The Wyckoff Wave Continues Its Rally Off The Lows

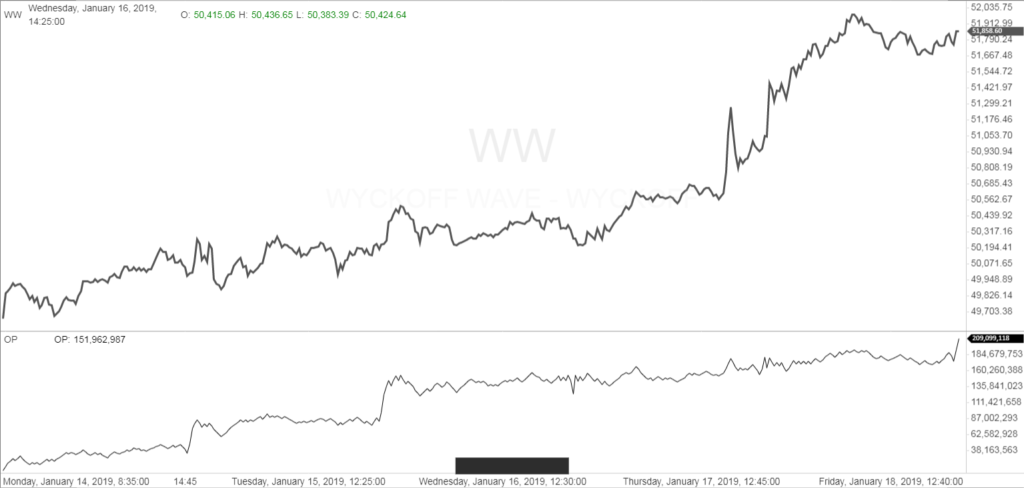

The Wyckoff Wave continued its rally of the last month. Volume has not been impressive on the rally.

The O-P was also up for the week.

The Force Index flat for the week.

The Technometer is overbought.

The OP and Wyckoff Wave is showing no major divergences or inharmonious action for the past week.

We was expecting the Wave to begin a correction this past week. We did get an overbought Technometer this week, but the market has refused to correct up to this point. We still expect a correction in the coming days…

We still feel the recent lows at 44,000 could be a good low, and last weeks action continues to back up those thoughts. Anxious to see how the next correction trades.

The Wyckoff Wave on year chart shows we did break the dashed blue downtrend line, which further verifies that we are trading possibly sideways in any further correction, and the downside is limited.

The Wyckoff Wave Growth Index (WWG), rallied with the Wyckoff Wave. It is slightly underperforming, broke its short term uptrend, and looks like further correction ahead.

The bond market traded lower for the week in negative correlation to stocks once again.

The Technometer is nearing oversold and we could find support here, especially if stocks turn lower once again. We have no new positions, but could possibly purchase in the days ahead.

The following chart of Boeing (BA), shows the continued outperformance of this stock. We like this stock longer term, and would like to buy once again on a pullback.

The software has been very successful with trades for Square (SQ). We got a solid overbought reading on SQ as marked by the blue circles, but it has continued higher, which shows the strength of this issue.

We would like to see a short term correction here as well to purchase again.

Union Pacific (UNP) has also continued higher. It it now rallying back to its overbought line of its longer term uptrend as marked in solid blue. We also like this one again on a pullback.

IMPORTANT ANNOUNCEMENT: Our “Pulse of The Market” charting software for Cryptocurrrencies is now working. This software has consolidated volume for the Crypto’s which is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites.

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 948 students enroll since its launch on June 22, 2017. On June 28th we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Crptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA

Please subscribe and click the bell to be notified of our upcoming broadcasts.

Our current schedule is Monday-Thursday approximately 6:30 p.m. CST, and they usually last approximately one hour. We will also broadcast at additional random times since we want to satisfy our international subscribers as well.

If you would also like to follow us on twitter for news and trade ideas, follow “LearnCryptoShow”, or “WyckoffonCrypto”. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses