Wyckoff Wave Rolling Over Once Again?

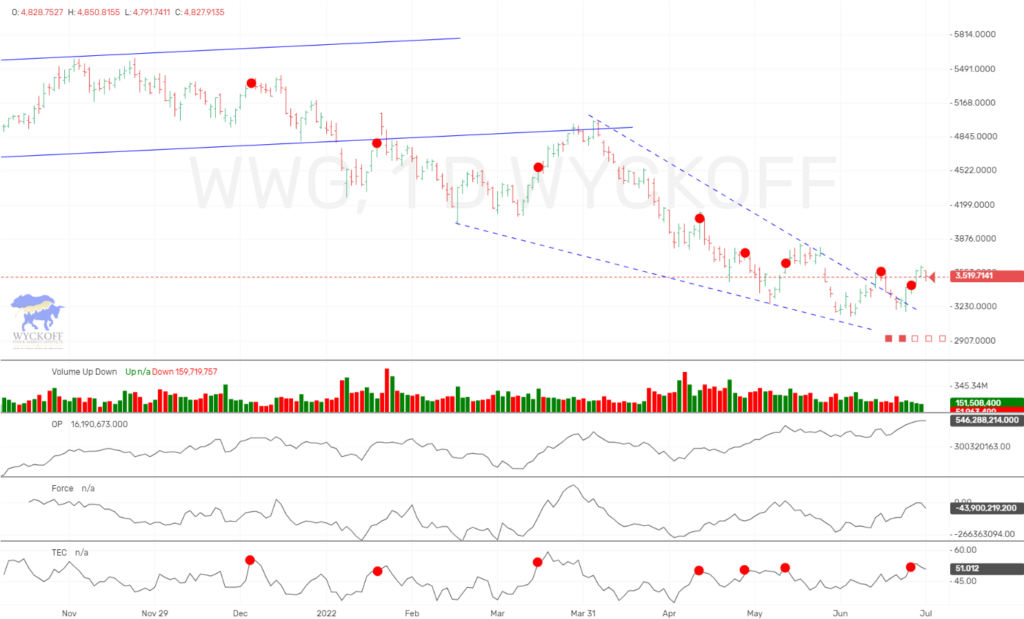

The Wyckoff Wave closed last week slightly lower, on average volume.

Beginning Wednesday we started to register some overbought readings on our Technometers.

Therefore we put out a warning that we could turn lower once again. It appears that has started at today’s opening.

The Technometer is neutral at a reading of 43.1, and we would like this to get closer to oversold, to call for another rally attempt.

The OP is trading in unison with the Wave. There was a negative divergence at Friday’s high, with the OP new high, while price did not. This shows there was selling under the surface.

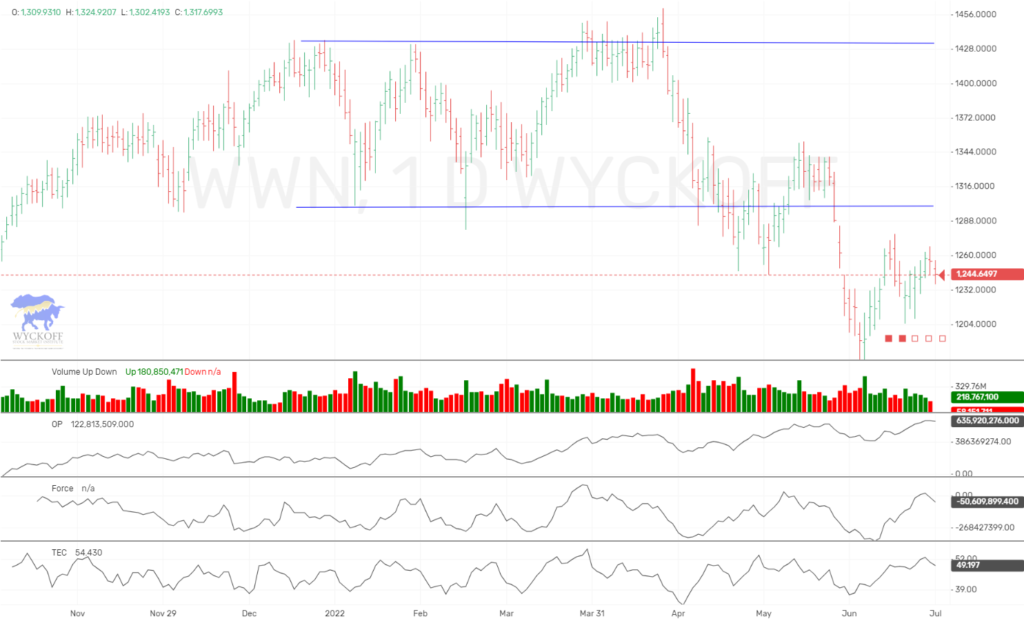

WWN – The Wyckoff Wave New Index closed slightly higher for the week on low volume. As mentioned for the Wave above, we got an overbought Technometer on Wednesday and are looking for a pullback.

The Technometer is overbought at 49.5.

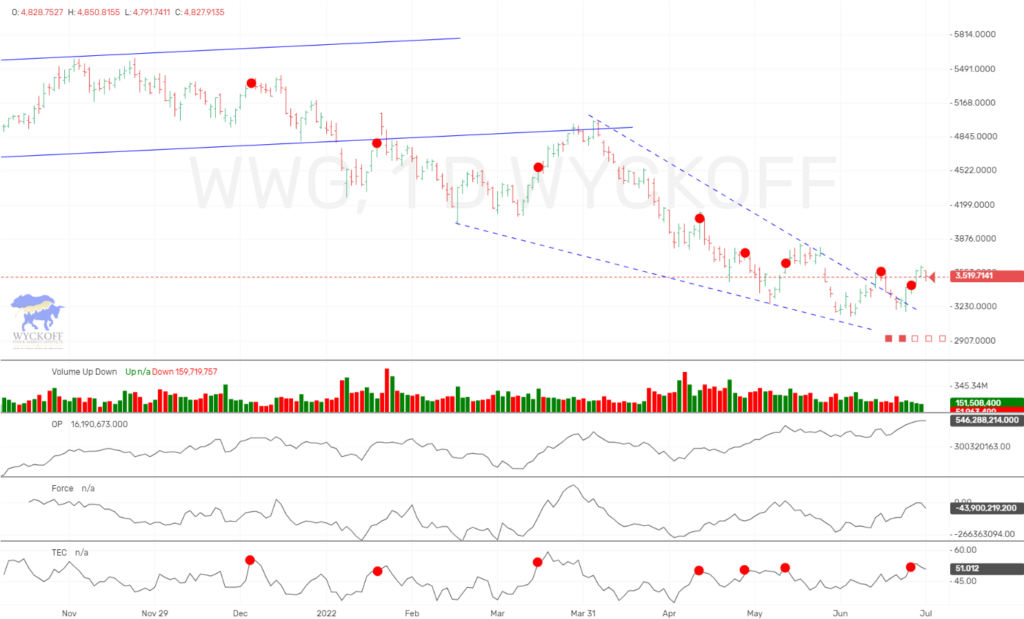

The Wyckoff Wave Growth Index was up for the week on low volume.

We wanted the WWG to take out a previous price high, when our Technometer was overbought (as shown by red dot), to make this market look more bullish.

We got the overbought Technometer here Wednesday but we then did manage to take out the previous high from the previous week on Friday.

Let’s watch this market, as if we can get the Technometer to quickly get near oversold on a slight pullback, we would be bullish.

Currently the Techometer is overbought at 50.5.

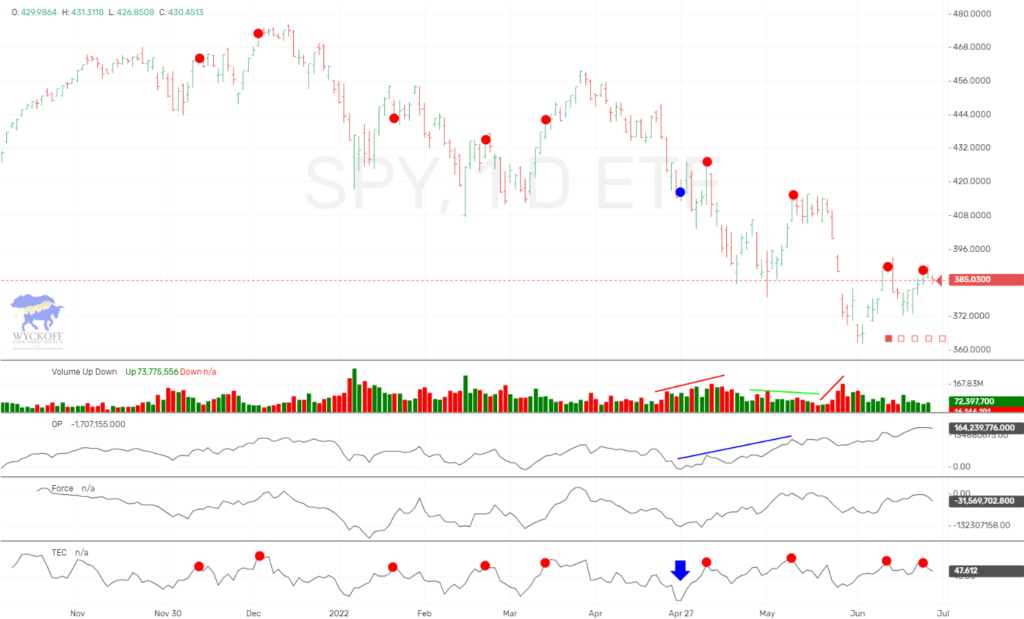

The SPY closed the week also slightly higher on low volume. We got overbought on the SPY on Thursday and are still below the previous red dot sell from a week ago. This is concerning, as we keep making lower highs on the sells.

We are neutral/overbought at 47.4 on the Technometer.

If you want more current up to the minute updates and trades as shown above, please join our ProTraders/Private Stock Discord. Join Here If you are a Crypto Discord Member, and would like the ProTraders/Private Stock Discord as well, you can have access for only $20 a month. Join Here

The bond market closed lower for the week on low volume.

We think there is more upside on the TLT from here, and Friday we registered an extreme oversold reading. Today we have gapped higher and looks like we can assault last week’s highs at a minimum.

The Technometer is extreme oversold at 33.3.

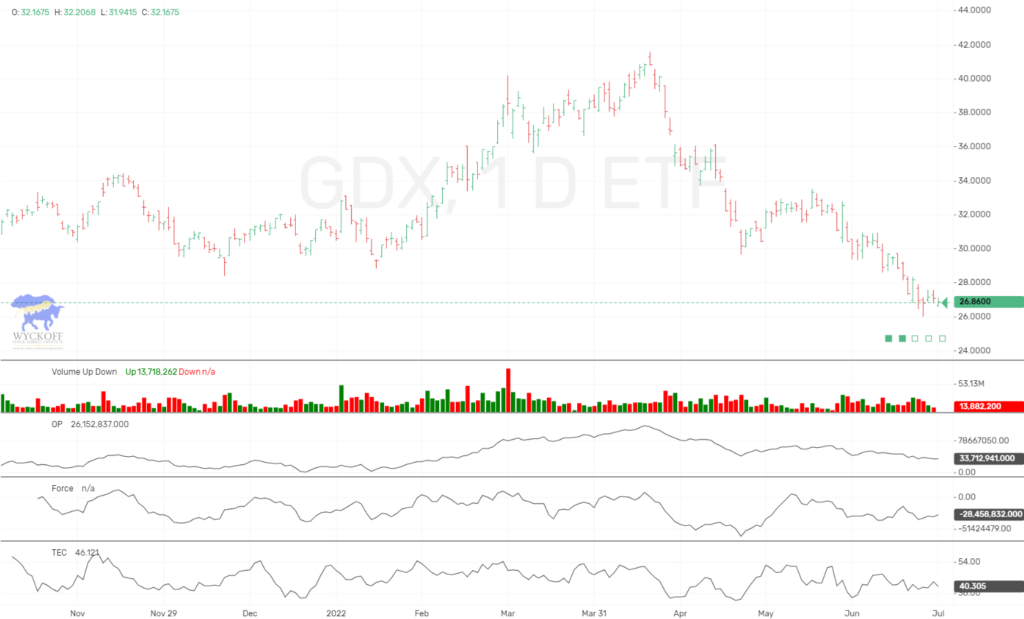

The GDX traded the week lower, on average volume.

We was expecting this market to find a low and at least have a corrective rally. Thus far it has failed to occur. We still look for higher.

Technometer is near oversold at 40.4.

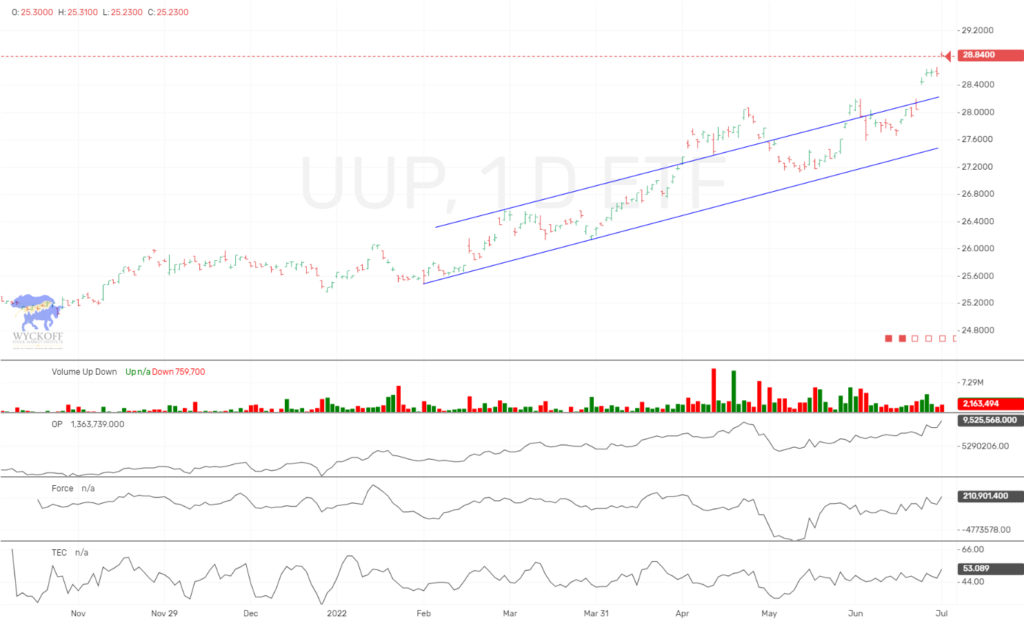

The long dollar ETF, UUP closed the week sharply higher on low volume.

We have been looking for a top, but can not get a solid risk/reward setup to enter a short. We are on the sidelines.

The Technometer is overbought with a reading of 53.1.

Bitcoin followed stocks higher for the week.

We had mentioned a bullish divergence between the price/OP as marked in blue. This lead to last week’s rally to take out the previous high at $21,800.

With our Technometers overbought on stocks/Bitcoin, we look for lower for this week. If we can now get an oversold Technometer while holding the previous price lows, this would be bullish.

Our Technometer for Bitcoin is near neutral at 45.6.

IMPORTANT ANNOUNCEMENTS:

We launched our WyckoffSMIChina.com site late March, for our China community. Check it out!

We have just released a lower cost version of our Unleashed Course, which is an excellent value at $349.99.

Click Here Our new “Pulse of The Market” charting software for Cryptocurrrencies is now showing consolidated volume from over 140+ exchanges. This is utmost important when applying Wyckoff Technical Analysis. We are showing this software in use on our social media sites, and will be launching for subscription in near future.

We have an active Discord channel where we discuss the Crypto markets. We have had huge success and if you trade Bitcoin you might like monthly access at $40 a month. Join Here

Due to the demand for Bitcoin/Cryptocurrency information and trading knowledge, we released a Cryptocurrency and Wyckoff Trading Course at our site, LearnCrypto.io This course is being offered at an affordable $299.99. We have had 1029 students enroll since its launch on June 22, 2017. On June 28th, 2018 we added lessons detailing the OP, Force, and Technometer and how to use these Wyckoff Tools for analysis.

If you are interested in Wyckoff stock chart analysis as well as Cryptocurrency, search “Learn Crypto / Wyckoff SMI” or click this link https://www.youtube.com/channel/UCDxK2PwEDvoaHZgjPV_WgcA Please subscribe and click the bell to be notified of our upcoming broadcasts.

If you would also like to follow us on twitter for news and trade ideas, follow “WyckoffonStocks“, “LearnCryptoShow“, or “WyckoffonCrypto“. We have given numerous profitable trades to our subscribers on the Youtube channel, as well as Twitter.

Good Trading,

Todd Butterfield