Buy Bank of America, (BAC) at Monday’s opening. Sell Stop at $27.65

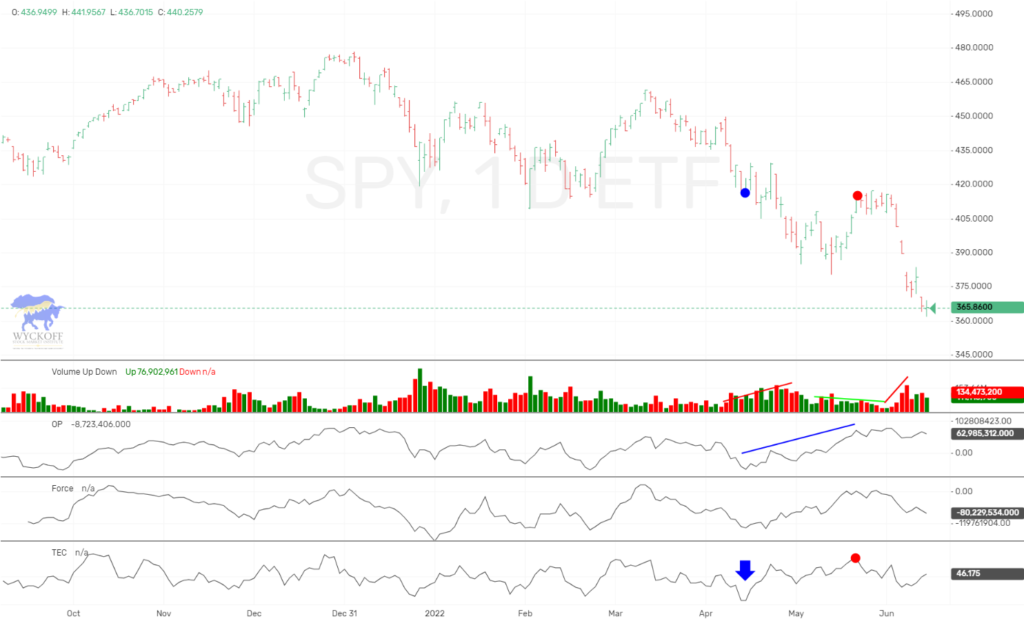

We feel that interest rates could work higher in the months ahead. Normally in this rate environment, financials can outperform to the upside. We therefore want to purchase Bank of America at the market.

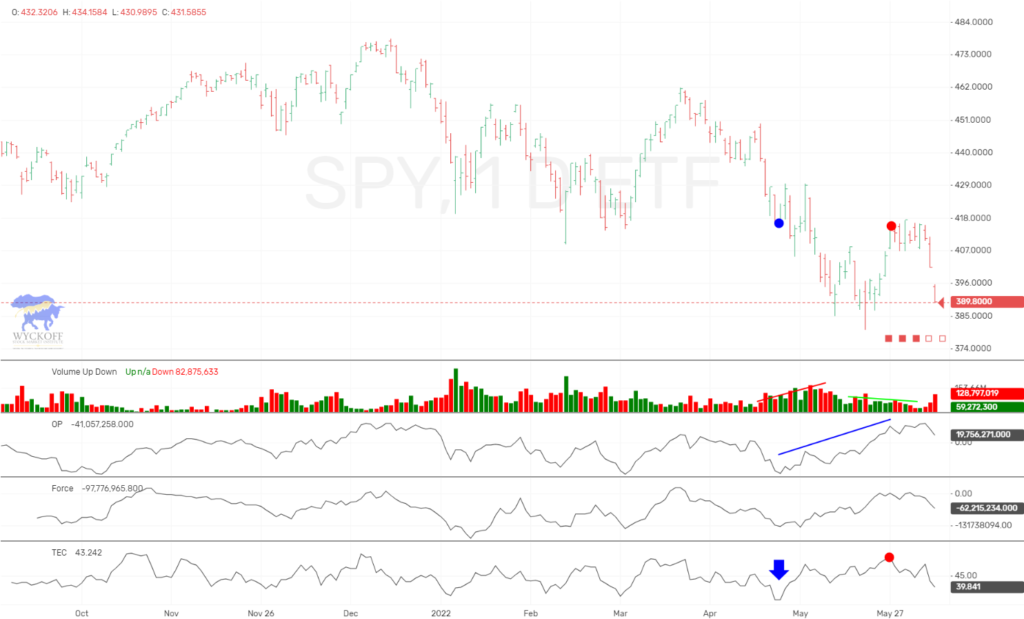

We feel like we had a selling climax at the red arrow, and since then have had an accumulation phase. We like the volume that came in at the green arrow as we reentered the trading range off of the spring.

We want to take a partial position now, as our Technometer is overbought and we would like to buy more shares when it is back to neutral or so.

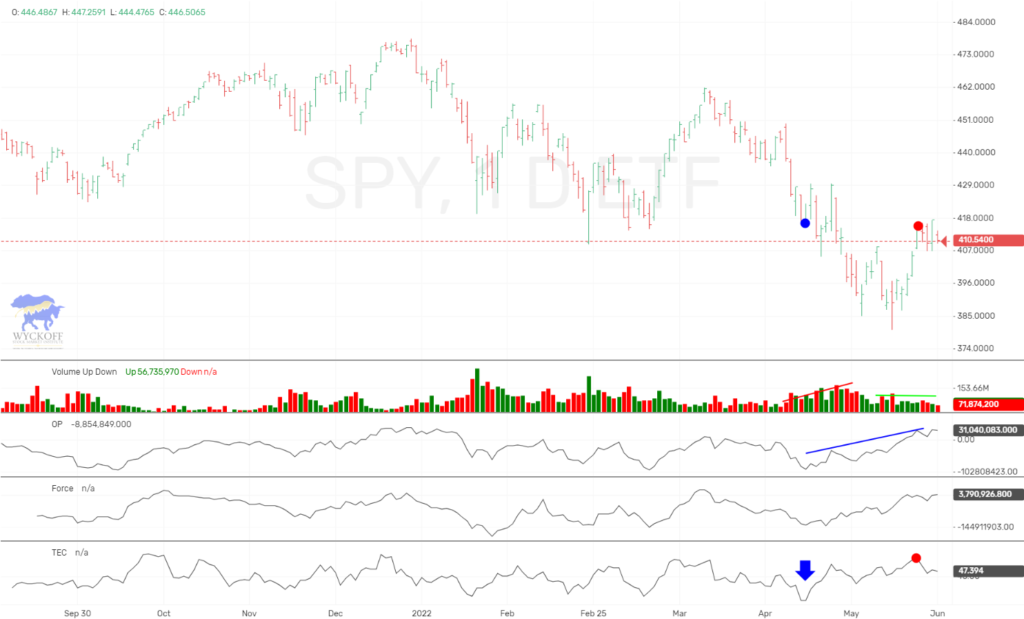

The following chart has BAC charted against TLT, which is the Treasury Bond ETF. You can see when the TLT experienced its last big selloff as show in the bottom red line, BAC responded nicely to the upside. When the TLT rallied recently as shown by the bottom green line, BAC traded sideways. We think TLT is preparing to move to the downside again, and BAC could move out of this accumulation range to the upside.

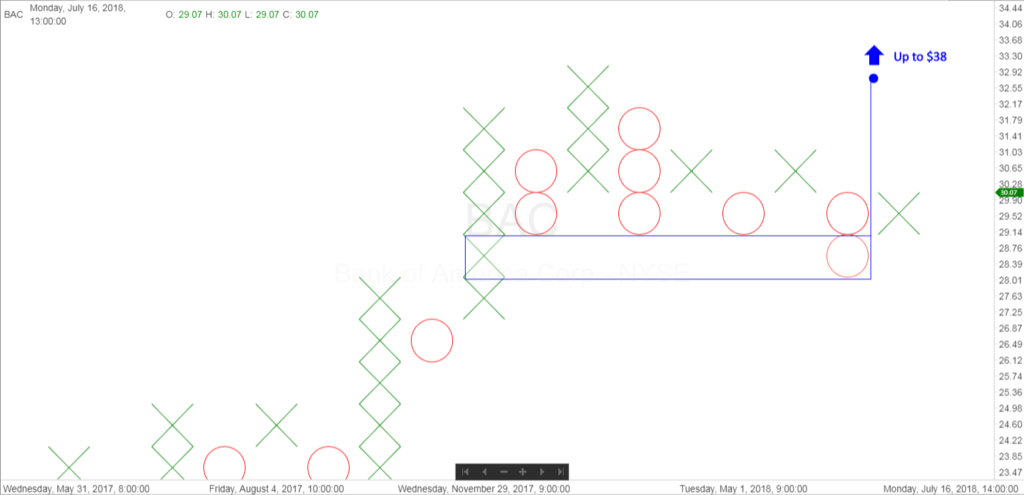

Below is our Point & Figure chart which is showing an accumulation count of $10. This would give us an upside objective of $38 if the complete area is accumulation.

Good Trading,

Todd Butterfield

Responses