Test of the Spring?

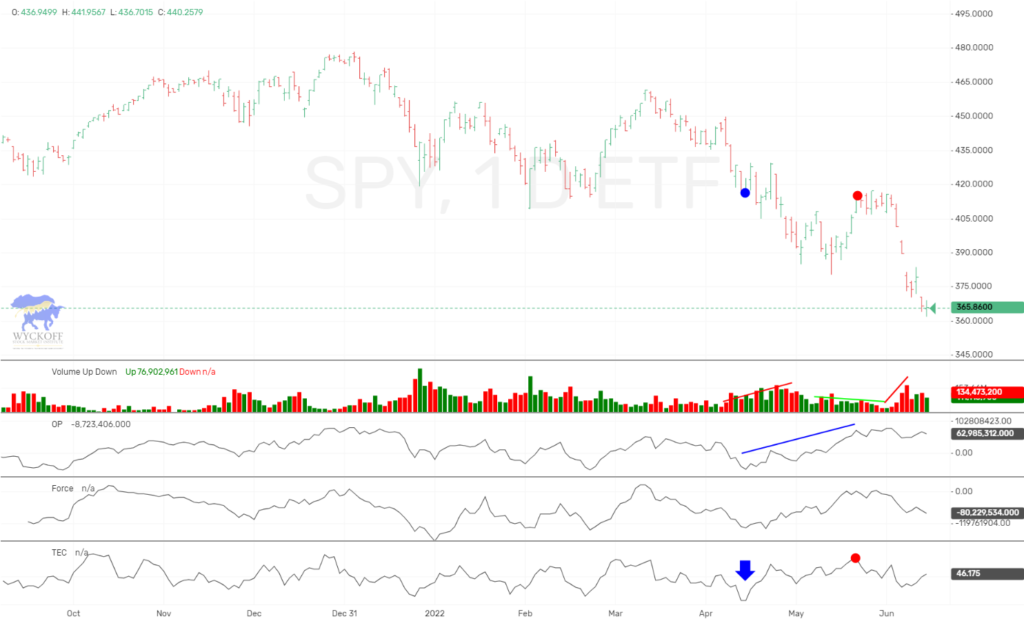

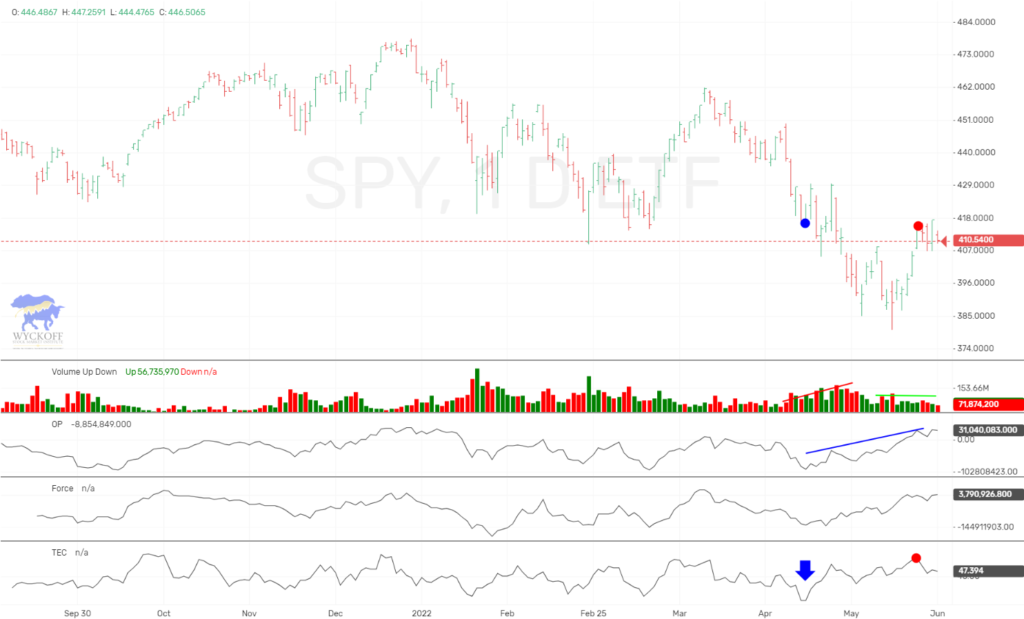

This past week the Wyckoff Wave extended its advance off of the Spring of the support level of “M” and “O”. Volume contracted as the rally progressed.

The Technometer is nearing an overbought condition on the rally.

The S&P was up approximately 1.4% for the week and the Nasdaq was up 2%.

After experiencing a spring off of the recent trading range support level, the Wyckoff Wave continued its advance last week. The rally was on declining volume, and declining price spread. We therefore would expect a test of the spring, which we feel will be starting from these approximate levels.

On the rally, the O-P has not had much buying volume as well, so the rally appears tired. It has also stopped at the 1/2 way point of the recent trading range. We look for a test of the recent spring, or possibly a failed test and a move through the bottom of the support level.

The Force Index closed the week at -257, which is providing downside pressure to the market.

This recent trading range, and lack of volatility has been hard to trade. We are still holding shorts of weak performing stocks, and also holding a few longs on outperforming stocks. We would continue to look for stocks that are outperforming to the upside, and could lead us higher after this correction has run its course. Stocks that are having normal reactions, or preferably back up to the creeks.

For now, we look for the Wyckoff Wave to move lower, and we are anxious to see how it acts as it nears the bottom of the recent range.

The bond market was flat for the week. We are standing aside but will be looking to sell a rally.

Good Trading,

Todd Butterfield

Responses