Wyckoff SMI Blog

Highlight..... "Blog", "Week In Review", or "Videos"....

Vanguard Blinks – The “Never Crypto” Giant Pivots

How an $11 trillion giant went from “never crypto” to lowering all the sails. For nearly two years, Vanguard was the lone ship anchored stubbornly

Vanguard Opens Platform to Crypto ETFs in Major Shift: Bloomberg

The move will give access to the firm’s 50 million clients to invest in regulated digital asset ETFs, a reversal from Vanguard’s long-standing anti-crypto stance.

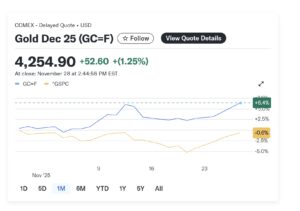

Gold clinches fourth straight monthly gain, closes in on record high as markets solidify rate cut bets

Gold (GC=F) futures settled near $4,240 per ounce on Friday, closing out their fourth straight month of gains and bringing the yellow metal back within

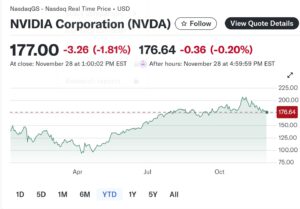

Nvidia says it isn’t using ‘circular financing’ schemes. 2 famous short sellers disagree.

Nvidia (NVDA) sent a memo to Wall Street analysts over the weekend arguing that it is not engaged in vendor financing, a controversial practice in which

Bitget CEO Says Altcoin Season Won’t Return Until 2026 — If Ever

Bitget CEO Gracy Chen has warned that the long-anticipated altcoin season is unlikely to arrive in 2025 or even 2026, signaling a dramatic shift in

US Regulators Probe 200+ Firms Over Unusual Trading Ahead of Crypto-Treasury Deals

US regulators are reportedly probing more than 200 firms with crypto treasuries over insider trading. The Securities and Exchange Commission (SEC) and the Financial Industry

Ether Treasury Company SharpLink Gaming Buys Back $15M in ‘Undervalued’ Shares

The repurchase happened as the firm’s stock price fell below the net asset value of its underlying ether holdings. SharpLink Gaming (SBET), a Nasdaq-listed ether (ETH) treasury firm

Stock market today: Dow, S&P 500, Nasdaq slip as tariff concerns mount ahead of key inflation data

US stocks pulled back slightly on Monday as Wall Street braced for a turbulent week, with renewed trade tensions injecting uncertainty ahead of a key inflation report

Stocks are little changed as traders await Nvidia earnings:

Stocks oscillated on Wednesday as investors parsed the latest earnings reports while awaiting Federal Reserve meeting minutes and Nvidia’s quarterly figures. The S&P 500 traded down 0.1%, as did

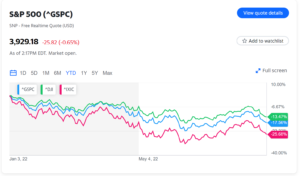

Bitcoin, S&P 500 Take Backseat to Stagflation Trade as Trump Tariffs Threaten to Derail Growth

Goldman’s stagflation basket has surged nearly 20% this year, outperforming bitcoin, U.S. stocks, and even gold. No one dared to speak about the potential for stagflation,

Crypto exchange volume hits record high: CCData

Crypto exchanges clocked more than $10 trillion in volume across spot and derivatives markets, CCData said. Trading volume on centralized cryptocurrency exchanges (CEXs) hit all-time

Spot Bitcoin ETF Options Could Start Trading as Early as Tomorrow

The availability of options is thought to possibly bring further institutional interest to the bitcoin ETFs. Options trading on spot bitcoin exchange-traded funds (ETFs) —

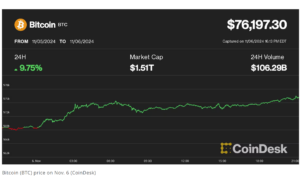

Bitcoin Blasts Past $76K for First Time as Violent Crypto Rally Liquidates Nearly $400M Shorts

Crypto exchange Coinbase’s shares closed the day 31% higher, leading gains among digital asset-related stocks. Crypto assets kept climbing higher Wednesday after Donald Trump won

Nearly 50% of U.S. Investors Plan to Invest in Crypto ETFs: Charles Schwab Survey

Crypto was the leading asset class among millennial ETF investors, topping even stocks and bonds, the survey showed. U.S. investors are very much keen on

The Fed — Why Are We Paying These Guys

By Elliott Wave International When it comes to interest rates, the Fed is NOT in control. The Fed does not lead; it follows the market.

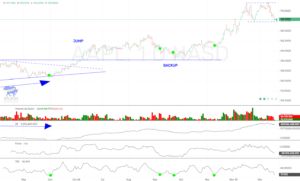

Our Wyckoff Wave chart, which we use for general stock market direction does not look constructive here. We had new highs in our OP Indicator which measures volume, while price did not. Also an overbought Technometer as shown with red dots, and fell out of uptrend.

BlackRock Sees Sovereign Wealth Funds, Pensions Coming to Bitcoin ETFs

The asset manager has been helping educate pension funds, endowments and sovereign wealth funds about the new spot bitcoin ETF products, BlackRock’s head of digital

NYSE contemplates following cryptocurrency markets with 24/7 trading: Financial Times

Traditional markets could be taking a page from cryptocurrency markets as the New York Stock Exchange contemplates trading nonstop in a recent survey, according to

Join us at Patreon.com/LearnCrypto so we can get you involved in newly launched #cryptocurrency projects before everyone else!!

Bitcoin ETFs ‘Deemed a Success’ By Key Measures One Month After Debut

One month after their historic launch, ETF insiders and crypto proponents alike say Bitcoin spot funds are proving an unequivocal success on key trading measures. Some 21

Looking at some stock charts…. #SNPS #PATH #ODP #KNSL #CTAS #AAPL #AMD #DIS #PFE #SOFI #PLTR

Nasdaq, Cboe apply to offer BTC ETF options trading, receive fast response

Options are “the next logical step” for BTC ETF trading and could begin by the end of February, according to an analyst. On Jan. 19,

ProShares files for five leveraged and inverse bitcoin ETFs

ProShares on Tuesday filed prospectus materials for five leveraged and inverse bitcoin exchange-traded funds, just days after spot bitcoin ETFs began trading. The names of the funds

Closed trades in CRM and ANET. Join our ProTraders Stock Discord. https://discord.com/servers/wyckoff-smi-644244174534869012

Franklin Templeton Latest Wall Street Giant to File for Bitcoin ETF

Franklin Templeton is the latest high-profile fund manager hoping to get a spot Bitcoin ETF approved by the SEC. Asset manager Franklin Templeton is the

Our #Wyckoff “Week In Review” for #stocks, bonds, metals, and #Crypto for 9.10.23 #BTC #SPY $TLT

Crypto Exchange EDX Markets Taps Anchorage as Custody Provider

The exchange, which is backed by several Wall Street firms, differs from its peers because it doesn’t hold customers’ digital assets. Crypto exchange EDX Markets,

Apple fell as we called for, and now we are oversold. Let’s look for a bounce here soon….

LTC still looks like one to watch to lead next rally. Go to LearnCryto.io for more Crypto info.

#Stocks and #Crypto up nicely today after yesterday’s BUY 😎👍 #wyckoff #shorts #trading #bitcoin

ETH/USD Tech is quickly back to 46.5. ETH/USDT is at 48. This looks like it would stop the rally soon….

Quick update on stocks and crypto. #investing #trading #stocks #crypto #shorts #wyckoff #courses

Let’s see how this 5 minutes chart plays out. Looks like we had 5 waves down on the QQQ chart and now an a-b-c rally if you don’t mind a little Elliott Wave Theory. We are overbought on our Wyckoff Technometer and I was looking for lower. You can see the OP went to new highs as the QQQ was rolling over. This should also keep Bitcoin a little weaker in the days ahead if it works out as planned.

Crypto extending gains once again 😎👍 #wyckoff #bitcoin #ethereum #cryptocurrency #trading #shorts

Another strong day in Crypto!! #cryptocurrency #bitcoin #ethereum #bnb #Wyckoff #trading #shorts

Crypto looks higher this week. #Wyckoff #bitcoin #cryptocurrency #trading #daytrading #shorts

Coinbase stock up 21% following lawsuit dismissal

Shares of Coinbase have been rallying since Wednesday afternoon after a federal judge dismissed a lawsuit against the company. The stock was up by roughly

Fidelity plans NFT marketplace and financial services in the metaverse

Newly filed trademark applications outline a long list of possible avenues for the firm in the metaverse. Investment giant Fidelity Investments has filed trademark applications

Buy ETH at the market.

Stock market collapsing once again, which is dragging down Crypto. Our ETH chart shows a divergence between price and volume (OP) on the daily, and

Legendary Value Investor Bill Miller Says Buy Bitcoin And Eight Other Stock Bargains

Legendary value investor Bill Miller sees fresh opportunities in the stock market amid the brutal selloff this year, urging investors to take advantage of shares

Stocks have been the ‘drunkest asset class out there’: Strategist

The rout in U.S. equities appears likely to deepen until Federal Reserve officials change course on their monetary tightening plans, at least according to one

Meme-Stock Frenzy Returns, Baffling Wall Street’s ‘Smart Guys’

Retail traders who lurk in forums like Reddit’s WallStreetBets are back to betting against Wall Street pros and the Federal Reserve as rallies for meme

Paul Tudor Jones says he can’t think of a worse financial environment for stocks or bonds right now

https://www.cnbc.com/2022/05/03/paul-tudor-jones-says-he-cant-think-of-a-worse-financial-environment-for-stocks-or-bonds-right-now.html

Let’s raise the sell stop on the MAR we bought at $177.95, to a sell stop level of $176.00

We like the action in MAR ($177.95, Marriott). We are going to buy at the market and using a sell stop at $162.50. Earnings are started to release on May 4th.

*You should be accessing trades at our stock discord in real-time. If you do not have access, please let us know. We also will be

We are going to go long TBT which is the Ultrashort 20 year Treasury. This means we expect the TLT to move lower, and 20 year treasury rates to move higher. Current Price of TBT is $17.39. We are using a $16.97 protective sell stop. **Remember TBT is a leveraged short, so position size lower if needed.

TLT looks like it is making a top as the OP keeps hitting new highs (which happened two months ago), and also just happened at

I am going to raise yesterday’s protective sell stop on the 1/3rd of our original long BTC position to $46,740.

I am going to put a protective sell stop on another 1/3rd of our original long BTC position at $46,440. Not happy with the last hours weakness….

I am going to put a protective sell stop on another 1/3rd of our original long BTC position at $46,440. Not happy with the last

Our general market indicators are overbought and looking like we are making a short term top here. I am selling IWM at the market ($222.40), and taking small loss. I am also entering a sell stop order on QLYS at $109.70 Good Until Cancelled. I will watch this one as if we can’t breakout here, I might just take small profit and look to buy back lower.

We have the BTC USD Technometer at 37.8 and a bullish divergence with OP (volume) hitting new lows while price holds higher lows. I think we make a bottom here….. So if you used the $36,100 mental I recommend, I would buy back that 66% at the market here. Current price $33,829

Buy SI – Silvergate Capital

I want some long term exposure here to Crypto markets, so I am going to start that by buying SI (Silvergate Capital) $90.74. I like

Buy MSFT at the market, current price $236.16

OP hitting new lows while price has jumped a creek and backed up. Technometer oversold.

I am selling 100% of our KEYS position at the market, current price $143.95. We purchased this at $119.51.

Buying TRIP, (Trip Advisor) at the market. Current Price $26.84.

We could be backing up to previous resistance, and we have a deeply oversold Technometer

I am going to purchase MSFT at the market, current price $218.91.

You can see on chart that we have had two instances where down volume came in as shown by the blue arrows on the OP,

Buying PAGS at the market, current price $47.26.

PAGS just came off an oversold Technometer as well as a possible back up to the creek. We like it here.

Selling TLT at the market, current price $159.10

TLT has not rallied as expected, and now Technometer is at an extreme overbought reading. Taking small profit and standing aside.

Buying TLT at the market, current price $157.09. We will use sell stop at the previous low of $154.62

TLT having the OP go to a new low here and price is testing a 50% pullback of the last advance from 154 to 161.

Buying the SDS which is the (double short the SPY) ETF.

We could be testing the previous upthrust, and we have an overbought Technometer. We look for lower prices in the stock market from here.

I am buying TLT (20 yr long treasury) at the market. Current Price $159.15

We near oversold levels and I think we can rally back to middle of trading range. I will watch action, but we will be having

Selling CTAS and MASI at the market.

I think this recent stock rally has ran its course, and we could see some type of correction here. Lets take profits and stand aside

Buying DUST at the market, current price $18.82. This is the inverse precious metals ETF. We think GDX could turn lower again.

Also buying UUP, the long dollar ETF. Current price $25.34

Doubling on long position of MASI, current price $233.35. Use stop on both positions at $216.10

Raising stops on our long positions in MASI and CTAS.

We are going to raise the protective sell stop on MASI, to our purchase price of $216.10. Also raising the protective sell stop on CTAS

Buying MASI at the market, current price $216.10. Also buying CTAS at $316.16.

We think the general market will bounce in the days ahead, so we have covered our shorts and going long a few stocks.

Selling DUST at the market.

We are selling DUST at the market, current price $21.01. Also selling SDS at the market, current price $17.49. We will look to buy back

I am going to sell CTAS at the market. As you know I am just not that friendly on stocks, and as just posted our Technometers are back to overbought on not much of a rally. If you want to stay long, I would use a stop at $322.

It is neutral Tech after being super oversold. OP is not rallying well here as volume is not coming into the upside. So I am

Going short stocks here looking for a correction of recent advance.

I am buying SDS once again at the market. This is the Proshares UltraShort S&P 500. It is 2X short. Current Price $18.74

Going short stocks here looking for a correction of recent advance.

I am buying SDS at the market. This is the Proshares UltraShort S&P 500. It is 2X short. Current Price $19.60

We are selling are final 3 positions at market. Sell T, TWTR, and AGCO.

We are selling our final 3 positions at market. Sell T, TWTR, and AGCO.

Buy the 75% Bitcoin position back at the market, current price $8,960

We sold our 75% Bitcoin position at $9,520. We would now buy that back at the market, current price $8,960. But we are using a

Use a sell stop on our 75% long Bitcoin position at $9,520

We want to use a sell stop at $9,520 on the 75% position in Bitcoin we bought at $7,875 If stopped out we will look

Sell AKAM at the market!

We are selling our long AKAM at the market, current price $100.77. We was long from $96.04

Buy 75% position in Bitcoin at the market, current price $7,875

Buy 75% position in Bitcoin at the market, current price $7,875 We were stopped out of our earlier positions at $8,550, so want to reestablish

Buy KEYS at the market, current price $95.13

Buy KEYS at the market, current price $95.13 Use sell stop at today’s low of $90.90

Buy AT&T (T) at the market, current price $36.48

Buy AT&T (T) at the market, current price $36.48

Buy 75% position in Bitcoin at the market, current price $8,670

Buy 75% position in Bitcoin at the market, current price $8,670 We will use a protective sell stop at $8,000 for now.

Buy CGC at the market, current price $21.87

Buy CGC at the market, current price $21.87 Looks like we are trying to complete a “BackUp” to the “Jump” here. I think stocks in

Thomas Lee Predicts Gains of Over 100% for Bitcoin in 2020

Our opinion on BTC was highlighted in the article. https://www.ccn.com/thomas-lee-predicts-gains-of-over-100-for-bitcoin-in-2020/

Sell MCD at the market

We are going to take the quick profit in McDonalds (MCD). Technometer is extreme overbought and we would expect a slowing of the rally,

Buy MCD at the market

I am going to enter 50% partial long position in MCD at the market, current price $197.58 We will use protective sell stop at $192.35

Raising protective sell stops!

Raising protective sell stops! On TLT lets raise the protective sell stop to $136.51. We are overbought and not getting the quick rally we anticipated.

Raise stop on AT&T to $38.90

Raise stop on AT&T to $38.90 We have not seen volume come in on this rally, as you can see by the underperformance of the

Going to buy CBOE at the market, and also a 50% position in TLT at the market.

Going to buy CBOE at the market, and also a 50% position in TLT at the market. Current Prices: CBOE $117.78, TLT $136.79 We will

Buy GDX at the market, current price $27.39, use a sell stop at $26.14

Buy GDX at the market, current price $27.39, use a sell stop at $26.14 We have the OP trending lower, while price making higher lows.

Sell ULTA at the market, current price $256.07

Sell ULTA at the market, current price $256.07. Wyckoff Wave is overbought and we think we will see a correction in the next couple weeks.

Buy ULTA at the market, current price $237.20

Buy ULTA at the market, current price $237.20. Use protective sell stop at $223. ULTA has a short term buy divergence with the OP hitting

Sell our bearish U.S. Dollar Index ETF, UDN at the market. Current price $20.53

Sell our bearish U.S. Dollar Index ETF, UDN at the market. Current price $20.53 We are selling our long UDN position at the market. Our

Sell short MicroChip Tech (MCHP, $94.54) at the opening. Use buy stop at $98.90

Stocks are currently called up 90 points at Monday’s opening. We are looking for the general market to correct, so we will take an opportunity

We are buying back 50% of our Bitcoin at the market, current price $7,130. Using a $6,800 sell stop.

We got stopped out of our 75% long Bitcoin at $7,250 It is now currently $7,130. We are buying back 50% at the market, with

We are buying back 75% of our Bitcoin at the market, with a $7,250 stop.

We got stopped out of our 100% long Bitcoin at $8,000 It is now currently $7,600. We are buying back 75% at the market, with

We are recommending a buy in AT&T at the market, current price $36.48

We are recommending a buy in AT&T at the market, current price $36.48 Technometer is now extreme oversold at a level of 33. We are

Discord for WyckoffSMI.com for stock analysis.

We are excited to announce a private DISCORD for our WyckoffSMI.com followers and subscribers. This DISCORD channel is accessible if you purchased a $40 monthly

Buy your last 25% of our Bitcoin position at the market. Current price $8,450.

Buy your last 25% of our Bitcoin position at the market. Current price $8,450. Use stop on 100% of position at $8,000

Buy the bearish U.S. Dollar Index ETF, UDN $20.44 at the market

Buy the bearish U.S. Dollar Index ETF, UDN $20.44 at the market. Use a protective sell stop at $20.20

Buying TLT at the market. Stop to follow.

Buying TLT at the market. Stop to follow. Technometer is extreme oversold, bounce is due….

We want to sell T, sell KEYS, and buy GDX all at the market

We want to sell T, sell KEYS, and buy GDX all at the market.

ProTraders Video Update November 3, 2019

A video update for our ProTraders Members https://youtu.be/m0_Ve0gWGqY

We are going to sell our SQ at tomorrows opening, or if it opens, up trail a stop at today’s low of $61.48

We are going to sell our SQ (Square) at tomorrows opening, or if it opens up, trail a stop at today’s low of $61.48 Currently

Supercharged Bitcoin Turns Ultra-Bullish After Shaking Out Retail Traders

https://www.ccn.com/bitcoin-ultra-bullish-dumping-retail-traders/

Crypto Trader Boldly Predicts Bitcoin Bottom at $6,250

https://www.ccn.com/crypto-trader-boldly-predicts-bitcoin-bottom-6250/

Buy back the 75% position in Bitcoin that we got stopped out of at $7,920 which was breakeven. Buy back at the market with current price of $7,490

Buy back the 75% position in Bitcoin that we got stopped out of at $7,920 which was breakeven. Buy back at the market with

We want to buy 50% of a normal position in KEYS at the market. Current Price $103.44

KEYS had a jump across the creek and a successful backup. It is now breaking out to the upside. Risk is higher buying on the

Raise sell stop on our 75% long Bitcoin position to purchase price of $7,920.

Bitcoin rallied as soon as we purchased it at $7,920, and rallied above $8,300. We still think we continue higher. We now wish to raise

Buy Bitcoin at the market, current price $7,920

We were stopped out of our 75% long Bitcoin positions at $8,225. We are now trading $7,920 and wish to buy back at market. We

Battered Canopy Growth Looking to End Its Brutal Downtrend Says Top Analyst

https://www.ccn.com/battered-canopy-growth-looking-to-end-brutal-downtrend/

Placing stop on Bitcoin long positions at $8,225

We are long Bitcoin from two different prices……..25% from $7,873, and 50% from $8,330. We want to use a sell stop at $8,225 for these

Buy another 25% of your normal Bitcoin position at the market. Current Price $7,873

Buy 25% of your normal Bitcoin position at the market. Current Price $7,873

Bitcoin to Head to $7,400 in the Near-Term Warns Technical Analyst

https://www.ccn.com/bitcoin-to-head-to-7400-in-the-near-term/

Top Analyst Says Ethereum Screams ‘Buy’ As It Prepares for a Wave Up

https://www.ccn.com/top-analyst-says-ethereum-screams-buy-as-it-prepares-for-a-wave-up/

Symantec Turning Tech Data Privacy Issues Into Growth Opportunities

https://www.ccn.com/symantec-turning-tech-data-privacy-issues-into-growth-opportunities/

Twitter Stock Breakout Could Spark Monster Bull Run

https://www.ccn.com/twitter-stock-breakout-could-spark-monster-bull-run/

We want to buy TWTR at the market. Use a protective sell stop at $39.62

We want to buy TWTR at the market. Use a protective sell stop at $39.62 Twitter is holding up much better than the general market,

JNJ Stock Laughs Off $572 Million Opioid Fine With DJIA-Best Rally

https://www.ccn.com/jnj-stock-leads-dow-despite-opioid-czse/

This Bitcoin Price Dump Isn’t Over – Not Even Close

https://www.ccn.com/bitcoin-price-technical-analysis-8-29-2019/

AT&T Screams Buy Even Though There’s a Mass Exodus of TV Subscribers

https://www.ccn.com/att-screams-buy-even-though-theres-a-mass-exodus-of-tv-subscribers/

Buy AT&T (T) at the market, current price $34.78. Use a sell stop of $32.35

Buy AT&T (T) at the market, current price $34.78. Use a sell stop of $32.35 AT&T has gone through an accumulation phase, and appears ready

HERE’S WHY NETFLIX STOCK WILL REBOUND FROM UGLY 30% CRASH

https://www.ccn.com/netflix-stock-recover-from-crash/

THIS S&P 500 STOCK IS UP 50% IN 2019 & IT’S JUST GETTING STARTED

https://www.ccn.com/sp-500-stock-xerox-technical-analysis/

We are entering short UUP, or long UDN at the market.

We are going short the UUP at the market, current price $26.66. We would use a buy stop at the high of $26.80. Looks like

We are adding to our long position in AMD at the market! Current Price $29.06

We are adding to our long position in AMD at the market! Current Price $29.06

Taking profits on SPY, TLT, GDX, and GDXJ at the market

Taking profits on SPY, TLT, GDX, and GDXJ at the market. Stocks, bonds, and metals have had nice trends in our favor recently, but it

Update on our current Stock/ETF open positions….

Update on our current Stock/ETF open positions…. Our short SPY was right on the money. The China news has helped this position considerably. We have

Bitcoin is now $10,375, we are SELLING our BITCOIN at the MARKET

Bitcoin is now $10,375 so we are SELLING our BITCOIN at the MARKET

Raise Bitcoin protective sell stop to $9,650

Bitcoin has had a nice rally last 24 hours. We therefore want to raise our Bitcoin protective sell stop to $9,650

We are buying AMD at the market, current price $31.01

AMD has been very strong and today experiencing a pullback to correct its recent advance. Our Technometer is nearing oversold and this is a growth

Adding back 50% position in BTC at the market. Stop at $9,200

We had our biggest loss of the year on this last trade in Bitcoin. As you can see by chart below, we are extreme oversold

It appears that stocks might need a pullback here, and bonds another rally.

We think the stock market could turn lower here, and bonds turn higher. We are going to sell short the SPY at Mondays opening, and

We are raising stops again on our long GDX and GDXJ positions. Adding to longs as well!

We are raising stops on our long GDX and GDXJ positions. GDX – raise stop to $23.12 GDXJ – raise stop to $32.30 We think

Selling short the long dollar ETF UUP at the market, or buy the short dollar ETF UDN.

Selling short the long dollar index UUP at the market, current price $26.17 We have fallen out of the uptrend and now in a sideways

We are raising stops on our long GDX and GDXJ positions.

We are raising stops on our long GDX and GDXJ positions. GDX – raise stop to $21.19 GDXJ – raise stop to $28.89 We think

Took Profits on our Long TLT position.

We have been long TLT since 2/25/19 at a price of $120.98. We have an extreme overbought Technometer and reaching some upside objectives. So take

We want to buy GDXJ and/or GDX at the market…..

We want to buy GDXJ $28.64, and GDX $20.41 at the market. You could for now use a sell stop $1 below buy price. On

Our recent Litecoin (LTC) buy reco’s have been spot on.

Our software at LearnCrypto.io is showing its worth. We have had numerous buy points on LTC and they have worked perfectly. At LearnCrypto.io, you can

Sell SHOP at the market, current price $204.60

We are going to take our profits on SHOP at the market. Current price $204.60. We will look to buy back at lower prices.

We want to begin to build a longer term position in Shopify at these levels.

We think Shopify (SHOP, $187.94) is an interesting longer term play, as we like their fundamental business model. Currently we have the Wyckoff Wave extremely

Buy TLT at the market.

We like the recent action in the TLT. We are going to go long 50% position today, and add 50% on any weakness. Current Price

We are raising our sell stop on GDX

We are raising our sell stop on GDX on all positions to $22.28 These positions have worked nicely, and we expect GDX to continue to

Updated Charts on Bitcoin and Litecoin

Updated charts showing our recent buy/sells for $BTC and $LTC from our Cryptocurrency “Pulse of the Market” charting software.

Interesting development in GDX

Since the 10%+ quick rally we had in GDX, we have now experienced a high level consolidation. During this time the Technometer has went from

Pulse Of The Market, February 5, 2019

https://youtu.be/6Xn-Fvb6Ql8

LTC (Litecoin) chart from our Crypto Charting Software

OP has continued to hit new lows, while price has made higher lows. Technometer has given us various buy signals along the way. More info

GDX Point and Figure Chart Objective

We have attached a 1/2 point & figure chart for GDX. We think we could see an upside objective of $26+ on this rally. This

Bitcoin making short term low?

BTC has the OP making new lows while the price holds in a sideways triangle type pattern. Wyckoff would have called this the apex, or

We have two positions we are adding at the market.

We want to buy at the market the following two positions. GDX – Current price $20.56. We are using a close sell stop at $20.22

Looking for a short term low…

Of the Wyckoff Wave component stocks, we like the action in Boeing (BA, $304.55), and Union Pacific (UNP, $132.54). So Monday morning we will begin

Sell Short the long dollar etf, UUP $26.05

Sell short UUP at the market, current price $26.05 We are expecting the U.S. Dollar to begin a correction of its year long advance, so

Raise sell stop once again on ABX to $13.06

Raise sell stop on long ABX to $13.06. We do not want today’s action to end up being a upthrust, so we will raise our

Caterpillar (CAT, $122.29) Cover short at the market, or lower buy stop.

Caterpillar is now trading some $17 lower from our initial short price. It is now oversold on the Technometer, and the Wyckoff Wave is also

Wyckoff Wave and Components Technical Analysis 12/7/18

CLICK HERE FOR YOUTUBE VIDEO

Wyckoff Wave and Components Technical Analysis 12/3/18

CLICK HERE FOR YOUTUBE VIDEO

Caterpillar (CAT, $139.98) We want to short at the market, with a buy stop at $144.97.

Sell short CAT at the market, current price $139.98. We want to use a buy stop at $144.97. Technometer is in an extreme overbought condition,

How we classify trends….

There are many ways to classify trends as to types or the sizes of trends. At Wyckoff SMI we use four classifications for simplicity. The

New Subscribers sell short TLT at Monday’s opening at the market. Use buy stop at $115.76

We are going short the TLT, at the market. Current Price: $115.14 Use buy stop at Friday’s high of $115.76. We are previous short from

Raise sell stop on ABX to $12.28

Raise sell stop on long ABX to $12.28. This was the recent spring level, and we do not want to see this stock back at

Wyckoff Wave and Components Technical Analysis 11/15/18

CLICK HERE FOR YOUTUBE VIDEO

We recommend going short in TLT at the market. Current Price: $114.27

We are going short the TLT, at the market. Current Price: $114.27 We had covered our previous short at $112.90 looking for a really and

Wyckoff Wave and Components Technical Analysis 11/9/18

CLICK HERE FOR YOUTUBE VIDEO

We recommend covering our short in TLT at the market. Current Price: $112.90

We are covering our short in the TLT, at the market. Current Price: $112.90 The Technometer is back to extremely oversold so we will take

We recommend taking profits on the long Square (SQ) at the market, $82.31

Sell the long position we have in Square (SQ) at the market. Current price $82.31 Technometer is now nearing overbought, and as you can see

Raise stops to the following prices.

Raise sell stop on ABX to $11.83 Raise sell stop on SQ to $71.04 Raise sell stop on TWTR to $31.30 Good

We recommend going short the TLT at the opening Monday. Current Price: $114.99

The Technometer was extremely oversold at the level we have marked with the “B” three weeks ago. We now have relieved that, as expected, and

We like the way Twitter (TWTR, $28.95) is outperforming on a short term basis here.

Twitter bouncing nicely today, so we want to raise stop to entry price, $28.95. Let’s see if we can keep this rally going.

We like the way Twitter (TWTR, $28.95) is outperforming on a short term basis here.

We are going to buy Twitter (TWTR, $28.95) at the market. Use a sell stop at $26.19 Good Trading, Todd Butterfield

ABX is classic Wyckoff!!

ABX has been a classic Wyckoff setup with our indicators. The rally has proceeded as expected, and we would now raise protective sell stops to

Wyckoff Wave and Components Technical Analysis 10/11/18

CLICK HERE FOR YOUTUBE VIDEO

We our covering our short in Cheesecake Factory, (CAKE, $51.49)

We would have expected Cheesecake to fall much easier than it has the last few days, so we are going to cover our shorts at

We are beginning to establish a position in Square (SQ) at these levels.

Buy Square (SQ) at the market, $69.60 CFO just announced leaving…. After hours trading at $69.60, so we would buy at the market if you

Wyckoff Wave and Components Technical Analysis 10/10/18

CLICK HERE FOR YOUTUBE VIDEO

Some stocks on our radar.

We have added some charts of stocks that we think could look interesting here on a new buy signal. We will be watching these closely.

Wyckoff Wave and Components Technical Analysis 10/5/18

CLICK HERE FOR YOUTUBE VIDEO

Wyckoff Wave and Components Technical Analysis 10/3/18

CLICK HERE FOR YOUTUBE VIDEO

We are buying GDXJ at the market. Also can buy ABX at the market

We like the chart action for GDXJ, which is the Precious Metals Junior Gold Miners. You can see the recent positive divergences with the OP

Raise protective sell stop on REGN to $390.25

We want to raise our sell stop on REGN to $390.25 which is just above today’s low. We are long from $394.70 so this will

Wyckoff Wave and Components Technical Analysis 9/24/18

CLICK HERE FOR YOUTUBE VIDEO

Wyckoff Wave and Components Technical Analysis 9/17/18

Click Here for YouTube Video

We are going to add to our long position in Bank of America (BAC, $30.37)

We are going to add to our long position in Bank of America at the opening Monday. We have had a corrective reaction to the

Bitcoin trying to take a stand against the bears….

Many of you have heard about the Wyckoff Method of Technical Analysis. In the early 1900’s, Mr. Richard D. Wyckoff was a pioneer in reading

The Wyckoff Wave Looking Like A Possible Test Of 63,000.

https://youtu.be/WN6mp1LWw-4 The Wyckoff Wave traded lower for the week as expected, on average low volume. We have been talking about a selloff to the 63,000

The Wyckoff Wave Overbought, Still Looking For Possible Test To 63,000.

The Wyckoff Wave traded sideways for the week, on slight increase in volume due to expiration. We was looking for lower, and still the same

The Wyckoff Wave Still Looks Lower In The Coming Week, To Possibly Test 63,000.

https://youtu.be/t1lfv547C5Q The Wyckoff Wave traded lower for the week, on low volume. We was looking for lower, and got just that. It appears we still

The Wyckoff Wave Testing The Highs, Ready To Turn Lower.

The Wyckoff Wave traded higher for the week, on very low volume. We was wanting a couple day rally to upthrust the highs as shown

The Wyckoff Wave Appears To Still Look Lower In The Week Ahead.

The Wyckoff Wave traded only slightly lower for the week, on very low volume. Our Technometer was oversold to begin last week, so we thought

The Wyckoff Wave Corrected As Expected, Now Oversold.

The Wyckoff Wave traded lower for the week, on low volume. We was expecting a correction for a backup to the previous creek. We did

Looking For The Wyckoff Wave To Move Lower In The Week Ahead.

The Wyckoff Wave traded slightly higher for the week, on low volume. We are expecting a correction for a backup to the previous creek. We

The Wyckoff Wave In The Midst Of A Correction.

The Wyckoff Wave traded slightly lower for the week, on lower volume. It appears we are correcting for a backup to the previous creek. We

The Wyckoff Wave Continued Higher Once Again For The Week.

The Wyckoff Wave traded higher for the week once again, on lower volume then the week before. We were looking for a pullback soon, but

The Wyckoff Wave Continued Higher But Nearing Overbought.

The Wyckoff Wave traded higher for the week, on an increase in volume. We was looking for a pullback last week, but instead got further

The Wyckoff Wave Tested The Highs, Looks Lower Next Week.

The Wyckoff Wave traded slightly higher for the week, on average low volume. We was looking for an opportunity to enter longs early in the

The Wyckoff Wave Holding Near The Top Of Its Trading Range.

The Wyckoff Wave traded slightly lower for the week, on low volume. We was looking for a successful test of the upthrust, because of the

The Wyckoff Wave Testing It’s Upthrust.

The Wyckoff Wave traded higher for the week, on low volume. Last week we began the test of the recent upthrust. Thus far it is

The Wyckoff Wave Still Looks A Little Lower After Last Week’s Selling Pressure.

The Wyckoff Wave traded lower for the week as expected, on low volume. We did upthrust resistance as I mentioned, and came off nicely. Volume

The Wyckoff Wave Looks Lower After Friday’s Reversal To The Downside.

The Wyckoff Wave traded higher for the week on average volume, then reversed lower on Friday, on an increase in volume. We are upthrusting resistance

The Wyckoff Wave Bumping Its Head On Resistance, Sideways To Lower In The Coming Week.

The Wyckoff Wave traded slightly higher for the week, on a slight decline in volume. We are back at resistance that has stopped the Wave

The Wyckoff Wave Saw Increased Volume To The Upside To End The Week, But Appears We Could Work Sideways To Lower In The Coming Week.

The Wyckoff Wave traded sideways early in the week, then finished strongly higher, on an increase in volume. We was wanting a little more weakness

The Wyckoff Wave Could Continue Trading Sideways/Lower In The Week Ahead.

The Wyckoff Wave finished the week lower as expected, on average volume. We was expecting sideways/lower last week, and could see more of that this

The Wyckoff Wave Looks Lower In The Week Ahead.

The Wyckoff Wave finished the week slightly higher as expected, on average volume. We are not impressed by the lack of solid upside action last

Wyckoff Wave Tested The Previous Week’s Low, And Appears Ready To Move Higher Once Again.

The Wyckoff Wave finished the week slightly lower, and tested the previous weeks low, on lower volume. We liked last weeks action, as we appeared

Wyckoff Wave Pulled Back As Expected, And Rallied Strongly Off An Oversold Technometer.

The Wyckoff Wave finished the week slightly lower after rallying strongly on Friday, on average volume. We as looking for lower last week, which we

Wyckoff Wave Did Pullback To Previous Resistance at 59,400 As Wanted, Still Looks Like It Could Consolidate More.

The Wyckoff Wave finished the week lower as expected, on average volume. We had been wanting lower, and at least a pullback to $59,400 or

We Would Like To See The Wyckoff Wave Pullback To Previous Resistance at 59,400.

The Wyckoff Wave finished the week up ever so slightly once again, on average volume. We have been expecting lower, and still look for lower

The Wyckoff Wave Still Looks Slightly Lower In The Coming Week.

The Wyckoff Wave finished the week up ever so slightly, on average low volume. We have been expecting lower, and still look for slightly lower

The Wyckoff Wave Still Looks Like It Could Work Slightly Lower.

The Wyckoff Wave finished the lower, on average low volume. We have been expecting lower, and still look for slightly lower in the week ahead.

The Wyckoff Wave Now Overbought, Sideways To Lower.

The Wyckoff Wave finished the week strong, on average volume. We had been wanting a pullback and an oversold Technometer to buy. Instead, we have

The Wyckoff Wave Still Looks Lower Short Term.

The Wyckoff Wave finished the week only slightly higher, on much lower volume. We are still expecting lower in the coming week, and hopefully we

The Wyckoff Wave Price Action Not Looking That Bullish.

The Wyckoff Wave finished the week slightly lower, on an increase in volume. Last week we thought the Wave could meet some support, and it

The Wyckoff Wave Pulling Back To Previous Resistance And Near Oversold.

The Wyckoff Wave finished the week lower, on a sharp increase in volume. Last week we was wanting a continuation of the rally, before an

The Wyckoff Wave Should Continue Last Week’s Recovery.

The Wyckoff Wave finished the week higher as expected, on average low volume. Last week, we was wanting a slight correction to get our Technometer

The Wyckoff Wave Could Retrace Some Of Our Recent Losses.

The Wyckoff Wave finished the week lower once again , on low volume. We was wanting a slight correction to get our Technometer closer to

The Wyckoff Wave Sideways, But Looks Constructive.

MARKETS ARE CLOSED FOR MONDAY. The Wyckoff Wave finished the week ever so slightly lower again , on low volume. We would like to see

“Week In Review”11.29.25 Our thoughts on #Stocks #Bonds #Oil #Metals #Crypto. Stocks & Crypto higher, TLT lower, Oil bottoming #Wyckoff

Analysis on #Bitcoin and Emerging Markets done this morning with Bitcoin at $77,900… Must watch if you are in #Crypto

Stock setups/trades/discussions per the Wyckoff Method. You can follow this list if you use TradingView. Go to WyckoffSMI.com to join our ProTraders Discord Channel where you can get this list for FREE, and also sign up for more detailed discussions/trades.

“Week In Review” 2.23.25 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto lower, GLD lower. #Wyckoff

“Week In Review” 2.9.25 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto lower, GLD lower. #Wyckoff

Crypto Update on BTC, ETH, BNB, SOL, and XRP. Getting interested in price action and going to be buying some things soon…

“Week In Review” 1.20.25 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto lower, XLE/GDX lower. #Wyckoff

“Week In Review” 12.29.24 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto $88k?, XLE/GDX low soon? #Wyckoff

“Week In Review” 12.23.24 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto $88k?, XLE/GDX low soon? #Wyckoff

“Week In Review” 11.17.24 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. Stocks lower, Crypto buy dip, Oil lower. #Wyckoff

“Week In Review” 8.12.24 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. We are partial long BTC, ETH #Wyckoff

“Week In Review” 8.4.24 Our thoughts on #Stocks, #Bonds, #Oil, #Metals, and #Crypto. We bought some BTC, ETH #Wyckoff