Wyckoff Wave At The Lows, Will Buying Come In?

The Wyckoff Wave closed sharply lower once again for the week, on an increase in volume.

We were looking for a successful test of the June lows last week, but after the FED announcement we saw increased selling come in.

The first few days of this week will be important, as we will see if we will test the June lows and find support, or we will continue lower. Our Technometer finally did register oversold on Thursday/Friday, so lets see if that slows/stops the selling.

The Technometer is oversold at 38.1.

The Wave and OP are moving lower in unision.

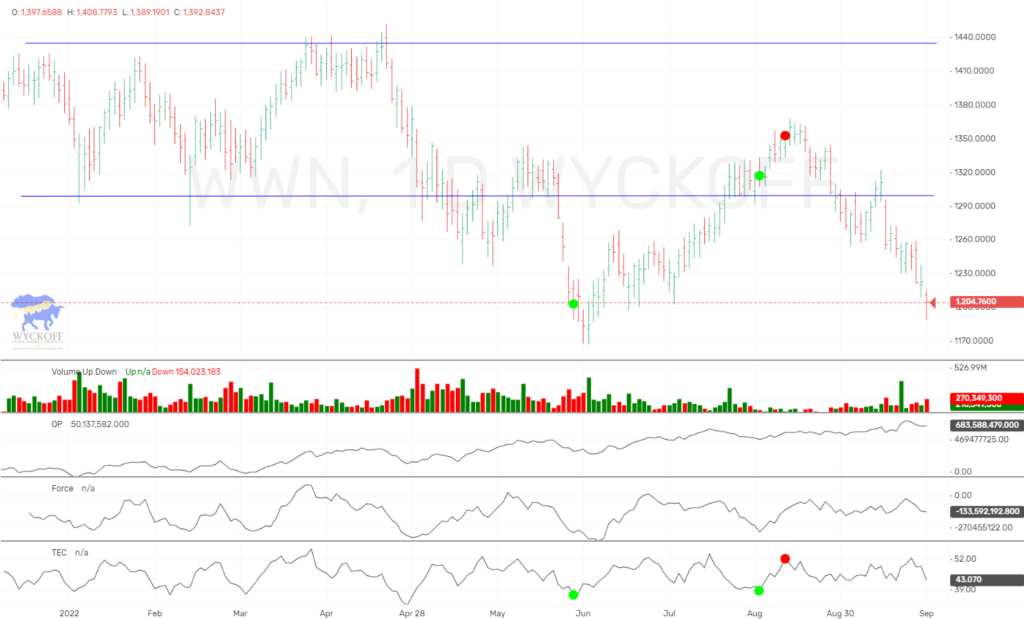

WWN – The Wyckoff Wave New Index also closed lower again for the week, on a increase in volume.

We were wanting our Technometers to get closer to oversold, but actually on Tuesday they registered overbought and warned of possible sell pressure. We got just that after the FED meeting.

Currently the Technometer is only slight below neutral, which allows more selling early in the week.

The Technometer is neutral at 43.1.

The Wyckoff Wave Growth Index was down for the week, on a slight increase in volume from recent weeks low levels.

We had an overbought Technometer here as well to start the week, and that turned us down for the week. We are now nearing oversold so lets see if we can have a higher test of the June lows and turn higher.

Currently the Techometer is nearing oversold at 40.5.

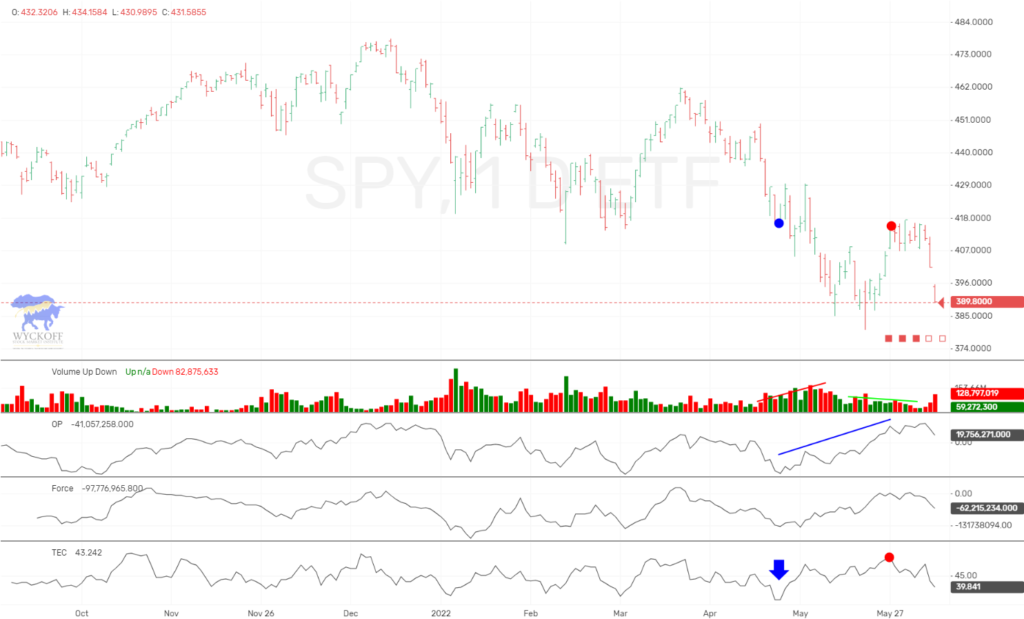

The SPY had a sharp selloff the last three days of the week, with a slight increase in volume.

We were looking for a test of last week’s low but that gave away after the FED meeting. our Technometer also did not register anything near oversold so we are standing aside. It appears we can have more selling early in the week.

We had only two positions on last week, one being precious metals, as we have never gotten the buy signal that we were wanting the last few weeks.

The Technometer is neutral at 44.8.

If you want more current up to the minute updates and trades as shown above, please join our ProTraders/Private Stock Discord. Join Here If you are a Crypto Discord Member, and would like the ProTraders/Private Stock Discord as well, you can have access for only $20 a month. Join Here

The bond market continues the selling of the last two months, on a slight increase in volume.

We were standing aside, and now our Technometer is overbought, and we are deeper in price then a spring would allow. So we will continue to stand aside.

Technometer is near overbought at 49.1.

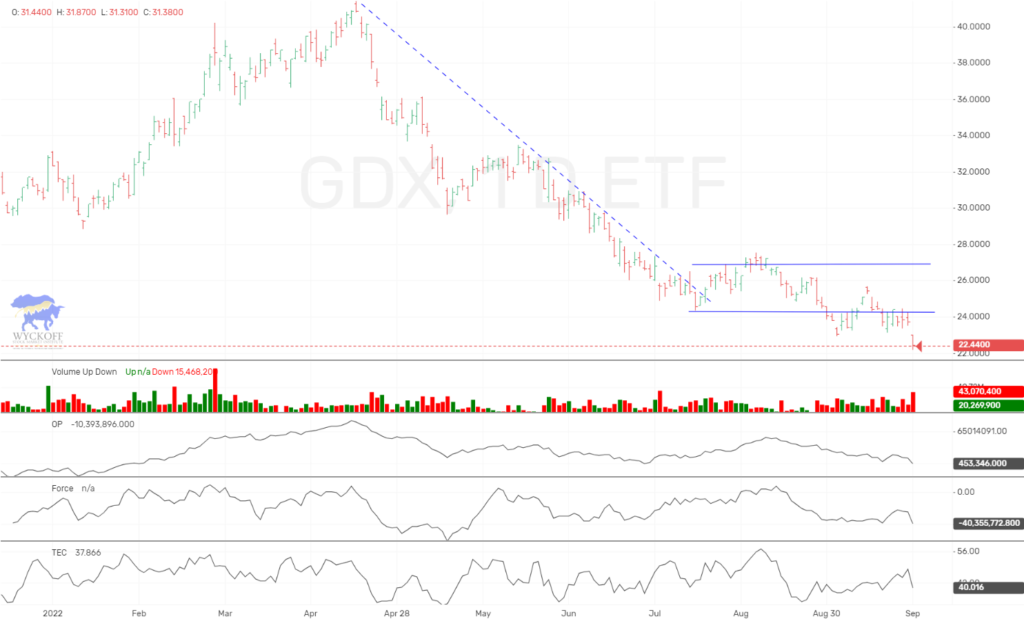

The GDX traded the week sideways, then got hit with selling on Friday, on slight increase in volume.

