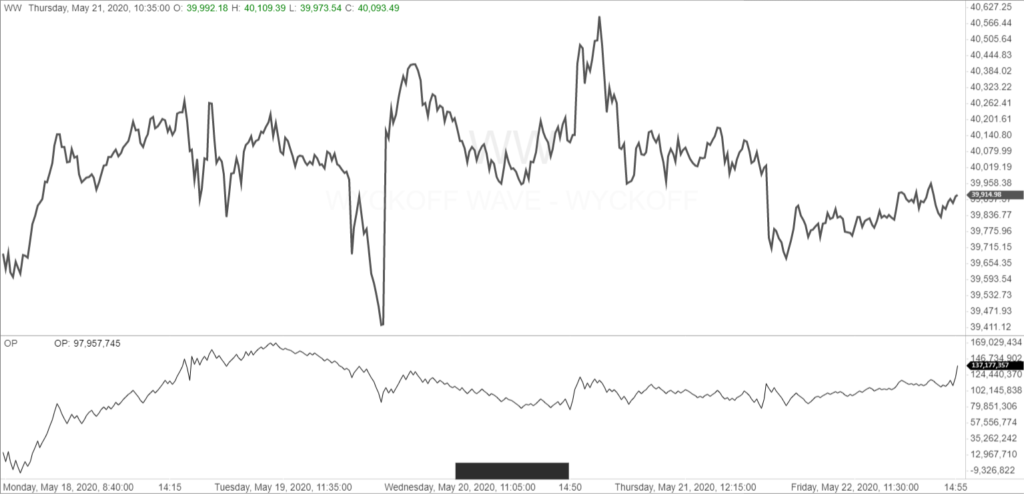

The Wyckoff Wave Continued Higher Off Of Spring

The Wyckoff Wave was higher for the week. Volume was at average levels.

The O-P was up for the week.

The Force Index was up slightly for the week.

The Technometer is sitting at neutral/overbought.

The OP and Wyckoff Wave are trading somewhat in unison.

The Wyckoff Wave was up for the week, trying to add more distance from the spring level which was what we called for. We could be working on the test as we speak as volume has lightened up, but we did have Holiday trading Friday. So we will watch early in the week for a more clearer direction.

The Technometer was oversold on the spring, and we are now above neutral. We will try to stay long until we get a more clear overbought reading, or the spring low is violated. This would be bearish.

The Wyckoff Wave Growth Index (WWG) was up for the week.

The Technometer is near overbought but this market has outperformed to the upside and will probably continue somewhat higher.

