Still holding at the top of the trading range

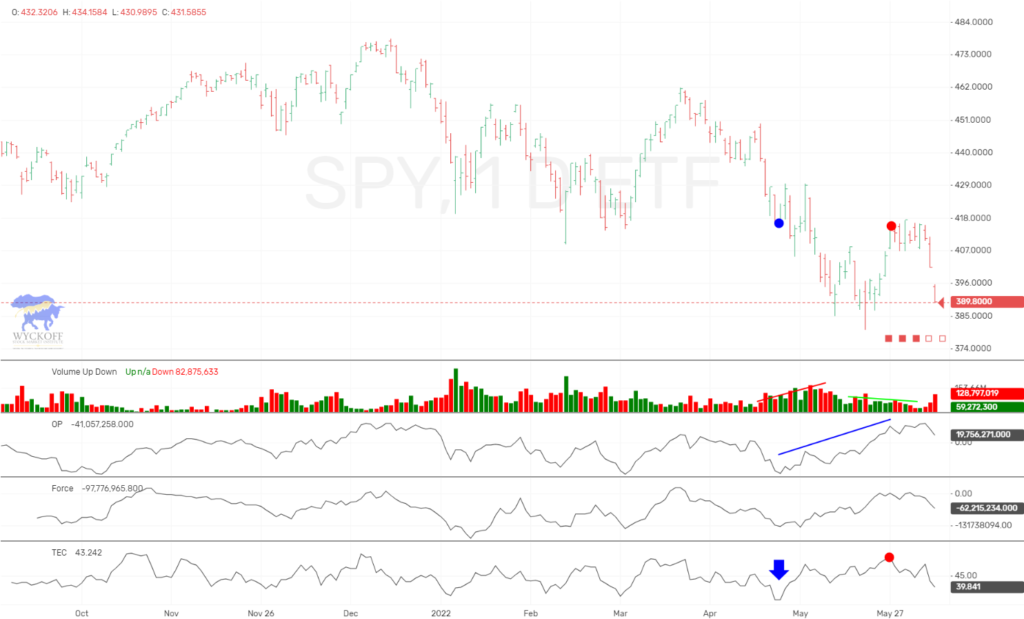

This past week the Wyckoff Wave was fractionally lower for the week. After opening higher on Monday, it upthrusted the top of the range on Tuesday/Wednesday, then spent Thursday/Friday moving sideways in a narrow range. Volume gave no strong clues. Volume was not strong on Tuesday/Wednesday pullback which makes the Upthrust scenario suspect.

The Technometer is at oversold levels at Friday’s close.

The S&P was .3% for the week while the Nasdaq was up 1.75%.

The Wave began the week with a rally on Monday, then immediately turned lower Tuesday and continued the reaction on Wednesday. The Wave then traded quietly sideways the rest of the week. The Wave is holding at the top of the range which is encouraging, and now the Technometer has returned to oversold after being overbought just 6 days ago. This tells us the Wave is vulnerable to a rally here.

The O-P spent the week in a downtrend and closed the week on a large negative wave which was some of the Russell rebalancing which influences are indicators.

The Force Index closed the week at -189, which is providing some downside pull. We would like to see this indicator turn up if the Wave is going to be able to put in a meaningful rally here.

We have a few shorts on and had expected more of a pullback here. We actually sold short GE early in the week and the stock sold off into Friday. With the Technometer now oversold we are not wanting to hold short positions much longer, and we will be watching the early action Monday closely.

We continue to hold a few longs as well and have identified other stocks still outperforming to the upside.

The Wyckoff Wave Growth Index (WWG) chart is not quite as bullish as the Wyckoff Wave, and the Technometer is still at overbought levels. This action is making us hesitant to jump on the Wyckoff Wave bullish indications without a little more trading action early this week.

The bond market experienced further gains last week and now near the top of the uptrend channel. The Technometer is overbought so we are close to closing out our short term long positions. We have nice short term gains, and do not want to see them erased.

We are probably going to be looking to going short this market, and looking for some type of short term correction.

Good Trading,

Todd Butterfield

Responses