Reaction In Progress

Thursday, January 12, 2017

What To Do?

Short Term

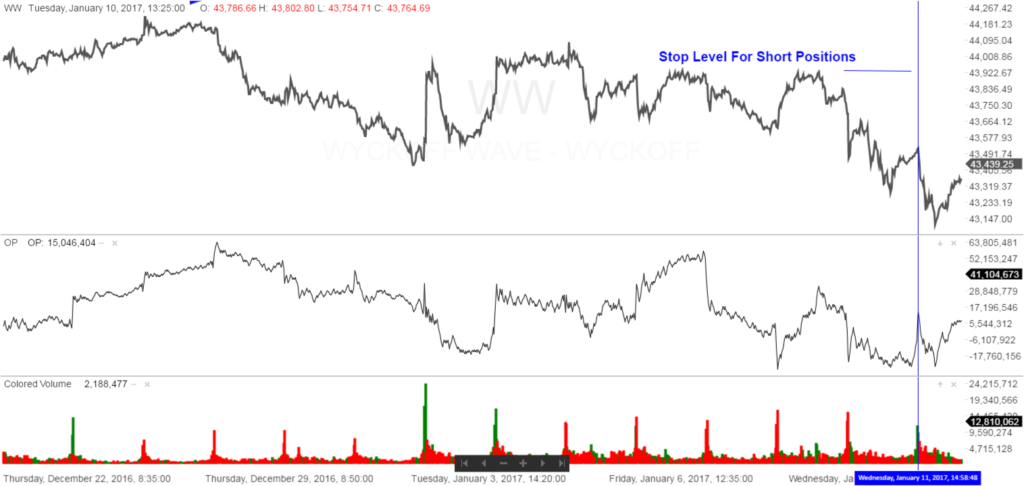

Short-term bears should hold short positions and lower stops to Tuesdays high as marked on the intra-day chart.

Short-term bulls should be looking for long candidates and be prepared to act.

Intermediate & Long Term:

Intermediate and long term positions to the upside should be maintained.

There are no intermediate or long term opportunities to the downside.

Market Trends:

Intra-day: Down

Short Term: Down

Intermediate Term: Up

Long Term: Neutral

The stock market, as measured by the Wyckoff Wave opened lower and traded down for the first half of the day. Then a rally began and brought us back to almost unchanged again. Volume was at the same level as last two days.

The Wyckoff Wave closed slightly lower today, and the price spread and volume showed a little supply on the market once again.

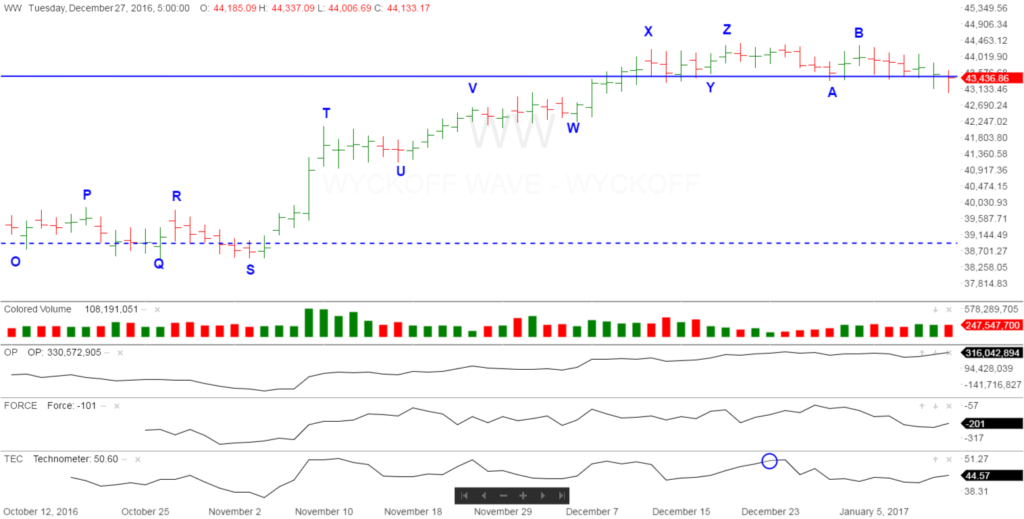

The Technometer is back to a neutral reading again.

The Nasdaq and S&P 500 were both slightly lower today.

A review of the intra-day waves shows the Wave traded quickly lower at the opening. Then began a rally right back to almost unchanged at the close once again. The O-P did not confirm the recent decline of the last few days, so the decline could not get into gear to the downside. Lets see if the O-P staying firm the last few days can get any rally going in the Wave here.

The Optimism-Pessimism Index closed slightly higher today.

The Force Index closed higher again today but continuing to exert downside pressure.

On Friday, the Technometer will open in a neutral condition once again.

Today, the Wyckoff Wave closed slightly lower again on average volume. We still feel there is more downside coming in the immediate days ahead.

We do not want to see a rally above Tuesdays highs, and we would like to see the Wave fall further back into the trading range from here. Being short has been a tiring process and very little reward.

As we mentioned a week ago, the alternative scenario is that we are backing up to the previous highs for a Last Point of Support. For all the reasons we have mentioned over the last few weeks, we see this as a very low probability. If the Wyckoff Wave can continue higher then that would be a bullish scenario, and we would discuss in more detail.

As we have been continuing to acknowledge, the rally from “S” to “Z” did not have the volume and price spread we was expecting from a Jump Across The Creek, but appeared more as a test of the upper limits of the trading range. Lets see if we can fall back into the trading range here as expected.

Good Trading,

Todd Butterfield

Responses