We had been looking for higher, and got stopped out for a small loss on our minor long position. We will stand aside for now, but we still think precious metals are due for a nice rally.

Technometer is near oversold at 40.0.

The Wyckoff Wave Metal Index is in the same position as GDX.

The Technometer is neutral at 43.6.

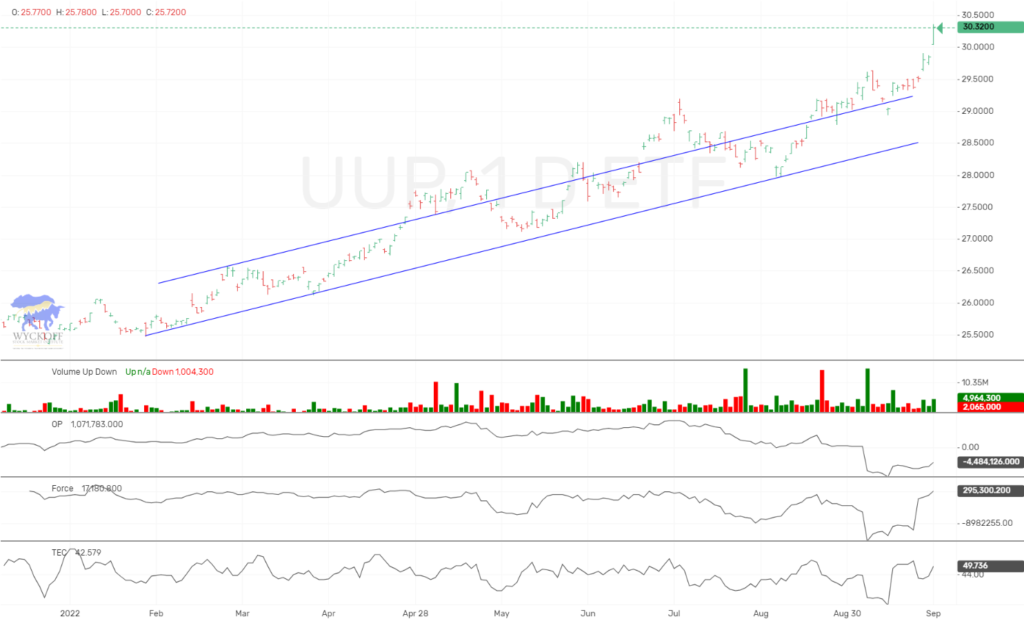

The long dollar ETF, UUP exploded higher, on average volume.

We was looking for a successful test of the previous high, but that was taking out on Wednesday after the FED meeting. Looks short term higher this week.

The Technometer is still overbought with a reading of 49.7.

Bitcoin traded the week sideway, on average volume.

We was hoping for a low in Bitcoin last week, but you have to be impressed that it held up well in the face of a horrible stock market. Because of that strength we cannot get the Technometer to oversold, so lets watch this week for a possible low.

Our Technometer for Bitcoin is neutral at 45.3.

IMPORTANT ANNOUNCEMENTS:

We launched our WyckoffSMIChina.com site late March, for our China community. Check it out!

We have just released a lower cost version of our Unleashed Course, which is an excellent value at $349.99.

Click Here Our new “Pulse of The Market” charting software for Cryptocurrrencies is now showing consolidated volume from over 140+ exchanges. This is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites, and will be launching for subscription in near future.

We have an active Discord channel where we discuss the Crypto markets. We have had huge success and if you trade Bitcoin you might like monthly access at $40 a month. Join Here

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 1029 students enroll since its launch on June 22, 2017. On June 28th, 2018 we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Cryptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA Please subscribe and click the bell to be notified of our upcoming broadcasts.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonStocks“, “LearnCryptoShow“, or “WyckoffonCrypto“. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield

Responses