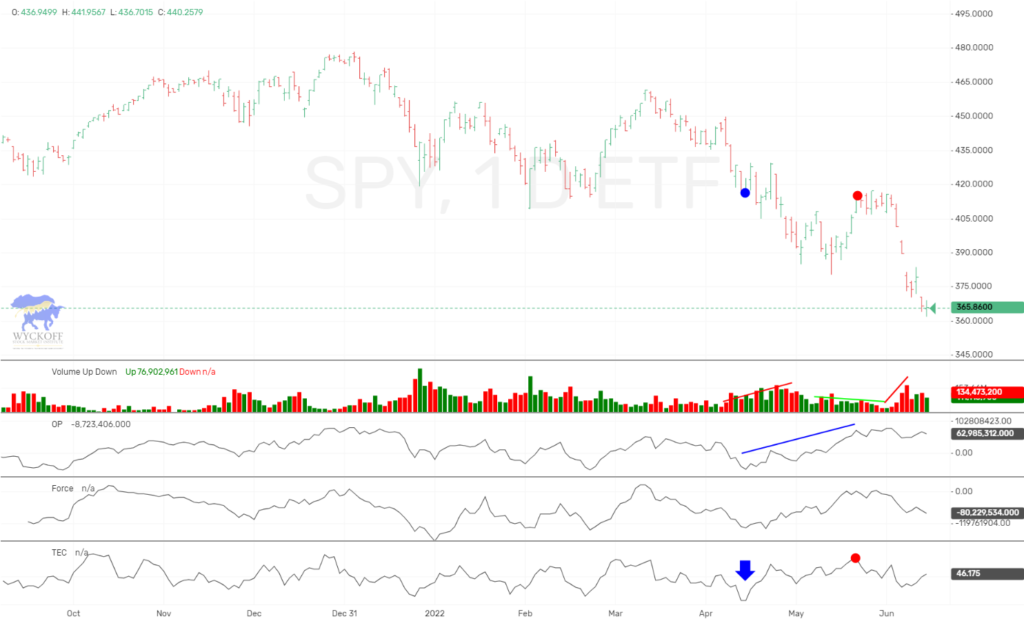

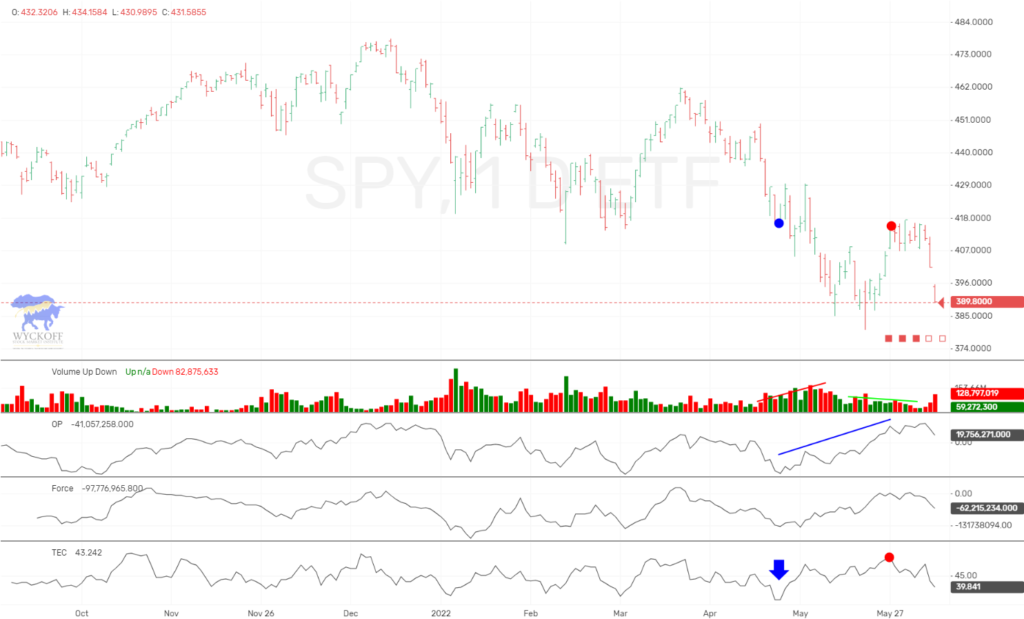

The SPY finished the week higher with the rest of the general market.

The Technometer was oversold and we expected higher prices. We are now neutral/overbought and we would expect still higher prices.

If you want more current up to the minute updates, please join our ProTraders/Private Discord. We are still long a few individual stocks. Join Here

The bond market closed lower for the week.

Our Technometer is still near overbought, and we would expect bonds still slightly lower if stocks continue higher.

The GDX finished the week slightly lower.

The Technometer started the week near overbought and now neutral. We still think this market looks lower intermediate term, and watch to be short.

Not much to add here, as mirrors the GDX.

The long dollar ETF, UUP was down slightly for the week.

This market has gone no where for weeks. We are wanting to enter a long here but our Technometer came off of oversold so we are still on sidelines.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites.

We have an active Discord channel where we discuss the Crypto markets. We have had huge success and if you trade Bitcoin you might like monthly access at $40 a month. https://www.patreon.com/LearnCrypto

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 1016 students enroll since its launch on June 22, 2017. On June 28th, 2018 we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Cryptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonStocks”, “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses