Sign Of Strength Scenario In Jeopardy

A great way to lose money in the stock market is to make a decision regarding its future direction and mentally try and justify those

decisions, even though the market conditions change. I would suggest it is far better to develop a few different scenarios and then, let the market tell you which one will play out.

That appears to be what is happening with the Sign of Strength within a trading range scenario that, up until this week seem to have an excellent probability of success. The past week’s market action has reduced the probability of success and additional scenarios need to be considered.

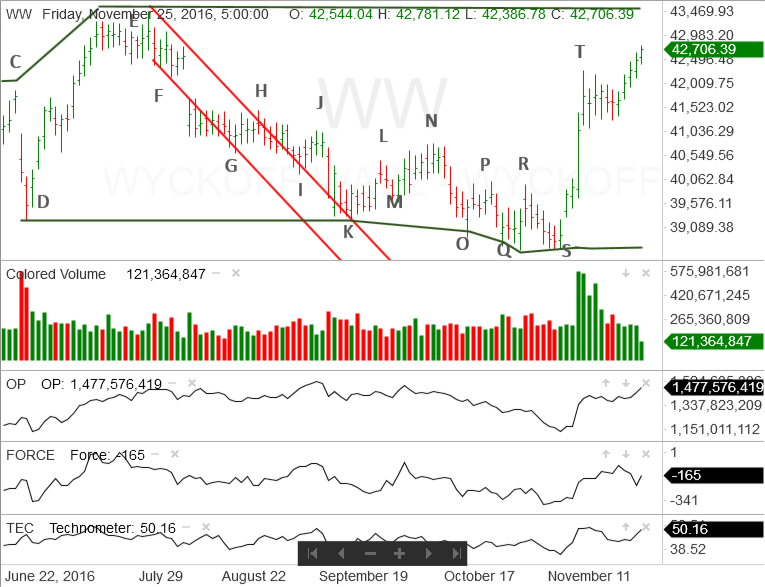

This is because a Sign of Strength is defined by strong demand. This presents itself as wider price spreads and increased volume levels. That’s what happened as the Wyckoff Wave rallied off the early November low at point S. It moved strongly to point T on relatively wider price spread and noticeably increased volume. Then, it began to roll over and appeared ready to react. If the reaction was on reduced price spread and volume and held above the halfway point of the rally from points S to T, the Wyckoff Wave would have put in a Last Point of Support. This would have created the opportunity for a more significant rally into new high ground.

This past week, instead of reacting and drying up supply, the Wyckoff Wave rallied. However, the rally was on a lack of demand. This was not consistent with a Sign of Strength, especially when approaching a significant resistance area. In this case the resistance is found at the

top of the trading range. It is defined by a horizontal line drawn from point E.

The weeks rally, while profitable for the bulls who took positions in the area of point S, suggests the move from point S is not a Sign of Strength. Instead, it now appears to be a simple rally within a trading range. This means the Wyckoff Wave is now expected to simply test the resistance at the top of the trading range. If the test is successful, and there is a good chance it will be, the Wyckoff Wave will react back into the trading range and continue to wait for ending action.

One important purpose of a trading range, especially one that appears to be accumulation, is the drying up supply. This is done by taking in stock sold by weak holders. Supply is found at different levels within the trading range.

A few weeks ago, I wrote about that “pesky supply” that came into the market as the Wyckoff Wave tried to rally off points O and Q. The strong move to point T suggested that much of the supply has been absorbed, or taken in. That is also supported by the ability of the Wyckoff Wave to rally on a lack of demand. A lack of demand is an open invitation for supply to commander the market. When it doesn’t, this suggests little if any supply is available.

However, more important supply is waiting at the top of the trading range. Weak holders, who purchased stocks in the area of point E, thought the market would continue strongly into new high ground. A rally back to the top of the trading range gives them a chance to get out even. Many will take advantage of that opportunity.

The Wyckoff Wave is also sending signals that the market is ready to react.

The Technometer has moved into an overbought condition. In addition, the moderate negative readings from the Force Index does not have a mitigating impact on the expected reaction.

In addition, the Optimism – Pessimism Index is in a negative divergence with the Wyckoff Wave when compared to the high at point E.

These negative indications support the rally back into the trading range and possibly even testing the lows at the bottom of the range scenario.

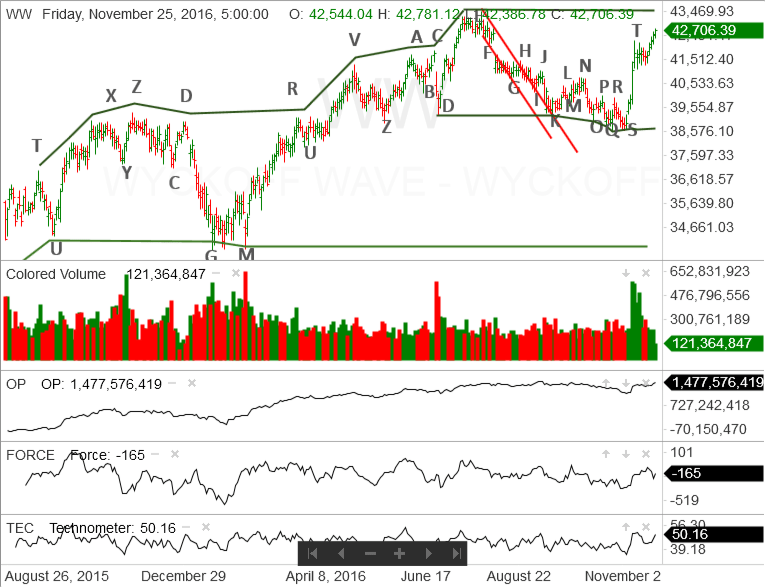

While the Wyckoff Wave will most probably not be putting in a Last Point of Support, the market action, beginning with the selling climax in August 2015, continues to suggest we are in a period of accumulation. At some point, the Wyckoff Wave will experience ending action and the bull market will continue.

The stock market, as measured by the Wyckoff Wave, should have one more nice move to the upside before it experiences a fairly significant reaction.

Responses