The Wyckoff Wave Back At Resistance

**We have had huge success with our Cryptocurrency Discord with over 670 members. Due to that success we just started a Discord for WyckoffSMI.com which will detail our stock analysis/opinions. Access is gained by purchasing a subscription to our ProTraders for $40 a month. https://wyckoffsmi.com/product/pro-traders-subscription/

If you are a member of our Cryptocurrency Discord, you can join the stock Discord for a discounted price of $20.

The Wyckoff Wave closed down for the week. Volume was at recent levels.

The O-P was down for the week.

The Force Index was down.

The Technometer was trading at oversold levels, and came off slightly.

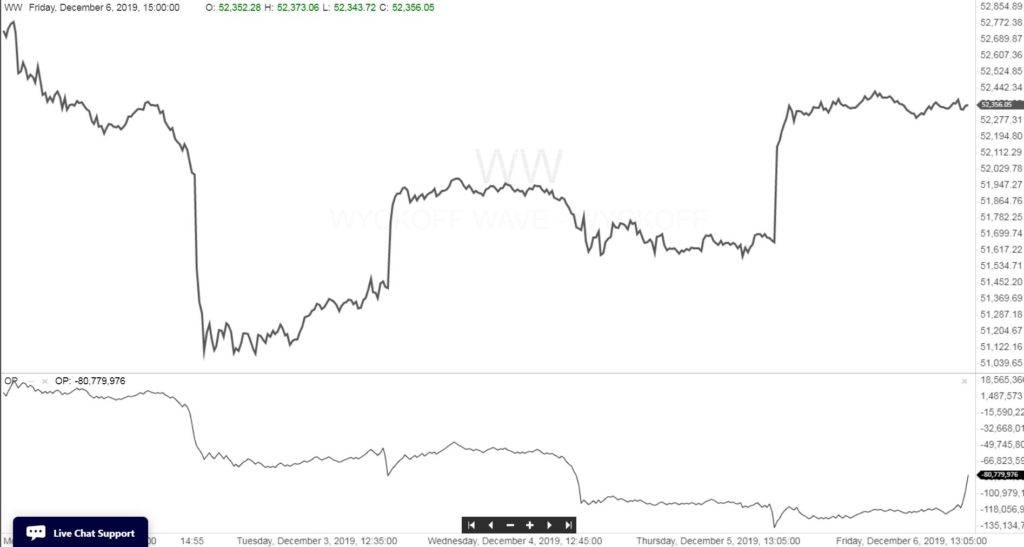

The OP is trading weaker than the Wyckoff Wave. You can see that all the way into Thursday’s close. That then lead to Fridays’ strong day in the Wyckoff Wave.

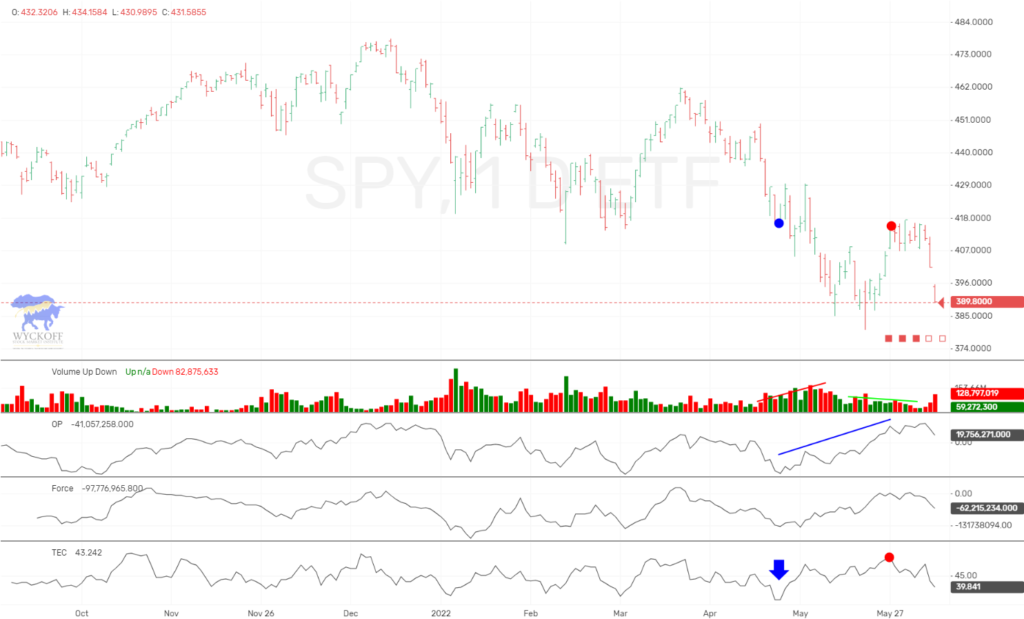

The Wyckoff Wave began the week with a sharp correction as we had been calling for. However, the weakness was quickly reversed and we only closed down slightly for the week.

The Technometer had been near overbought the last two weeks, and quickly became oversold early in the week on the selloff. This warned us that we would probably bounce, which we most definitely did. As we sit today, the Technometer is still just now coming off oversold and appears that the Wave can add to last weeks, late in the week gains.

The problem is we are still trading right at the resistance of our longer term trading range. We do have a chance to now jump this resistance, but we will need to see the OP to put in a strong performance here.

The Wyckoff Wave Growth Index (WWG) traded slightly lower for the week, as expected.

The Technometer quickly came down to oversold, which also lead to an end of week rally. It also appears to have more upside to go this week.

The SPY also finished the week ever so slightly higher.

The Technometer is coming off near oversold, and appears to allow us more rally here as well.

The bond market experience weakness last week, after a sharp some volatility early in the week.

The Technometer registered oversold on Monday’s weakness, and that lead to Tuesdays sharp rally. But that rally was completely erased as the blue downtrend line was too much for this market. It would appear there is more downside here, as stocks rally.

We would expect a test on the downside, of the blue line and expect it to hold. This would complete a test of the previous spring. We would then look to be a buyer for another strong rally.

The GDX finished the week slightly lower.

The Technometer is oversold so GDX could be expected to put in another minor low this coming week. We will stand aside this market for the time being.

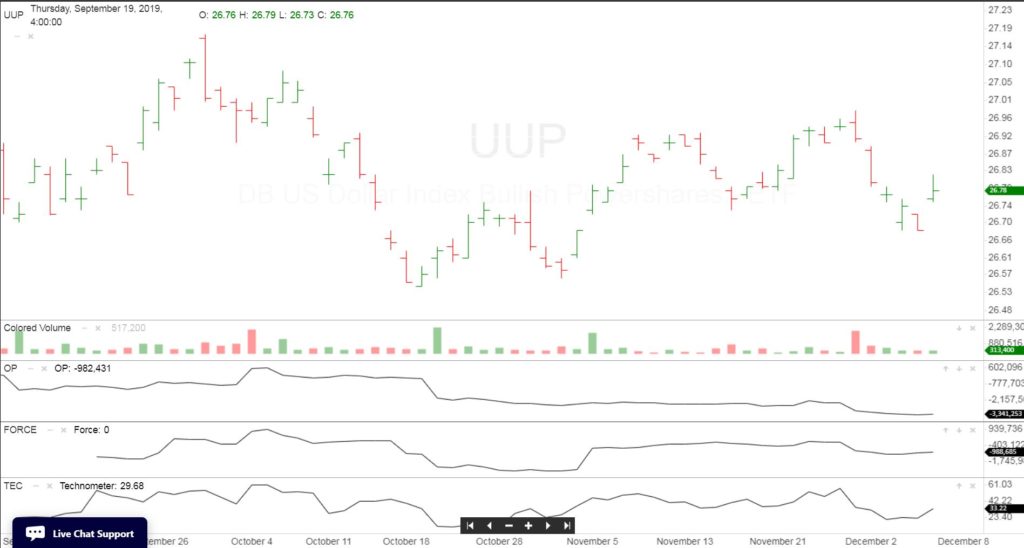

The long dollar ETF, UUP was down for the week. We had been short this market, but covered on the weakness. We will look to sell a bounce possibly.

In our newly launched Wyckoff SMI Discord we managed to catch a nice long in ULTA last week. As you can see from the chart below, there was selling that came into the stock as shown by the OP, but price just completed a test of the earlier spring. This was done while the Technometer was registering an oversold reading. This was telling us the Composite Man, was accumulating this stock on the selling pressure. Friday’s earning were positive, and this stock quickly gave us a 10% profit for the week. We will be on the lookout for these type of opportunities as we move forward with the Discord.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites.

We have recently started a Discord channel where we discuss the Crypto markets. We have had huge success and if you trade Bitcoin you might like monthy access at $40 a month. https://www.patreon.com/LearnCrypto

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 990 students enroll since its launch on June 22, 2017. On June 28th we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Crptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses