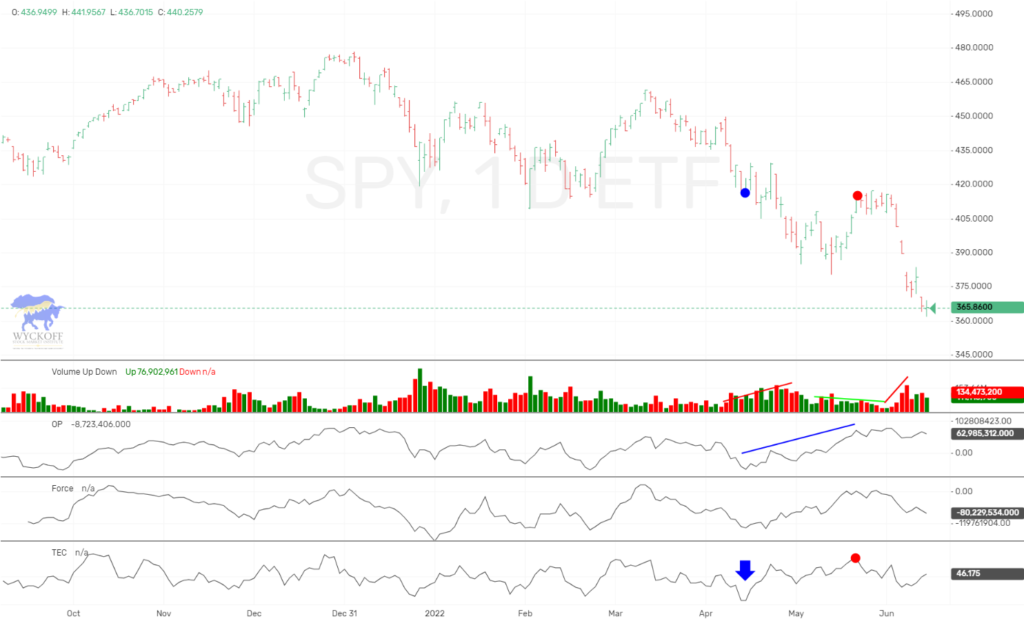

The O-P continued to underperform and traded a new low Wednesday for the intermediate decline since mid June. While it was doing so, price held higher which is a bullish divergence which we mentioned could happen. If volume would now come in off these lows we could see the Wave continue its rally.

The Force Index increased slightly for the week.

The Technometer closed the week slightly below neutral.

The intraday chart for last week showed the OP leading the way low. Thus far it has not rallied in unison with the Wave which is a worrisome sign. The OP will need to expand to the upside with good volume to keep this rally alive…

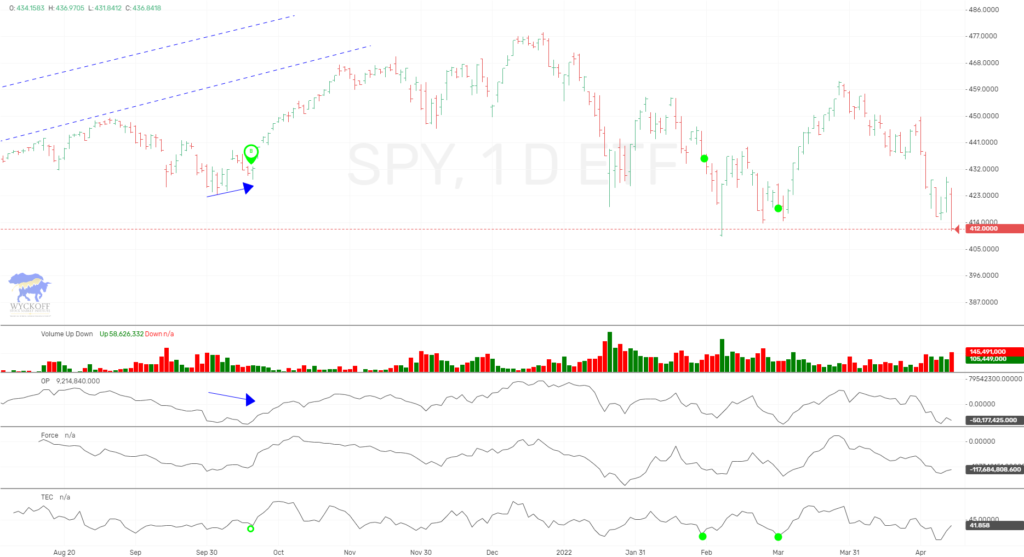

The one year daily chart shows the Wyckoff Wave trading in an uptrend on an intermediate term basis, and still in the middle of the short term trading range shown by the purple trendlines. We had expected a pullback in the past two weeks, which we got into Wednesday’s low. Then with China trade headlines more friendly, and WalMart’s strong gap higher, we saw the Wave rally nicely Thursday.

The Technometer also got near oversold on Wednesday’s decline, and still trading slightly below neutral. So it will support further rally, but we will need to overcome the resistance at the 54,300 level.

If the 50,500 level was a test of the previous spring down to 49,000, then the recent decline to 51,500 further testing, we should see the Wave rally quickly to the top of the purple trading range at 56,500. Any hesitation will be disappointing for the bulls.

The Wyckoff Wave Growth Index (WWG) traded lower for the week. The decline tested the support line of the recent uptrend.

Its Technometer reading is slightly below neutral.

The bond market traded slightly higher for the week. Volume on the recent rally has decreased and we feel it is meeting resistance and testing the previous short term highs. We are wanting to be short this market.

A month ago TLT had met resistance at its supply line of its intermediate down trend, and volume came in on the decline thereafter. The Technometer is trading near overbought after the recent corrective rally so short positions should be warranted soon.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are going to test reliability next few weeks, and then preparing to offer it to subscribers.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 938 students enroll since its launch on June 22, 2017. On June 28th we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Crptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses