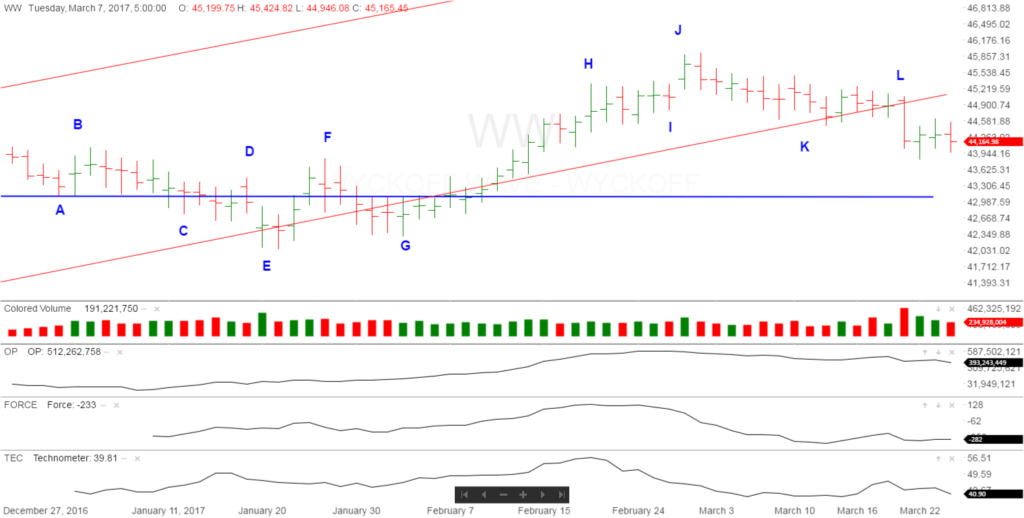

Wyckoff Wave Continues Its Correction

The Wyckoff Wave spent the past week extending its correction of the last month. Volume increased on the selloff and shows supply present.

The Technometer spent the week trading near neutral and finished Friday slightly below neutral.

Volatility picked up slightly and is at the high end of the range for the last year or so. VIX closed the weak at $12.96.

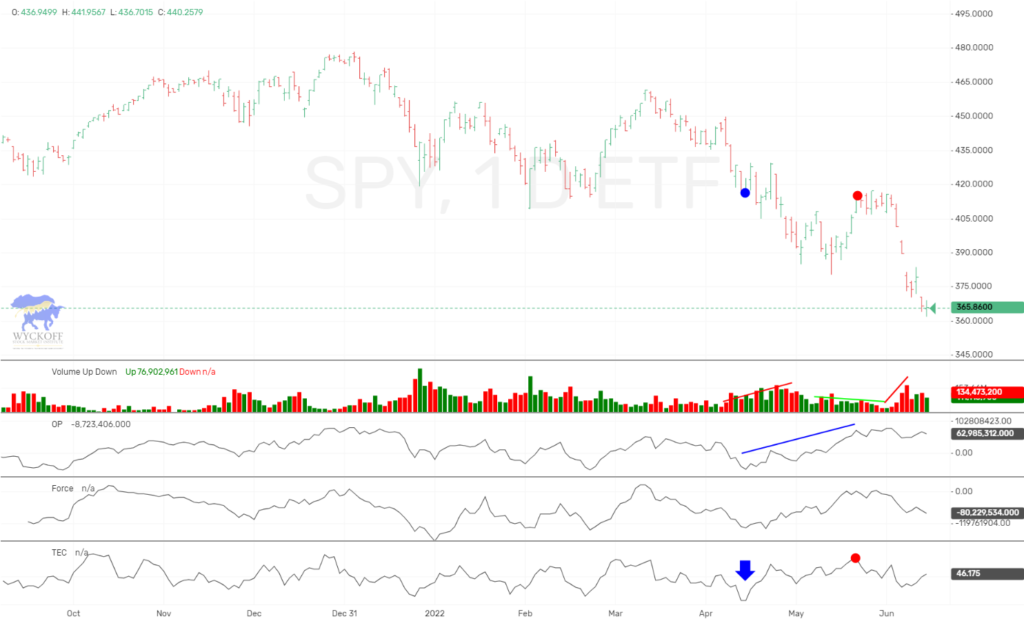

The S&P and Nasdaq Indices were both down appoximately 1.4% for the week.

The Wyckoff Wave traded sharply lower Tuesday and decisively broke the red uptrend channel as shown above. It then spent the next three days trading sideways, before what we feel will be another push lower.

The Optimism – Pessimism Index has continued to lead the Wave lower. Supply has been present. You can see on the 5 minute intra-day O-P line chart below, that there has been no buy divergences on this correction. The O-P and the Wyckoff Wave has been moving in lockstep to the downside.

The Force Index continues to trade at low levels and applying pressure to the downside. The downside pressure helps to negate an oversold Technometer reading in the next few days.

The Wyckoff Wave New did break down this past week as expected. We see still lower prices ahead….

We still have shorts on various stocks that continue to show relative weakness versus the general market. For our ProTraders we are short GE, SBUX, CAT, and PX. Friday we put out a bulletin on possibly stocks to buy on our next Wyckoff Wave buy signal. Please click here if you would like to become a Pro Trade Member.

The bond market continues to trade higher. We are now standing aside awaiting clarity.

Just this weekend, we have made the Wyckoff Unleashed Course more affordable to possible students. We have added an option of paying for the course in six easy installments of $189.99. We are trying to build the Wyckoff community and hope this easier pay option helps!! Click here for more info…

Good Trading,

Todd Butterfield

Responses