- Vanguard Blinks – The “Never Crypto” Giant Pivots

- Vanguard Opens Platform to Crypto ETFs in Major Shift: Bloomberg

- “Week In Review”11.29.25 Our thoughts on #Stocks #Bonds #Oil #Metals #Crypto. Stocks & Crypto higher, TLT lower, Oil bottoming #Wyckoff

- Gold clinches fourth straight monthly gain, closes in on record high as markets solidify rate cut bets

- Nvidia says it isn’t using ‘circular financing’ schemes. 2 famous short sellers disagree.

Welcome To The World Renowned "Wyckoff Stock Market Institute"

Our Institute was founded in 1931 by technical trader Richard D. Wyckoff, Wyckoff Stock Market Institute has been the leader in teaching Technical Trading for the past 92 years. Thousands of traders have chosen to learn at Wyckoff SMI for its proven trading techniques and invaluable proprietary market indicators, rest assured choosing us to help you become a better investor or trader is the right choice!

Watch this quick video to learn about Richard D. Wyckoff!

“Presenting the secret trading strategy from the 1930’s that hedge fund managers don’t want YOU to know about!”

Stocks & Commodities listed Richard Wyckoff as one of “The Titans Of Technical Analysis”. He shares this distinction with the likes of Charles Henry Dow, R.N. (Ralph Nelson) Elliott & Arthur A. Merrill

The Wyckoff Method

Learn How To Trade Invest Limit Risk !!

Richard Wyckoff was one of the most influential and successful traders in stock market history. His technical trading strategies & techniques have withstood the tests of over 90+ years of changing markets. They are as valid today as they were in 1930 when he developed the Stock Market Science and Technique Course, now known as the Wyckoff Unleashed Online Course.

Wyckoff Indicators Available At TradingView !!

The Wyckoff strategies and techniques teach technical traders to read the markets, and discover what and when the professionals are buying and selling. By analyzing the price movements and related volumes, Wyckoff traders can discover when large interests are accumulating or distributing a particular stock. This allows them to take a position just before the stock is ready to move.

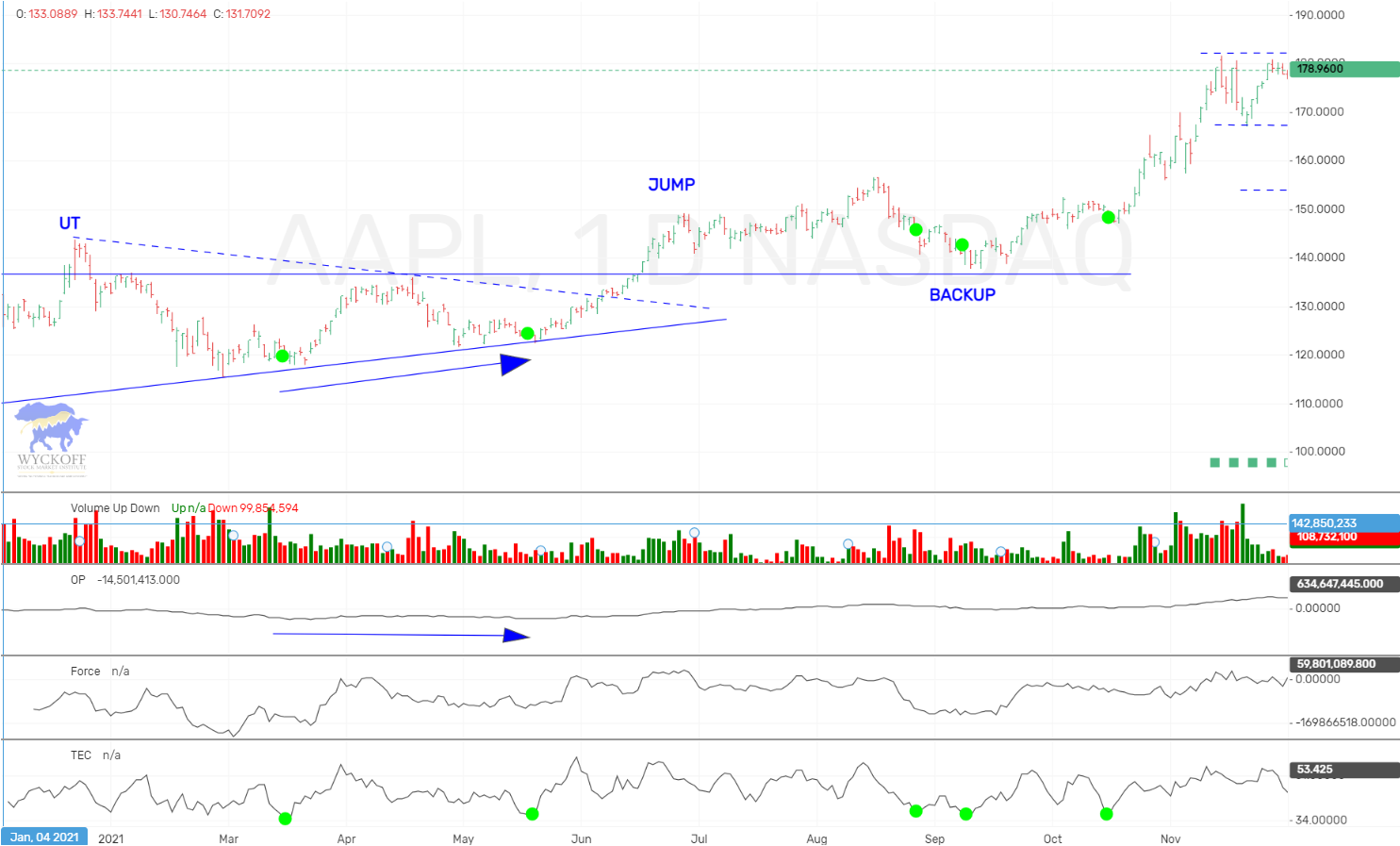

The Wyckoff Stock Market Institute website is filled with information to help the technical trader become more successful. Discover the Wyckoff Wave, a stock market index consisting of market leaders, and is extremely sensitive in forecasting market direction and changes.

The Wyckoff Wave is constructed from the following stocks: T, BAC, BA, BMY, CAT, XOM, DD, GE, F, IBM, UNP and WMT. We also constructed a Wyckoff Wave Tape Reading Index comprised of AAPL, AMZN, MSFT, BAC, BA, GE, and XOM. These stocks are analyzed in five minute intervals and up and down waves are developed. These waves which also include the price action and volume during those brief up and down market swings, provide the data for the important Wyckoff SMI indicators that make up the OP Index, Force, and Tachometer. These are the tools you must utilize to successfully trade in the stock market and are now available at TradingView as an Add-On Indicator. Email Support@WyckoffSMI.com for details.

Receive Our Free “Week In Review” Newsletter

The secret to Wyckoff they don’t want you to know about….

Learn The Wyckoff Trading Method online with Wyckoff SMI

Introduction To Wyckoff Course

Learn The Basics Of The Wyckoff Trading Method With This Online Course For Only $129

Our “Introduction To Wyckoff” online course will introduce you to the five steps of the Wyckoff Trading Method and the Wyckoff SMI indicators created by Wyckoff Stock Market Institute in the early 1940s. These 12 lessons accompanied with color charts and quizzes provide a sound foundation for any Wyckoff novice, or provide a well-rounded refresher for former Wyckoff Investors.

Introduction To Wyckoff Course Includes

- 12 Lessons & Quizzes

- 29 Full Color Lesson Charts

- 30 days FREE access to our "Pulse of the Market" Indicator Package For TradingView Software. ($39 Value)

- 30 days FREE access to our "ProTraders" Stock Discord/Groups. ($40 Value)

- Access To Our Course Educators To Answer & Help With Any Issues Or Questions You May Have

As You Are Nearing Completion Of The Online Course You’ll Receive The

30 Days Free Access To Our Online Indicator Package, As Well As ProTrader’s Stock Discord

Wyckoff Unleashed Online Course

Enroll In The World Renowned Wyckoff Unleashed Course (Formerly known as the Richard D. Wyckoff Course in Stock Market Science and Technique) By Wyckoff Stock Market Institute For Only $999

Learn the best way to Trade The Wyckoff Method while learning to utilize the world renowned Wyckoff SMI Indicators – Optimism-Pessimism Index, Force Index & Technometer. These indicators only available at Wyckoff SMI, are the secret to mastering the Wyckoff Trading Method in today’s markets.

Wyckoff Unleashed Course Includes

- Over 39 Lessons & Quizzes

- 8 Hours of Audio Lectures

- Our 559 Page Course Book

- Over 120 Full-Color Lesson Charts

- 90 days FREE access to our "Pulse of the Market" Indicator Package For TradingView Software. ($117 Value)

- 90 days FREE access to our "ProTraders" Stock Discord/Groups. ($120 Value)

- A Comprehensive Four Part Final Exam To Test Acquired Knowledge and Charting Skills

- Access To Our Course Educators To Answer & Help With Any Issues Or Questions You May Have For Life

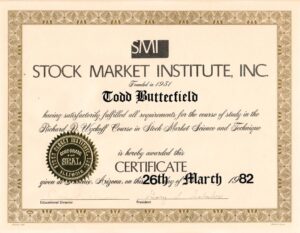

- Certificate Of Completion Once You Have Completed The Online Course

As You Are Nearing Completion Of The Online Course You’ll Receive The

90 Days Free Access To Our Online Indicator Package, As Well As ProTrader’s Stock Discord

*NO REFUNDS*

Wyckoff Unleashed Beginners Course

A Condensed Version Of Our Wyckoff Unleashed Course, This Unleashed Beginners Course Is Available For Only $349

Offering a course at a lower price point, and then you can continue your studies if you enjoy your experience with this $349 course, as you will receive a 35% off discount code for the $999 Unleashed Course. These 21 lessons will give you a thorough understanding of The Wyckoff Method.

Wyckoff Unleashed Beginners Course Includes

- 21 Lessons & Quizzes

- 29 Full Color Lesson Charts

- 60 days FREE access to our "Pulse of the Market" Indicator Package For TradingView Software.. ($78 Value)

- 60 days FREE access to our "ProTraders" Stock Discord/Groups. ($80 Value)

- Access To Our Course Educators To Answer & Help With Any Issues Or Questions You May Have

As You Are Nearing Completion Of The Online Course You’ll Receive The

60 Days Free Access To Our Online Indicator Package, As Well As ProTrader’s Stock Discord

A Wyckoff Primary Buying Opportunity - "BackUp (Last Point Support)"

A Wyckoff Primary Buying Opportunity - "Spring"

A Wyckoff Primary Selling Opportunity - "Upthrusts"

A Wyckoff Primary Selling Opportunity - "Rally Back (Last Point Supply)"

Unleashed Course Video

Wyckoff Stock Market Institute Alumni Testimonials

Click The Play Button To Listen To 1950’s Wyckoff SMI President Robert Evans Give His Opinion On Why You Should Enroll At Wyckoff SMI Today!

Access Our "Pulse Of The Market" Indicator Package For TradingView Software.

Access our “Pulse Of The Market” Indicator Package today and get exclusive access to the #1 tool world-class investors are trying to keep a secret! Our world-class “Pulse Of The Market” indicator package includes our proprietary indicators the Optimism-Pessimism Index, Force Index & Technometer that can be found nowhere else in the world. These indicators will allow you to gain the edge you need to accurately determine market direction like no other tool in the world does. Our “Pulse Of The Market” indicator package also allows you to monitor the markets with 5-minute updates of our indicators throughout the day.

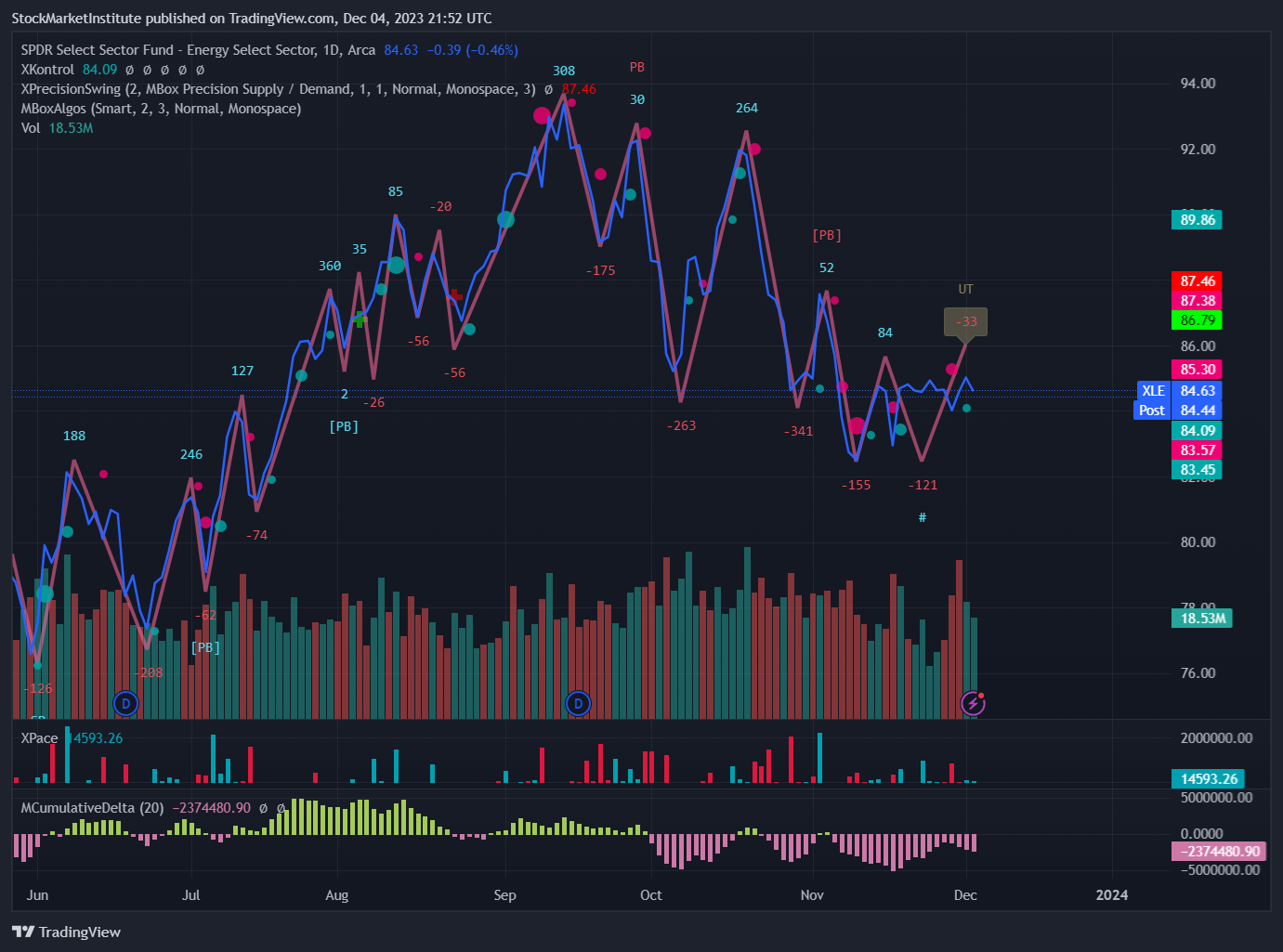

Access To The MBoxWave Wyckoff Trading System

Exploit Supply & Demand Imbalances Using Order Flow And Algorithimic DELTA Analysis.

Everything you NEED to exploit Supply & Demand Imbalances.

Algorithimic BUY/SELL Signals expose optimal entry points.

Follow the SMART MONEY with Delta Order Flow analysis.

Get Top Trade Picks Based On The Wyckoff Method

If You Trade Cryptocurrencies - Join Our Patron/Discord

A big part of learning any new skill such as trading Cryptocurrencies is having the ability to stay up to date with what’s going on in the markets and the news surrounding the Coins you are trading! That is why the team at WyckoffSmi began their Patreon/Discord and also broadcast on youtube when markets warrant it. You can catch those broadcasts at youtube.com/wyckoffstockmarketinstitute

Richard D. Wyckoff Tape Reading and Active Trading Course

The Tape Reading and Active Trading Online Program is made up of 13 study lessons and 10 recorded lectures. This course is to effectivily learn how to trade those intra-day moves.

Trading Techniques Online Course

Wyckoff SMI’s “Trading Techniques” Online course is for the Wyckoff Student who wants to take a trip into the past and revisit Wyckoff Stock Market Institute’s famous Trading Techniques lessons. Over the course of 5 decades Wyckoff SMI allowed students to subscribe to these short educational lessons where SMI instructors would go over and recap various Wyckoff Trading Method strategies and techniques. Enrollment in our “Trading Techniques” online course allows you to revisit the most popular Trading Technique lessons ever! Each lesson includes a audio lecture accompanied with charts and quizzes. This specific course has 14 lessons as well as 8 hours of video!!

Todd W. Butterfield President | Chief Strategist Wyckoff Stock Market Institute

In 1982, Mr. Butterfield graduated from the Wyckoff Stock Market Institute and was anxious to put his knowledge to the test. Mr. Butterfield decided to enter the U.S. Investment Championship’s real money competitions to prove that he was able to compete. The first one he entered he placed 12th in the nation, and every competition he entered over the years has been listed below. Mr. Butterfield began his professional career in 1984, as a Professional Stock, Option, and Commodity Trader with Rialcor Shatkin, Chicago, Illinois. In 1990, he registered as a Commodity Trading Advisor with a very successful 4 year track record. In 1991, he became a Financial Consultant for Smith Barney, Quincy, Illinois. At the beginning of 1997, Mr. Butterfield founded Butterfield Capital Advisors/Butterfield Futures. As a Registered Investment Advisor, he could offer fee-based investment advice to his clients, and as an IB he could offer futures brokerage services. In 2011, he formed The BlackBay Group, which encompasses BlackBay Capital Advisors (RIA). In 2016, took over the Wyckoff Stock Market Institute, and relaunched WyckoffSMI.com. In 2017, started actively trading/managing assets in the cryptocurrency space, as well as launching LearnCrypto.io. In March 2022, launched WyckoffSMIChina.com to better support our China family.

Click on each yearly tab to see details... These are the results from EVERY competition that Mr. Butterfield entered.

“12th in the Nation”, 31.9% (Feb 1-June 1), 85 Entrants, Futures Division, U.S. Investment Championship, 1984 Click here to view Barrons rankings.

Todd achieved a 79.8% average annual return, Commodity Trading Advisor 1987-1990 Click here to view Disclosure Document

In 1992, Todd Butterfield placed 34th in the U.S. Investment Championship $50,000+ “Stock Division” & 17th in the “Mutual Fund Switching Division”. Click here to view Barron’s rankings.

In 1993, Todd placed 4th in the Money Manager Verified Ratings “Low Risk Division” with a 28.1% return. ($1 Million-Plus Portfolio) Click here to view Barrons rankings

Todd placed “2nd in the Nation”, Money Manager Verified Ratings, 1st quarter, 1994.

In the 12 months ending 6/30/00, placed 2nd in the nation, Moni Research

11/30/2011 – 12/31/2011 : .32%

12/31/2011 – 12/31/2012 : 34.71%

12/31/12 – 7/31/2013 : 9.83%

Wyckoff SMI Staff

Our office and staff members are available around the clock to help you with any questions you may have. We offer 24-hour support by email and phone support during normal business hours. To send us a message please contact us here. A member of our team will reply right away.

JEAN HOWELL

Wyckoff SMI/Learn Crypto on Youtube!

Q&A

No that is not possible. Once you have purchased and have access, we cannot issue a refund. All sales are FINAL.

Yes, you can cancel your ProTrader membership at anytime, there is no contract.

No worries, our instructors will work with you to ensure you grasp the concepts and gain the knowledge necessary to pass the course and earn the certificate.

Yes, you can invite your friends and even earn money doing so. Sign up for our affiliate program and earn commission every-time your friends purchase our courses.

Yes, please contact us for private investing opportunities, and minimum account opening amounts. All investing done thru our Registered Investment Advisor, BlackBay Capital Advisors. Click here to visit website.

Articles

Read through our collection of vintage “The Magazine of WallStreet” articles! Founded by Richard D. Wyckoff in the early 1900’s the articles contained within the issues of The Magazine of Wall Street have provided millions of traders/investors with priceless insight into how the financial markets truly operate. We are proud to host a large collection of these articles right here on Wyckoff SMI for your enjoyment. Click to read now

Subscribe

Subscribe