Wyckoff Wave Still Looks Lower.

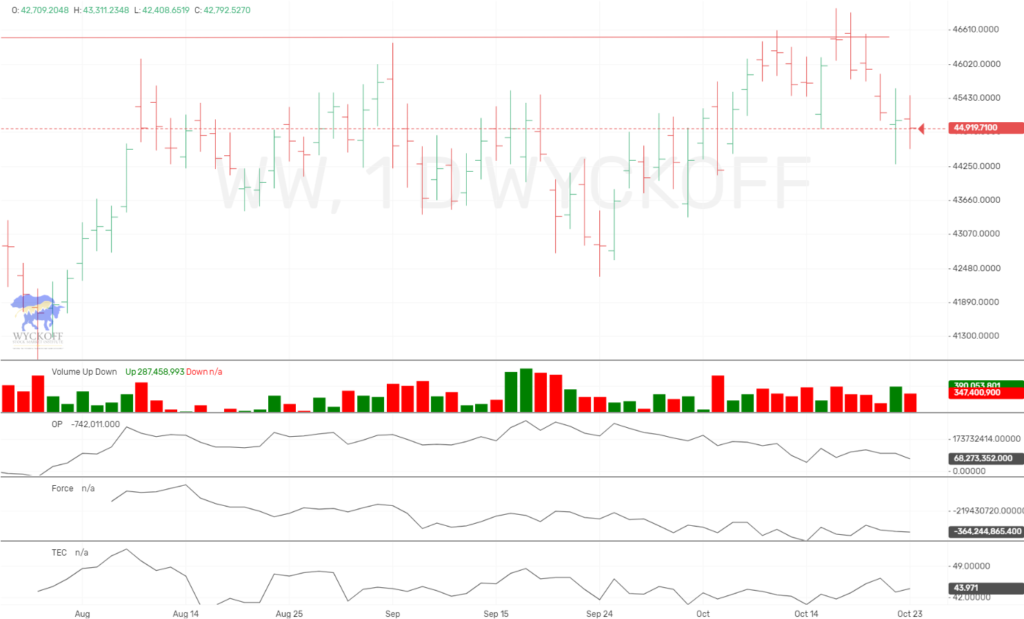

The Wyckoff Wave was down for the week. Volume was average.

The O-P was unchanged for the week.

The Force Index also unchanged for the week.

The Technometer is neutral.

The Optimism Pessimism Index is slightly stronger than the Wave.

The Wyckoff Wave closed lower for the week as expected. Volume was at average levels.

We was looking for the Wave to turn lower at resistance and correct. That occurred and it looks like it could continue.

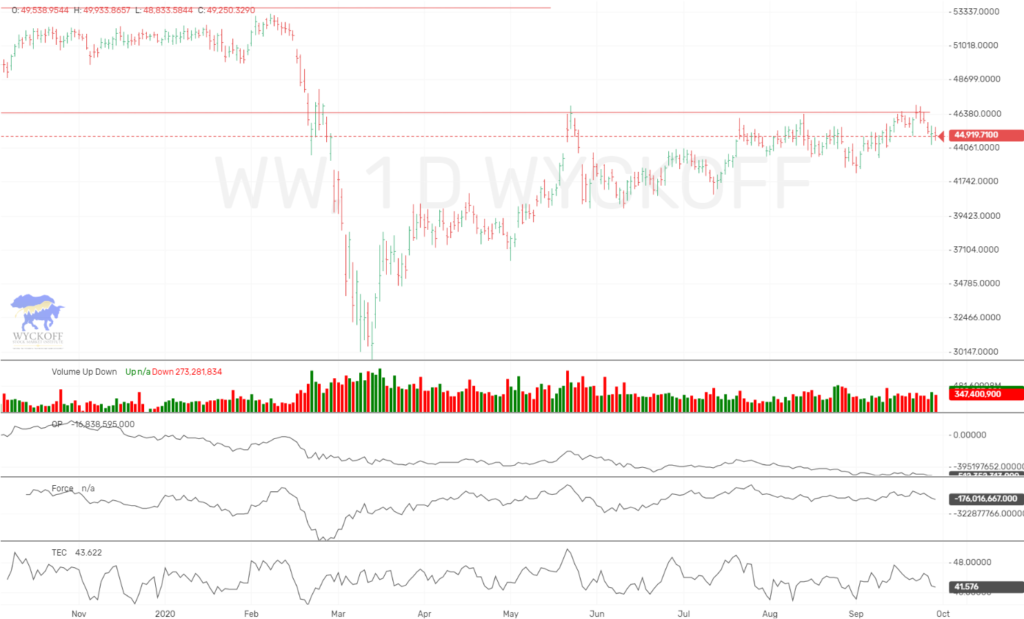

The Wyckoff Wave Growth Index (WWG) ended the week slightly lower. We had expected the rally to meet resistance and turn lower.

The Technometer was overbought last week and came very close to oversold on Tuesday. This warned us that the growth stocks could slow their decline and move sideways. This has happened and the Technometer is nearing overbought again.

We would look for this market to turn lower on any further rally attempts early in the week.

The SPY also finished the week slightly lower as expected.

The Technometer got close to oversold and now back to neutral. We think there is more downside here as well.

If you want more current up to the minute updates and trades, please join our ProTraders/Private Discord. Join Here

The bond market closed sharply lower for the week.

Price action has not been good here as we fell thru the support and did not successfully test the previous spring. The Technometer got close to oversold so we did enter a long position here and have small losses. We will watch this early in the week to see if we need to exit positions. We would expect a rally up to the previous blue support line then we will make a decision.

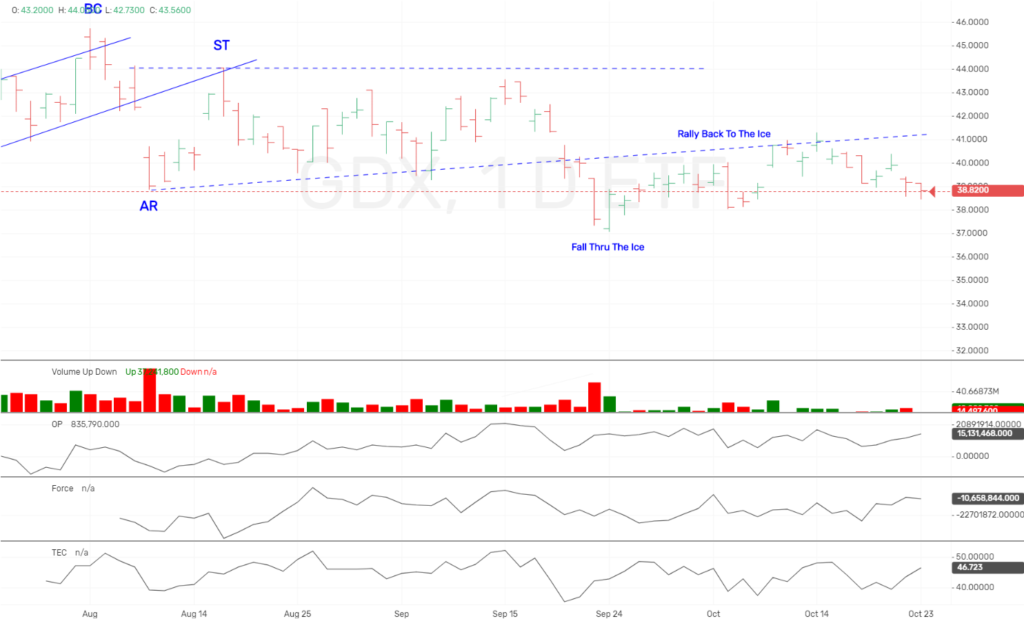

The GDX finished the week lower as expected.

The Technometer is once again nearing overbought and price action continues sloppy and negative. We will stay short and look for lower.

GDXJ slightly stronger but still looks bearish. The Technometer is nearing overbought here as well.

The long dollar ETF, UUP was higher as we were hoping for.

The long dollar ETF did hold Monday and reversed higher for the week. We are still long and looking for continued strength. Would like to see strong demand return here.

IMPORTANT ANNOUNCEMENT:

We have just released a lower cost version of our Unleashed Course, which is an excellent value at $349.99. Click Here

Are new “Pulse of The Market” charting software for Cryptocurrrencies is now showing consolidated volume from over 100+ exchanges. This is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites, and will be launching for subscription in near future.

We have an active Discord channel where we discuss the Crypto markets. We have had huge success and if you trade Bitcoin you might like monthly access at $40 a month. Join Here

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 1021 students enroll since its launch on June 22, 2017. On June 28th, 2018 we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Cryptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonStocks”, “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses