Wyckoff Wave Trading in a Narrow Range

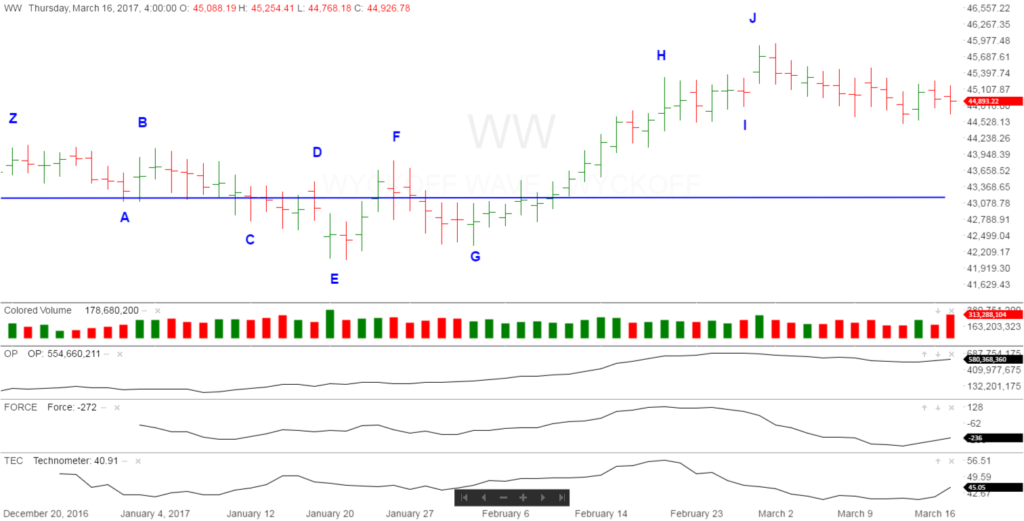

The Wyckoff Wave spent the past week trading sideways with very little movement, and closing slightly lower for the week. The price and volume relationship shows supply still present. It was not dominant, but still present.

The Technometer was nearing oversold early in the week, but now back to above a neutral reading. Any further rally in the Wave, will take the Technometer to overbought quickly.

Volatility has not picked up, and we are at historical low levels.

The S&P and Nasdaq Indices were both up slightly for the week.

The Wyckoff Wave traded slightly lower for the week. Monday/Tuesday saw slight selling, with a rally Wednesday off of the Fed news. Then Thursday/Friday saw minor supply present once again. We still expect lower prices from here.

The Optimism – Pessimism Index lagged on the rally to “J”, and traded aggressively lower the last three weeks. Last week the O-P continued to trade sideways, with no volume coming in to support the rallies.

The Force Index did not support the rally to “J” either, and has traded considerably lower in the last three weeks. Last week saw the downside pull lesson, but we appear to still have considerable pressure to the downside.

We want to also discuss a chart of the Wyckoff Wave New. This Wyckoff Wave includes more industry leaders as well as some major Nasdaq stocks. The components are: AMGN, AMZN, PG, WFC, JNJ, GE, FCX, DOW, XOM, SPG, AAPL, DUK. The Wyckoff Wave New has broken its recent uptrend as it could not rally to overbought line during the last month. It has now broken the support line of the uptrend and being rejected by it. We have also seen the O-P making a minor new high while the Wave has not. You can also see the Force has been applying downside pressure, and the Technometer is coming back to near an overbought level for a sell signal. These Wyckoff indicators show that the Wyckoff Wave New should see lower prices in the days/weeks ahead.

We still have shorts on various stocks that continue to show relative weakness versus the general market. For our ProTraders we are short GE, SBUX, CAT, and PX. We could possibly be adding more shorts this week.

The bond market traded up nicely off of the Fed meeting. We are now standing aside awaiting clarity.

Good Trading,

Todd Butterfield

Responses